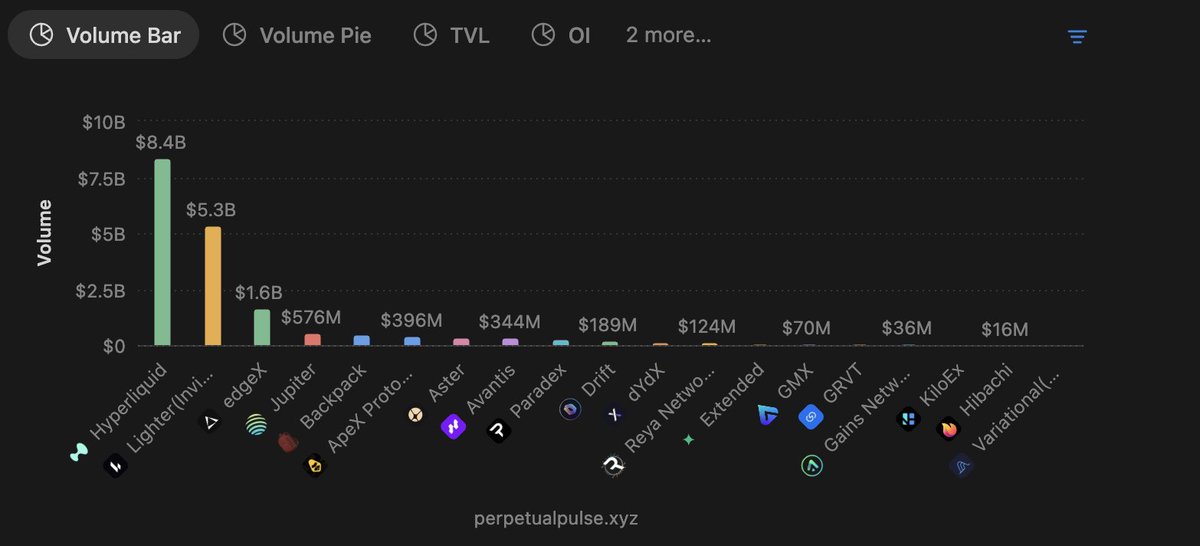

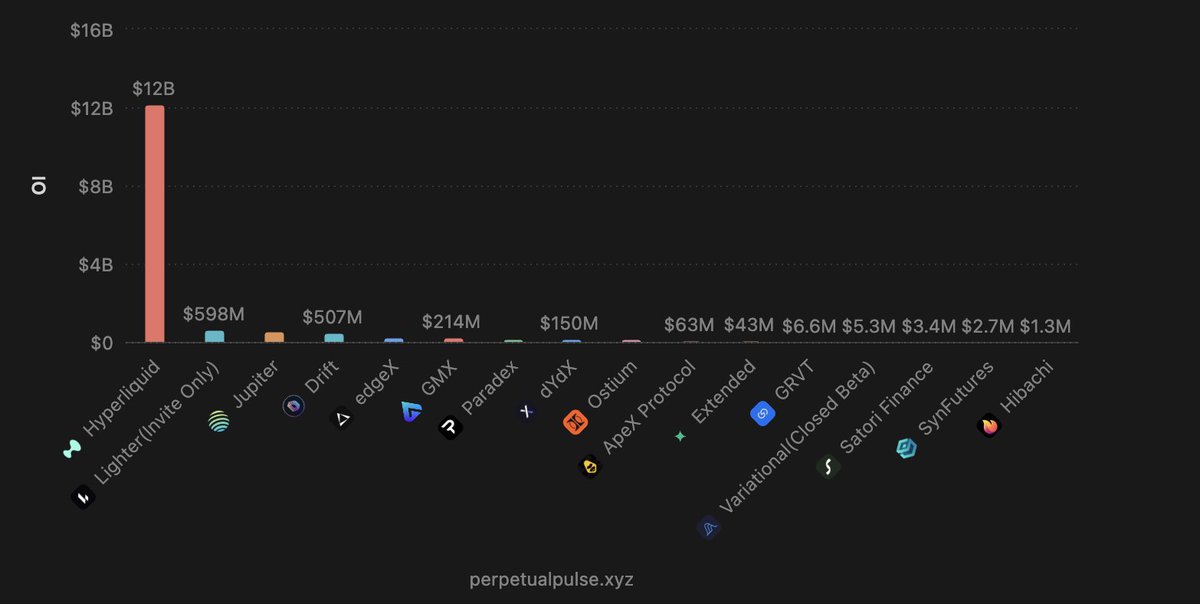

1. Lighter and EdgeX seem to be approaching hyperliquid volume, but OI (open interest) is lagging significantly. 2. Most transactions are spam for airdrop farming rather than actual users. 3. Some support retail user trading with subsidies, yet the trading retention rate is low. 4. EdgeX has high fees at the HL level, but the volume is decent while OI is relatively weak. 5. The challenge is to maintain volume, TVL, and OI even after the trading subsidies are stopped. 6. Designing tokenomics and securing token value are key. 7. There is a high possibility that users will leave the ecosystem after TGE. 8. With many competing projects, maintaining loyalty is difficult. 9. Concerns about a pattern similar to past L2 metas: 'airdrop expectations → short-term boom → quick exit.' 10. Ultimately, long-term user retention and value accumulation will determine success or failure. --- The above content summarizes the Twitter discussion. However, I think that airdrops are not unlikely...

everyone is so bullish on lighter and edgeX on the timeline but they will not tell you this. you have a look at the volumes across perp DEXs - it seems like lighter and edgeX are coming quite close to hl's volumes. then you have a look at the OI and you will get a totally different picture. turns out most of the users of these platforms are spamming txs to farm an airdrop. Some of these even subsidize transactions for retail users + airdrop rumors and yet users can't be bothered to keep a trade open. in particular, edgeX volumes are great considering that they have fees as high as hyperliquid. But OI is non-existent compared to it. while everyone has got a shot at it, these platforms now have the job to: stop subsidizing trades; retain volume, tvl and oi; create great tokenomics; accrue value to the token. what makes people think that as soon as these projects TGE will not leave the eco? especially with so many other similar options available the trend reminds me of the L2 meta....

3.7K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.