Quick snapshot on @SonicLabs momentum ↓

Whale activity:

• 1.8M $S bought in 24h, wallet linked to Sonic Gateway usage

• 573K $S bridged over 7 tx

• OpenSea handle tie: “bodhi9918” (World of Umans OG), looks trader, not a desk

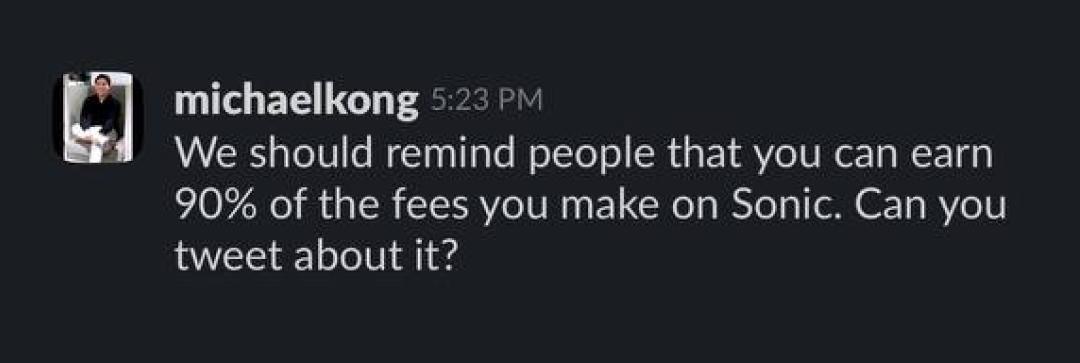

Builder economics (FeeM):

• 200+ apps earning direct fees

• Builders keep 90% of txn fees; no token launch, no upfront capex

• @SiloFinance accrued 17,026 $S post-deploy

Ecosystem execution:

• $400K deployed to builders (@Mainstreet_f + Silo, ODX, Ammalgam, HeyAnon)

• @gosodax migrating infra, self-staking 3M $S + running a validator

• @ShadowOnSonic processing ~$1B/mo on ~$30M TVL; $39M+ lifetime fees

Infra & safety:

• Sonic Gateway: batched heartbeats, Fast Lane option, 14d fail-safe, CCTP v2 for USDC

• Formal verification (TLA+ DAG proofs) with academic partners

Governance #1:

• U.S. ETP/ETF + BitGo custody

• NASDAQ PIPE

• Sonic USA entity

Distribution, liquidity, compliance lined up does this stack pull $S into mainstream flow or does timing cap the upside near-term

Show original

6.28K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.