🔥 Thanks to Viki for the amazing picture, I decided to pin it on my homepage haha

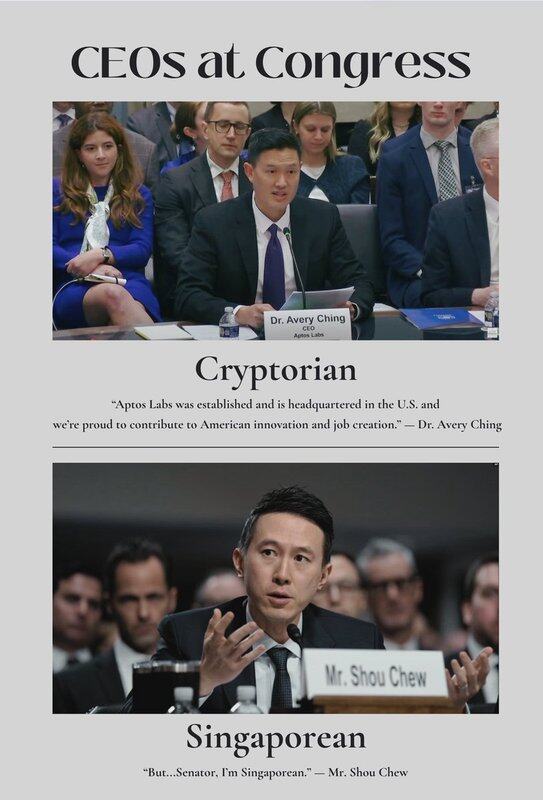

The scene of the Aptos CEO speaking in Congress reminds me of Zhou Shouzi's classic line, "Senator, I’m Singaporean!"

Don't say it, the two of them do look a bit alike 😆

Additionally, I keenly noticed that the young lady in the back left was watching Avery's entire speech with an appreciative gaze 👀...

However, not every CEO appearing at a hearing needs to prove their innocence, and not every Crypto CEO can go to a hearing to give testimony.

The main purpose of Aptos CEO Avery Ching's testimony was to educate lawmakers about the industry, call for clear cryptocurrency legislation, advocate for a clear regulatory environment for the industry, and enhance the United States' competitive position in the cryptocurrency field.

(Although the backgrounds of Avery and Zhou Shouzi attending the hearing are vastly different, it is undeniable that both CEOs have made outstanding contributions in their respective fields as Chinese individuals 👏)

————————

🚩【Background of the Hearing】

I took a look, and it was during the review of the Clarity Act. A crucial part of the Clarity Act is to delineate the jurisdiction of the SEC and CFTC over cryptocurrencies, asserting that most digital assets should be classified as "digital commodities" rather than securities, and thus be regulated by the CFTC. The Agriculture Committee is responsible for overseeing the CFTC.

Other important figures attending the same hearing included former SEC Commissioner and Acting Chair Michael S. Piwowar, as well as two senior lawyers in the cryptocurrency field, aiming to understand the situation from the perspectives of technical developers, former regulators, legal experts, and more.

Avery Ching is likely one of the very few CEOs of Crypto projects who can represent and participate in discussions at the level of a hearing.

🚩【Technical Aspects】

I remember having a deep chat with Sege outside a nightclub (I also love learning a lot 😆), where he educated me on the past and present of the Move programming language. This inevitably brings up Meta (Facebook). Before founding Aptos Labs, CEO Avery Ching had already worked at Meta for over ten years and was one of the core technical leaders of Meta's blockchain project, which laid an important technical foundation for Aptos.

The technical advantages of Aptos can be summarized as: speeding up through parallel processing, enhancing security through the Move language, and achieving stability and easy upgrades through modular design.

These designs aim to address the common pain points of existing blockchains, allowing them to support large-scale commercial applications and massive user bases. To emphasize, Aptos was designed from the outset for widespread commercial applications (I mean, working in large enterprises indeed brings a forward-thinking business mindset 😆)

🚩【Regulatory Aspects】

Due to regulatory uncertainty (everyone fears the SEC's hammer), the United States has lost a significant number of developers in the cryptocurrency field over the past decade, and more importantly, a lot of tax revenue ⚠️

Many projects, in order to avoid regulatory risks, have established their entities outside the United States. For example, Tether reported a profit of $6.2 billion in 2024, but due to its overseas registration, if fully subject to U.S. tax jurisdiction, it could have contributed about $1.3 billion in federal corporate tax and $316 million in state tax. (Source: Dragonfly 2025 Airdrop Research Report)

Now, the U.S. intends to treat cryptocurrency as an important financial innovation initiative, regardless of the reasons, but it is certain that the U.S. will be more inclined to support local companies and projects that are willing to actively embrace regulation and contribute to employment and tax revenue.

On this point, I believe many projects can learn from Aptos's proactive communication approach.

➤ Proactively influence legislation: Don’t wait until the regulatory hammer is about to fall before attending hearings, but take the initiative to approach lawmakers, using professional knowledge to influence and shape the future regulatory framework, creating a more favorable development environment for themselves.

➤ Establish a compliant image: In an industry filled with anonymous projects, overseas entities, and regulatory arbitrage, a CEO appearing publicly in the U.S. Congress can send a very critical signal — willing to operate within the U.S. legal framework, willing to take on certain social responsibilities (promoting innovation, employment, tax revenue, protecting consumers and investors), and willing to cooperate with lawmakers to ensure the U.S. maintains its leadership in the blockchain field, which is crucial for attracting large enterprises, financial institutions, and government cooperation.

————————

🚩 Following the legislative line, I personally think several points to focus on are:

✅ Pay attention to local projects represented by Aptos that are willing to contribute to employment and tax revenue in the U.S., AKA "pure-blood" American projects.

✅ Monitor which projects' representatives attended important meetings and participated in significant proposals. These are usually undercurrents that won't quickly reflect in market prices.

✅ Keep an eye on the trends in U.S. legislation and regulation. The advancement of these proposals usually takes a long time, and there are opportunities for early research.

Currently, the most important proposals include the Clarity Act (the most important), the anti-CBDC bill, and a White House report: Strengthening American Leadership in Digital Financial Technology, which is also worth a look.

While I also look forward to the day when regulatory clarity arrives, I believe there are still many things that need to be clarified at the legislative level (including but not limited to laws, accounting, taxes, etc.), so it is unlikely to happen quickly, even if Trump issues orders for rapid approvals. Of course, I welcome being proven wrong 😆

911

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.