JPMorgan analysts say Circle’s USDC is under growing pressure as Tether, Hyperliquid, and fintech firms like Robinhood and Revolut prepare rival stablecoins.

> Tether plans to launch USAT, a fully GENIUS Act–compliant token with reserves held at Anchorage Digital.

> Hyperliquid is rolling out USDH to reduce reliance on USDC.

> JPMorgan analysts also argue that fintech-backed coins could add further strain.

> Circle is countering with Arc, a blockchain built to keep USDC central.

> Analysts caution that the market may remain a “zero-sum game,” with issuers trading market share unless the overall crypto sector expands.

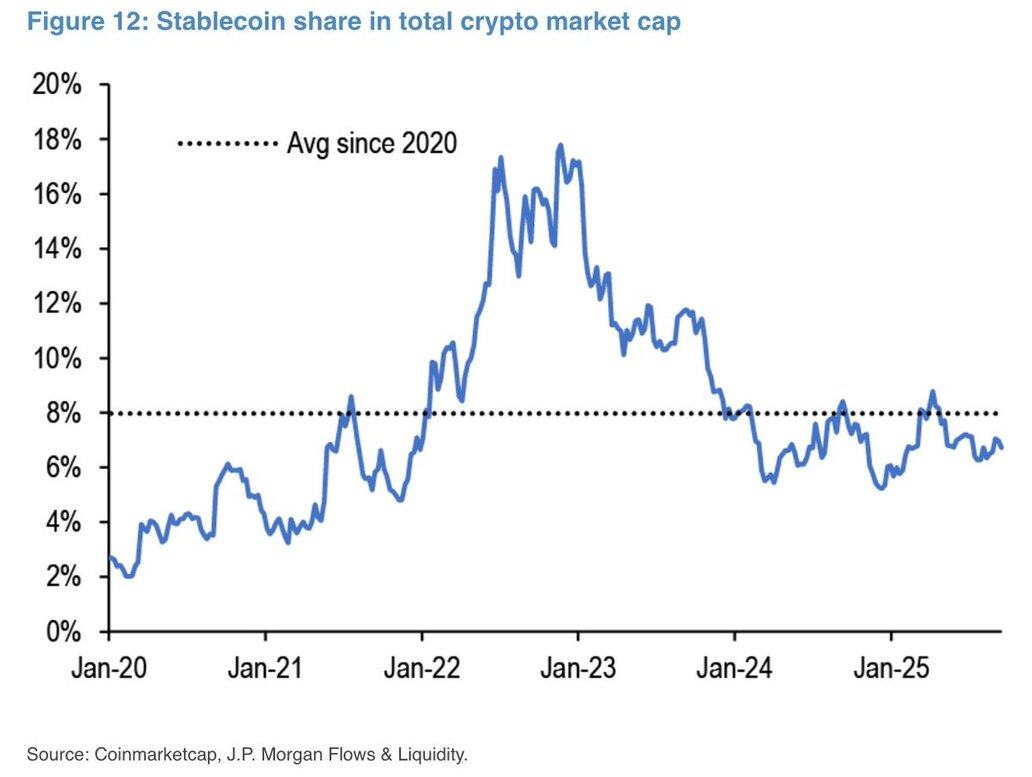

The stablecoin market is currently valued at $278B but remains below its 8% share of total crypto market cap.

Show original

1.63K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.