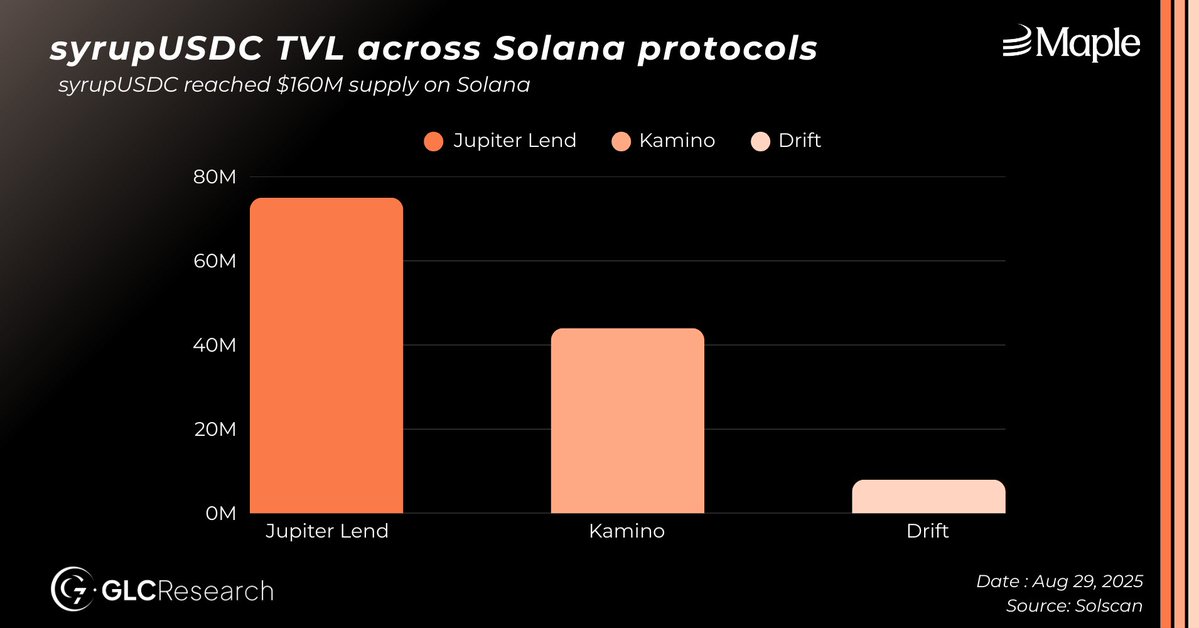

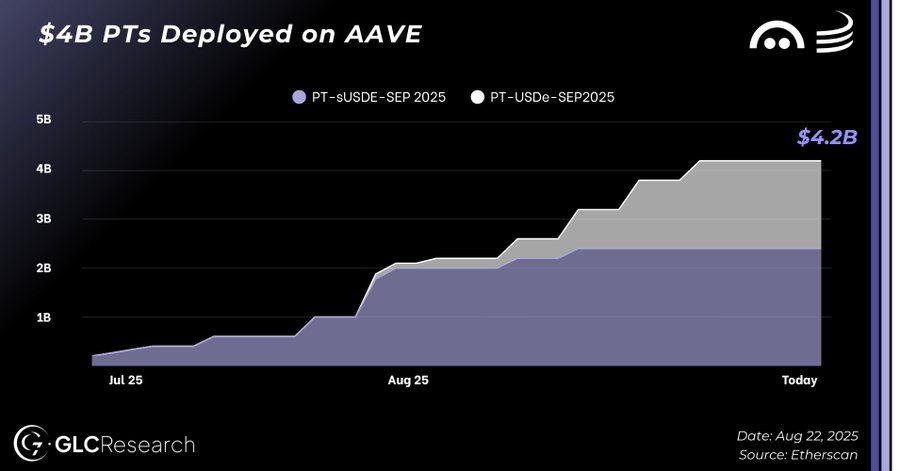

<Maple, what are the current achievements and the next momentum?> Maple (@maplefinance)'s recent growth is certainly remarkable. Just looking at the first half of 2025, SyrupUSD has established itself as one of the fastest-growing yield-bearing stablecoins (YBS) in the market. AUM skyrocketed from around $100 million to $2.2 billion, and the issuance expanded from $58 million to about $1 billion, making it the third-largest YBS after Ethena and Spark. It is broadening its holders and use cases on both Ethereum and Solana. The driving force behind this growth is Maple's clear strategy, which is "on-chain integration." By continuously connecting SyrupUSDC to major DeFi protocols like @pendle_fi, Morpho, Euler, Kamino, and Drift, it has transformed from a simple deposit asset into a 'circulating asset.' In fact, over $50 million in SyrupUSDC was deposited within just two months of its launch on Kamino, and with the integration of Jupiter Lend and Drift, the growth curve has become...

Show original

10.18K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.