Can XRP Price Hit $5 Amid Ripple ETF Optimism & This Massive Development?

Key Insights:

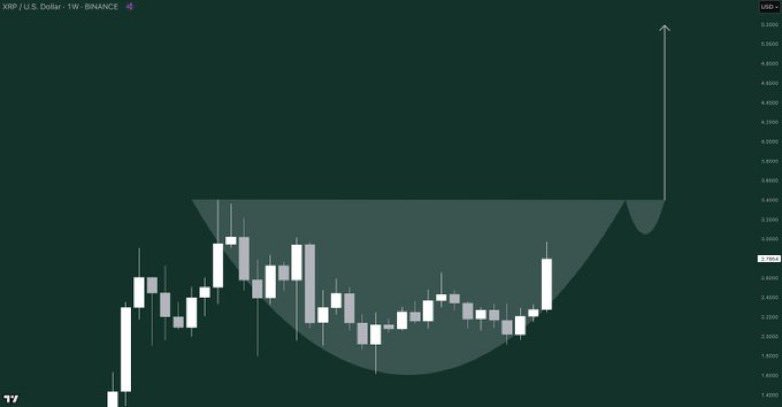

- XRP price forms massive cup and handle pattern targeting $5.20 breakout levels

- ProShares XRP ETF launches July 18 following federal court ruling clarity

- ISO 20022 goes live July 14 benefiting RippleNet integration capabilities

XRP price targets $5 amid multiple bullish developments including ETF approval and technical patterns. Analyst Gordon identifies huge cup and handle formation on weekly charts.

ProShares XRP ETF goes live July 18 following legal clarity. Additionally, ISO 20022 standard launches July 14 supporting RippleNet integration with global banking systems.

XRP Price Analysis Points to Massive Cup and Handle Breakout

Analyst Gordon identifies a huge cup and handle pattern forming on XRP weekly charts. The technical formation targets $5.20 breakout levels following pattern completion. Cup and handle patterns generally means substantial upward price movements.

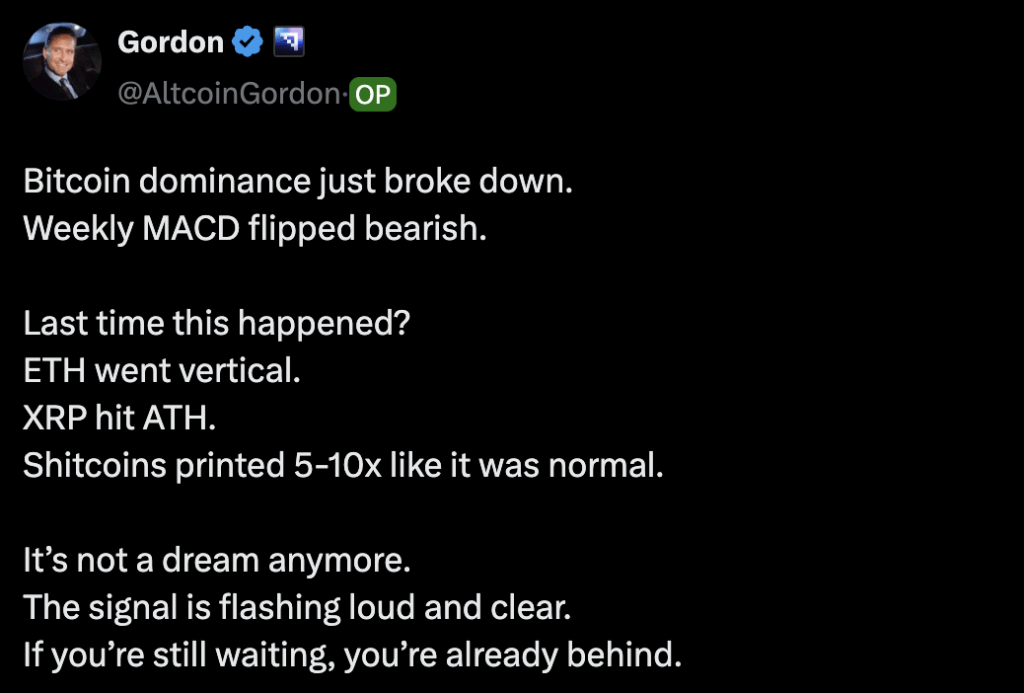

Bitcoin dominance broke down with weekly MACD flipping bearish according to analysis. The last occurrence led to ETH going vertical and XRP hitting highs. Altcoins printed 5-10x gains during similar market conditions previously.

The technical signal flashes clearly indicating altcoin season preparation across markets. Investors waiting for confirmation are already potentially behind existing market movement. Bitcoin dominance breakdowns have historically been responsible for major altcoin rallies each time.

XRP rides broad altcoin strength as dominance trends decline. Technical trends line up with fundamental advancement to support price appreciation potential.

