Hyperliquid was made by capital again, and the arbitrage dog set up the principal in the end.

$XPL Price manipulation event review

Event overview

Antecedent:

XPL is the native token of the Plasma network, a cryptocurrency-focused Layer-1 blockchain network designed to enable fee-free USDT transfers.

XPL tokens completed their public sale in July 2025, issuing 10% of the 1 billion tokens and raising $373 million at $0.05 each. XPL is currently trading presale on the Binance futures market and Hyperliquid's XPL-USD margined contract market at around $0.45, with a fully diluted valuation (FDV) of $4.5 billion, which is already up 10 times from the public sale price.

What happened:

On August 26, 2025, a price manipulation incident occurred on the Hyperliquid platform targeting XPL (the native token of the Plasma network).

Whale Wallet (suspected to be associated with Justin Sun, address: 0xb9c0283968744b80aef904455bb3dfc7ffd6801e

With huge leverage, bulls quickly push the price higher, forcing the bears to close their positions, creating a typical "liquidation hunt."

Within minutes, the XPL price skyrocketed from $0.6 to $1.8 (+200%) before quickly retreating. The event is limited to Hyperliquid (the special price feed mechanism of the HL platform will be introduced later), and other markets such as Binance are not affected.

Outcome:

Short liquidation losses may exceed 10 million US dollars (many are 1x pre-sale hedgers, and arbitrage has lost the capital);

Whales made a profit of about $16 million;

Community trust in Hyperliquid is compromised.

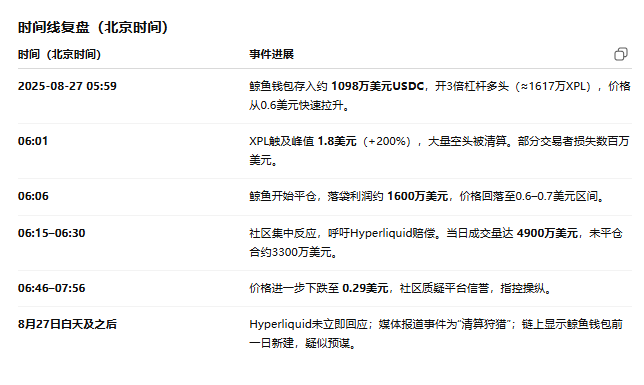

Timeline review (Beijing time)

2025-08-27 05:59: Whales deposited approximately $10.98 million USDC and opened a 3x leveraged long position (≈ 16.17 million XPL). The price pulled up from $0.6.

06:01: Peak at $1.8 was hit, and a large number of shorts were liquidated. Some traders lose millions.

06:06: Whales begin to close their positions, and the profit ≈ $16 million. The price fell back to $0.6–$0.7.

06:15–06:30: The community reacts intensively and calls for reparations. Notably, XPL's intraday trading volume was only $49 million, while open interest was as high as $33 million.

06:46–07:56: The price dropped to $0.29 at one point

Key mechanisms and influencing factors:

Platform mechanism: HL prices are based only on the internal order book, no external oracles.

Leverage Amplification: 3x leverage makes it easy for whales to trigger chain liquidations.

Funding rate failure: Even reaching 1200% APY fails to curb the imbalance.

Victim structure: Most liquidated people are 2x hedged arbitrage dogs, not high-risk speculation.

Losses and gains:

Whale profit: about $16 million

Trader loss: Up to $2.5 million for a single account, overall or over 10 million

Market Performance: Prices quickly retreated, but volume surged.

Speculation is on the rise

Speculative traders began to step in!

Rethink:

Spot trading vs pre-market trading

Spot trading: The token has been listed on mainstream exchanges, with sufficient liquidity and transparent prices, making it difficult to manipulate at a single point.

Pre-market trading: Tokens are not officially circulated, only a small number of shares can be traded, liquidity is weak, and the price is influenced by a small number of large funds.

This XPL incident is a typical vulnerability exposure in the pre-market market.

@maid_crypto sighed, who came up with this kind of loss trick for pre-market trading?

It can be seen that the vulnerability of the pre-sale leverage market comes from

Low liquidity: The current actual circulation of XPL may be limited to a portion of the public sale tokens for non-US purchasers, less than 10%, and some media reports that the circulation is 0%, most of the trading volume comes from pre-market trading, and the order book is extremely thin.

Leverage amplification: Small funds can leverage the entire market, triggering a liquidation cycle.

Inflated Valuation: XPL FDV is as high as $4.5 billion, but the mainnet has not been launched and lacks fundamental support.

Mechanism of Hyperliquid's liquidation attack again:

Design flaw continuation: Similar to the earlier JELLY incident, the internal pricing mechanism lacks external anchoring assistance.

Lack of liquidity: Presale tokens are inherently fragile, and whales only need a small amount of money to leverage the market.

Leverage is too lenient: 3x leverage is allowed on low-liquid assets.

Risk control lagging: The high funding rate mechanism failed to play a restraining role.

Show original

34.86K

73

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.