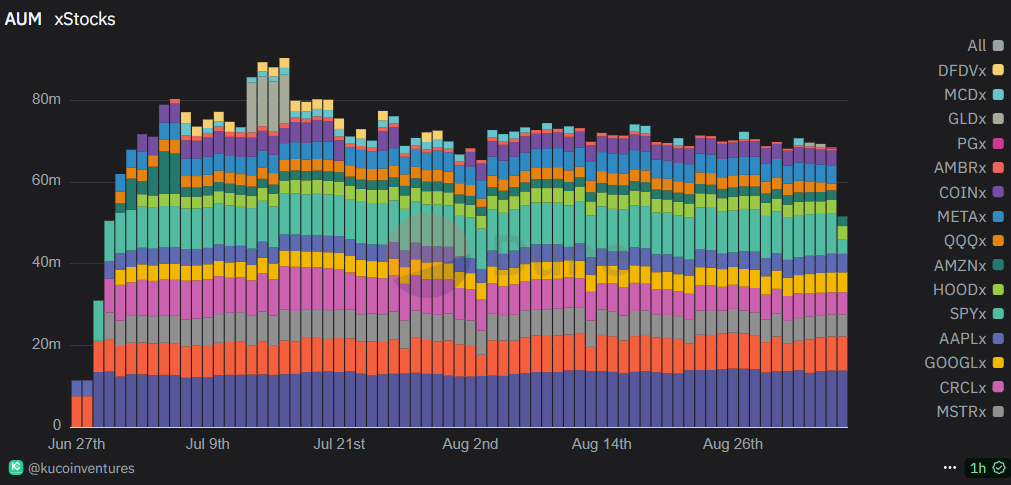

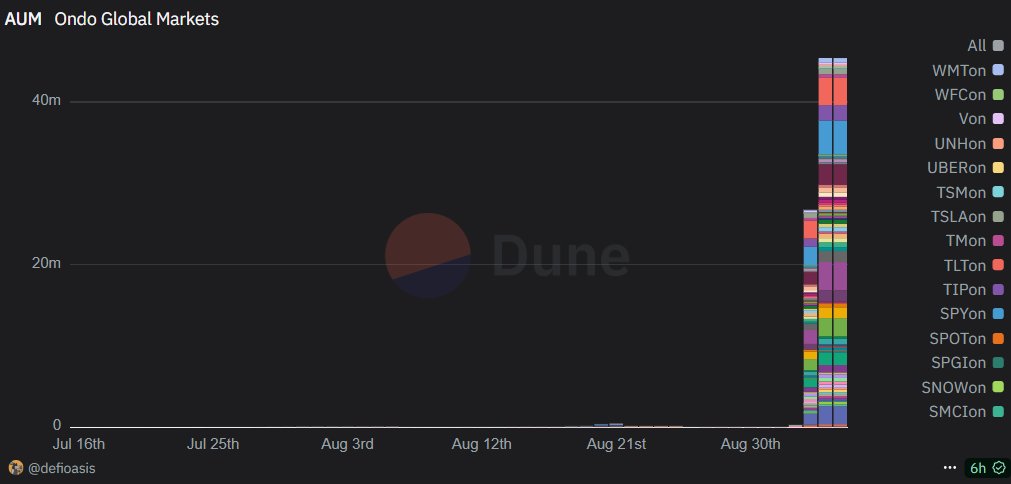

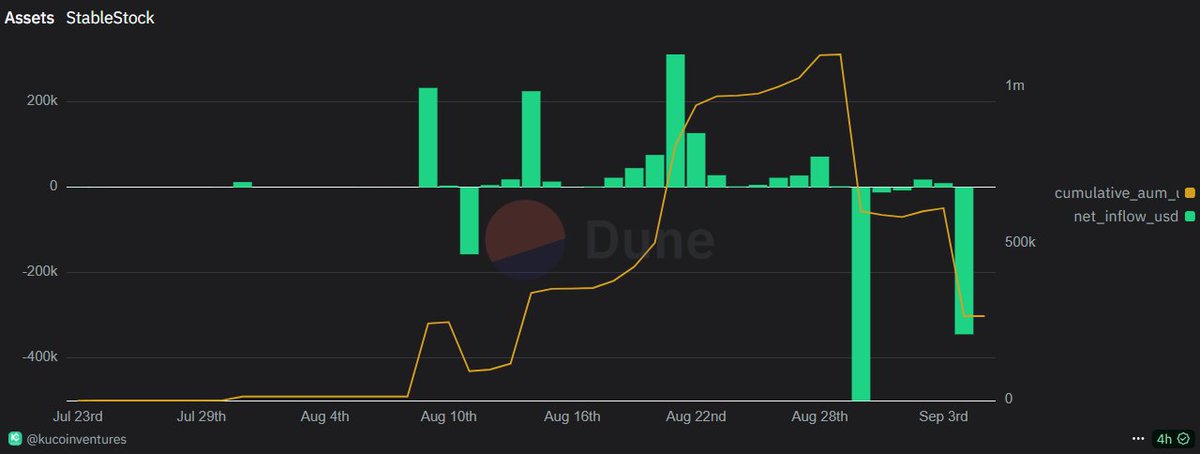

There are quite a few tokenized stock platforms in the market. Although their goals are similar, each platform's solutions are unique. Three types represent: xStocks focuses on the secondary market, Ondo focuses on the primary market, and StableStock focuses on the stock market. xStocks is quite strict in the issuance of stock tokens, only allowing compliant professional investors to mint and redeem stock tokens linked to real stocks; retail investors can only trade stock tokens on the secondary market of DEX and some CEX, without access to real stocks. The benefit is that retail investors have higher trading convenience, and exchanges are easier to access, but they are limited by the issuance scale of professional investors in the primary market and rely on them for arbitrage to anchor prices. However, professional investors seem to lack the motivation to issue stock tokens, and the AUM of xStocks stock tokens is almost stagnant in growth. Data: Unlike the active secondary market...

Show original

5.05K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.