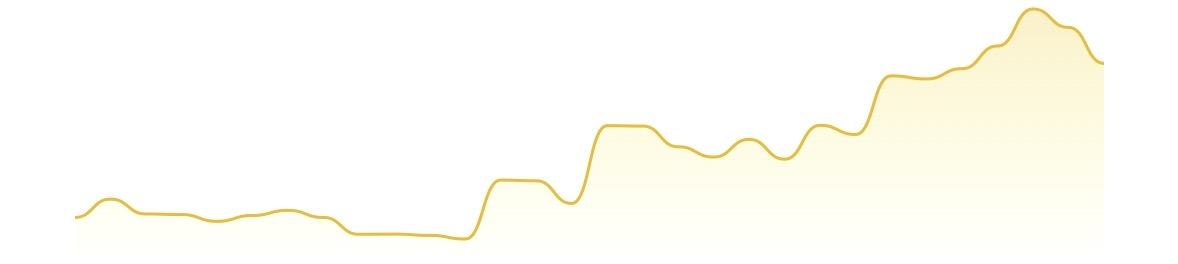

Just in the past month, I will summarize the strategy of "going long ETH and shorting a package of altcotts". Overall, this idea is very successful, ETH continues its strong performance, and for most of the month, other altcoins cannot rise ETH during the rise period, and the decline will exceed ETH during the decline. It can also be seen intuitively from the data that ETH. D has increased from 12% to 14.4%, and only 18 of the top 200 tokens on CMC by market capitalization have surpassed ETH in the past 30 days. The biggest advantage of this strategy lies in its robustness in the face of market fluctuations, even if ETH has experienced three pullbacks of more than 10% during the period, the return curve in Figure 2 still maintains an overall upward trend, which also makes the psychological pressure of hedging much less than unilateral long under the same position size. The key to the hedging strategy is to choose weak altcoins, according to the beginning of August, ETH from 3700 to...

At present, the long and short divergence is serious, I opened a hedging trade, long ETH, short a package of copycats, the position is about 1:1, and I will exchange ideas with you. My logic is that ETH is the engine of this round of rise that began at the end of June, and the main driving force is that institutions follow the micro-strategy and purchase ETH through currency stock financing, and the other is the stablecoin narrative, which is the relevant core infrastructure and settlement layer. Referring to the previous process of buying BTC with micro-strategies and driving prices all the way up, in the end, most altcoins are far from outperforming BTC. This part of the funds used by currency stocks and institutions to buy ETH is also unlikely to spill over to other altcoins. According to CMC, only 20 of the top 200 tokens have risen more than ETH in the past 30 days, including Bonk, Zora, CFX, and ENA, which are obviously driven by positive events. In terms of copycat...

284.71K

753

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.