This is what insight is.

Everyone is too busy yapping to read stuff like this...

The crypto space is getting wider, but our vision is getting narrower.

Later, this gap in thinking (not knowledge) will become the biggest weapon.

The structure of DAT companies like $MSTR and Digital Asset Treasury

In this article, I will write an interesting research piece about companies that buy cryptocurrencies with company funds, which are worth more than the total cryptocurrency holdings of the company, in the following order:

- Capital raising mechanisms

- Valuation methods

- Actual holdings

- Risks

What is the DAT strategy and what are the main differences between ETFs and DAT?

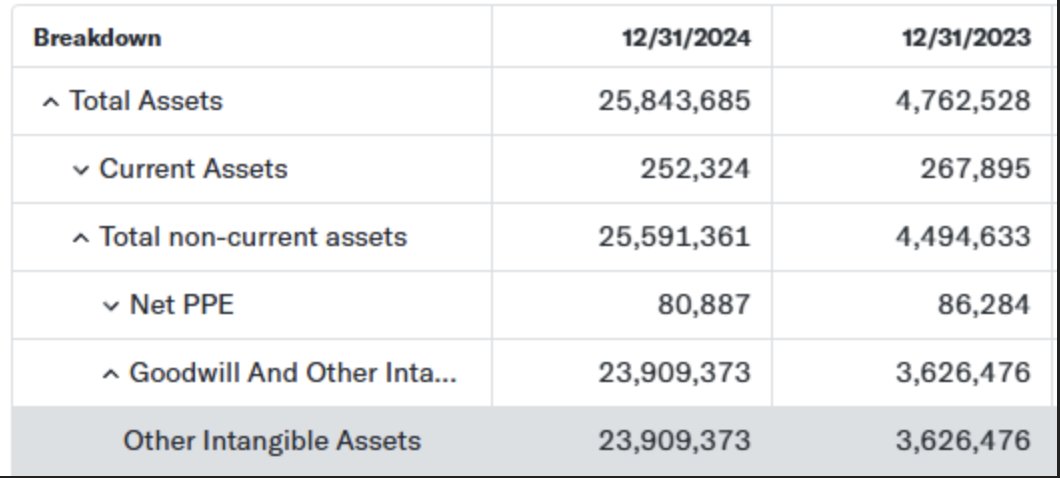

The DAT strategy involves companies directly purchasing virtual assets with company funds through capital raising, thereby holding assets like BTC or ETH on their balance sheets. A representative example is that while MicroStrategy's balance sheet does not explicitly list Bitcoin, under US GAAP (Generally Accepted Accounting Principles), virtual assets like Bitcoin are classified as "indefinite-lived intangible assets."

In other words, the value of cryptocurrencies is included in Other Intangible Assets.

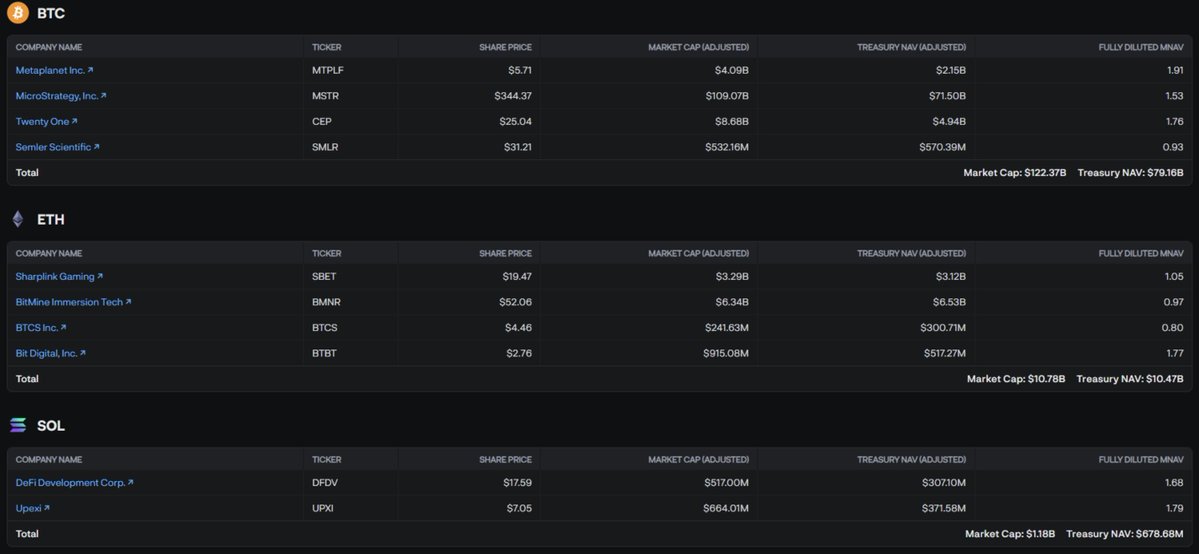

In the case of ETF operators like Grayscale, the coins held are assets of the fund (trust) and not the operator's assets, so they do not appear on the balance sheet but are accounted for as ETF managed assets. There is a document that neatly organizes the tickers and mNAV holdings of companies using DAT strategies for BTC, ETH, and SOL.

