Cardano Price Flashes Massive Weekly Indicator: What’s Next for ADA?

Key Insights:

- Cardano price’s 50-week moving average crosses above 200-week for first time.

- Grayscale Digital Large Cap Fund ETF conversion approved including ADA exposure.

- Bloomberg gives 90% approval odds for standalone Cardano ETF this cycle.

Cryptocurrency analyst Dan Gambardello identifies a major weekly technical indicator for Cardano price as the 50-week moving average crosses above the 200-week.

The development coincides with ETF approvals and institutional positioning ahead of potential Federal Reserve policy changes.

Cardano Price Achieves Critical Moving Average Crossover Signal

Cardano’s 50-week moving average has crossed above the 200-week moving average for the first time in an extended period. This has created a technical milestone that Gambardello identifies as a major bullish indicator. As per his analysis, this crossover took considerable time to develop given how overextended Cardano’s moving averages had become during the bear market phase.

The analyst notes how far the 20-week and 50-week moving averages had fallen below the 200-week moving average, requiring an entire pivot out of bear market conditions before the 50-week could reach the 200-week level again. Downside volatility helped bring the 200-week moving average lower while upward price action pushed the 50-week higher.

This weekly chart compression of such a moving average sets up bullish conditions and technical setup similar to Bitcoin’s setup when its January ETF approval occurred. Recent ADA price weekly chart analysis exhibits positive compression patterns with the 50-week crossing the 200-week signal.

ADA has yet to receive standalone ETF approval but, via listing in the Grayscale basket, effectively receives its first ETF exposure through institutional channels. The technical configuration is a precise mirror of Bitcoin’s action when its 50-week crossed the 200-week during ETF approval periods.

The SEC has cleared the conversion of Grayscale’s Digital Large Cap Fund into an ETF. This provides institutional access to Bitcoin, Ethereum, Solana, XRP, and Cardano in a single investment vehicle. This was done under a looming final deadline and allows instant access to diversified cryptocurrency holdings like ADA to traditional investors.

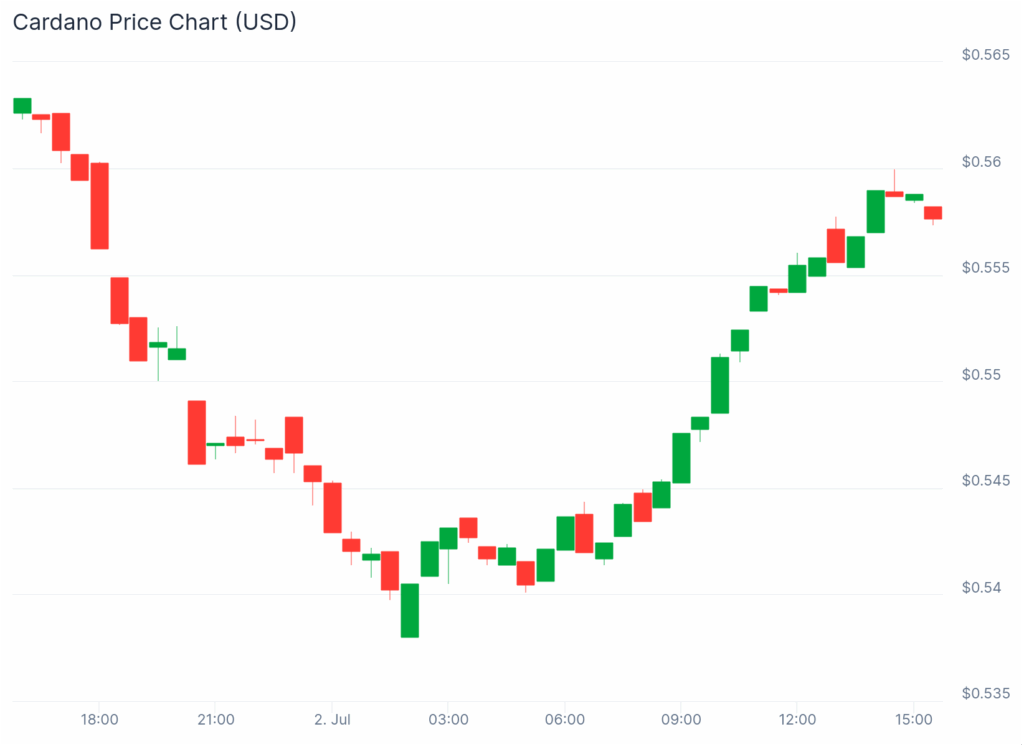

In spite of the ETF approval, cryptocurrency markets remain under sell pressure with Cardano price recording red weekly candles alongside Ethereum and the remainder of the major cryptocurrencies. This ADA price action mirrors the trend of Bitcoin after its ETF approval in January, when the cryptocurrency dropped by 20% in the following days despite the favorable regulatory news.

Bloomberg’s ETF approval odds indicate 95% for XRP, Solana, and Litecoin individual ETFs, and Dogecoin, ADA, and Polkadot have 90%. These favorable probability ratings indicate the following altcoin ETFs will be approved in this cycle, providing institutional access to the initial basket method.

Gambardello likens today’s altcoin setup to Bitcoin’s technical setup at the moment of its ETF approval. Bitcoin had already moved past bear market levels and advanced by nearly 200% before extending towards all-time highs, whereas altcoins are still around 50% short of previous highs.

Cardano Price Analysis Shows Extended Consolidation Patterns

Gambardello references previous analysis from April 10th when ADA price traded around 60-61 cents, noting the months of choppy sideways movement that followed. The analyst applies fractal analysis comparing the August 2024 capitulation to the April consolidation period.

The fractal overlay suggests ADA’s behavior remains consistent with historical patterns involving capitulation, escape attempts, and subsequent choppy consolidation phases. Current Cardano price action continues this established pattern and needs patience as the cryptocurrency works through technical resistance levels.

Weekly chart resistance centers around the confluent moving average area at 65 cents, where the 200-week and 50-week moving averages converge, with the 20-week moving average positioned at 69 cents. The 200-week moving average continues serving as the primary bull market resistance level requiring breakthrough for macro bullish confirmation.

ADA’s previous swing low sits around 51 cents, just a few cents below current levels, suggesting potential retesting scenarios remain possible. The analyst monitors momentum oscillators including daily RSI for signs of trend changes while maintaining focus on the critical 65-cent resistance zone.

The post Cardano Price Flashes Massive Weekly Indicator: What’s Next for ADA? appeared first on The Coin Republic.