Weekly time frames provide more reliable signals than the shorter-term charts. The $5.20 target anticipates the pattern completion and a successful breakout affirmation. Several technical indicators lend support to a bullish scenario for XRP price action.

ProShares XRP ETF Approval Follows Federal Court Clarity

ProShares XRP ETF goes live on July 18 following years of legal battles. The Wolf Of All Streets announced the ETF launch date confirmation. Lawyer John E Deaton highlighted the two-year timeline since federal court ruling.

A federal judge declared XRP itself not a security two years ago. This ruling came after 75,000 XRP holders fought for legal clarity. The court decision paved the way for institutional investment products.

Two years later XRP ETFs receive approval for public trading access. The timeline shows how legal clarity leads to institutional adoption. Free markets benefit from regulatory certainty according to Deaton’s analysis.

ETF approval provides larger investors with an opportunity to invest in XRP without necessarily holding it. Regular investment products enable more investors to step into cryptocurrency. ProShares leverages its long history in XRP product fund management. The ETF launch is timed with technical breakout patterns on XRP price charts.

Institutional purchase in the form of ETF products can underpin prices. Regulatory clarity overcomes significant barriers to institutional market entry. Earlier launches of ETFs for Ethereum and Bitcoin have created high price momentum. ETF for XRP can be expected to receive comparable institutional fund flows.

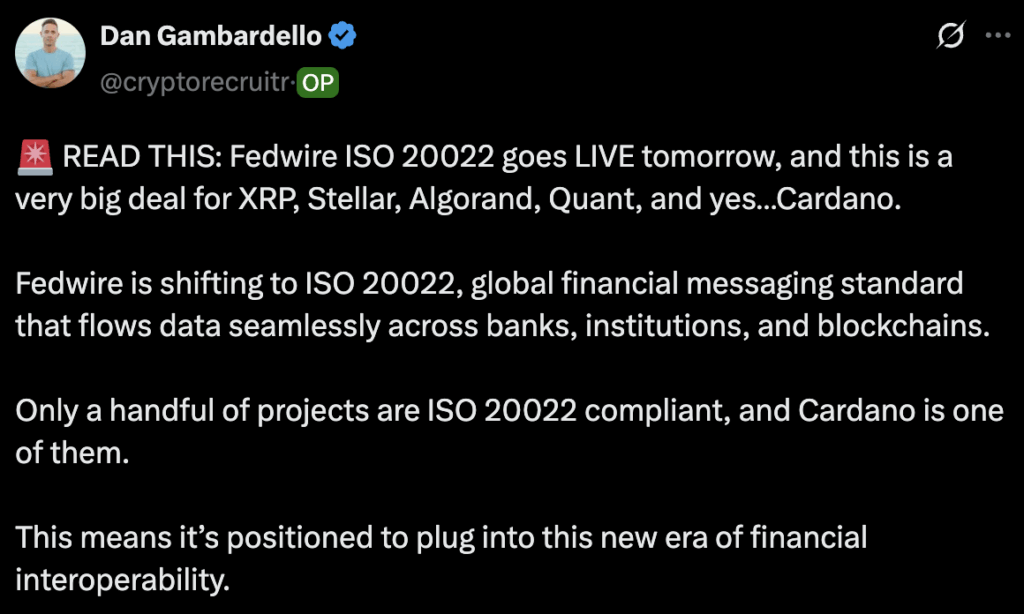

ISO 20022 Implementation Benefits RippleNet Integration Capabilities

ISO 20022 goes live on July 14 affecting XRP, Stellar, Algorand, and Cardano. Dan Gambardello explains the global financial messaging standard’s importance for blockchain integration. Fedwire shifts to ISO 20022 bringing the US in line with Europe.

ISO 20022 functions as a messaging standard rather than cryptocurrency or blockchain. The system allows financial institutions to communicate using unified data-rich formats.

It upgrades global payment systems from outdated to modern encrypted communication methods.

US Fedwire Funds Service settles trillions in payments using the new standard. This brings American financial infrastructure in line with SWIFT and European systems. The upgrade creates opportunities for compliant blockchain networks to integrate.

RippleNet operates as Ripple’s enterprise-grade network for banks and payment providers. The network maintains ISO 20022 compliance for direct banking infrastructure integration. XRP serves as bridge asset within RippleNet rather than being compliant itself.

Crypto tokens don’t use messaging formats making direct compliance impossible for cryptocurrencies. RippleNet’s compliance allows XRP utility within the compliant messaging system. Global payment rail upgrades facilitate easier RippleNet adoption by institutions.

More RippleNet adoption creates additional corridors increasing XRP utility and demand. The infrastructure upgrade lays foundation for increased cryptocurrency integration with banking.

The post Can XRP Price Hit $5 Amid Ripple ETF Optimism & This Massive Development? appeared first on The Coin Republic.