Capital raising mechanisms for companies using the DAT strategy

The most common methods in order are:

ATH (At the market) method -> After increasing the number of shares, sell them at market price in the securities market and use the proceeds to purchase cryptocurrencies.

Issuing corporate bonds -> Although interest costs are high, it allows for large-scale capital acquisition.

PIPE (Private Investment in Public Equity) -> A method of private capital increase, mainly issuing new shares to institutions, VCs, or hedge funds in exchange for cash.

Issuing zero-coupon convertible bonds -> Issuing convertible bonds without interest, which can be redeemed at face value or converted into shares at maturity. Investors can expect significant returns if the stock price rises.

How do these companies determine their value?

Typically, the company value = coin holding value (NAV) + business value + price including premium/discount.

For business value, for example, MicroStrategy would consider BI software sales, while Bitmain would consider mining equipment sales, but DAT investors usually ignore or undervalue this, so it does not hold much significance in company valuation.

Here, the points we need to focus on are the premium and discount, but before explaining, we need to understand the concept of mNAV (market-to-NAV multiple), which is the market capitalization divided by NAV (understood as coin holding value).

If mNAV is greater than 1, it indicates a premium; if less, a discount.

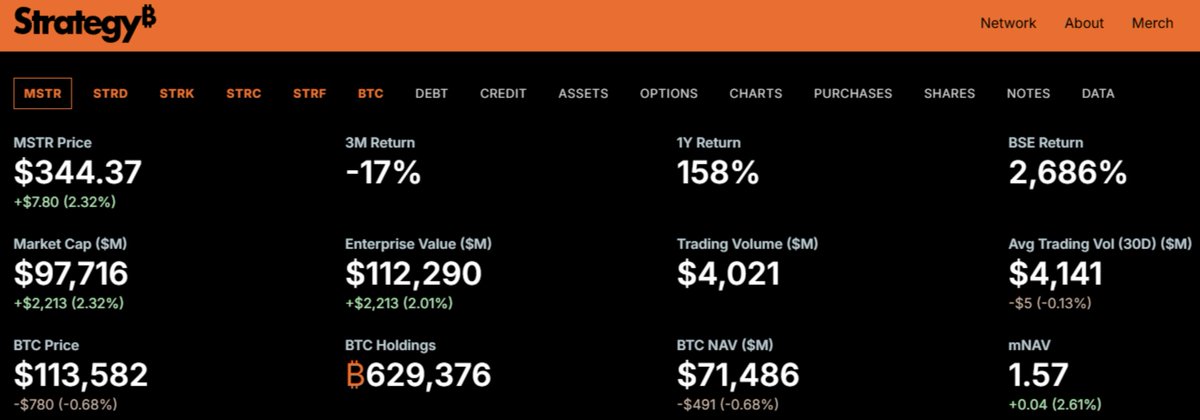

For example, in November 2024, $MSTR's mNAV peaked at 3.89, meaning @saylor's company @MicroStrategy was trading at a value of $3.89 for every $1 of Bitcoin holding value.

How much do they actually hold?

According to Galaxy, as of July 2025, DAT companies hold 791,662 BTC and 1.31M ETH, which corresponds to over $10 billion in digital assets, about 4% of the total Bitcoin supply.

A year ago, they held 416,000, and as of August 19, they are holding 950,000, showing an annual growth rate of over 120%.

Of this, MicroStrategy owns approximately 630,000.

What are the main risks for these companies?

Collapse of the premium -> The company value may become cheaper than the holding amount, leading to a discount.

For example, a company holding $100 million in Bitcoin may have its stock purchased at a premium of $300 million, but it could drop to $80 million, posing a risk.

Leverage risk, as most purchase coins with debt (leveraged investment), can benefit from rising coin prices but can lead to repayment burdens if prices fall, resulting in deeper declines in premium and stock prices.

For companies raising funds by increasing shares, existing shareholders' stakes will gradually be diluted, so if the coin price does not rise, it results in a double hit of stock decline and value dilution due to the increase.

Forced liquidation risk

If the coin price drops significantly later and creditors demand repayment, they may have to sell coins, which could create significant selling pressure.

So what is the conclusion?

In simple terms, the strategy of buying coins with company money is DAT.

Companies like MSTR can essentially be seen as leveraged Bitcoin ETFs.

These strategies are trending among traditional finance companies.

Thank you for reading this long article. I will leave the references in the comments.

4.41K

31

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.