BTC and ETH recently broke through key resistance levels, with BTC even reaching an all-time high. Although there was a subsequent pullback, many investors opted for a risk-off approach due to macro uncertainties. However, with clearer macro policies in the market, there is hope for hesitant buyers to re-enter.

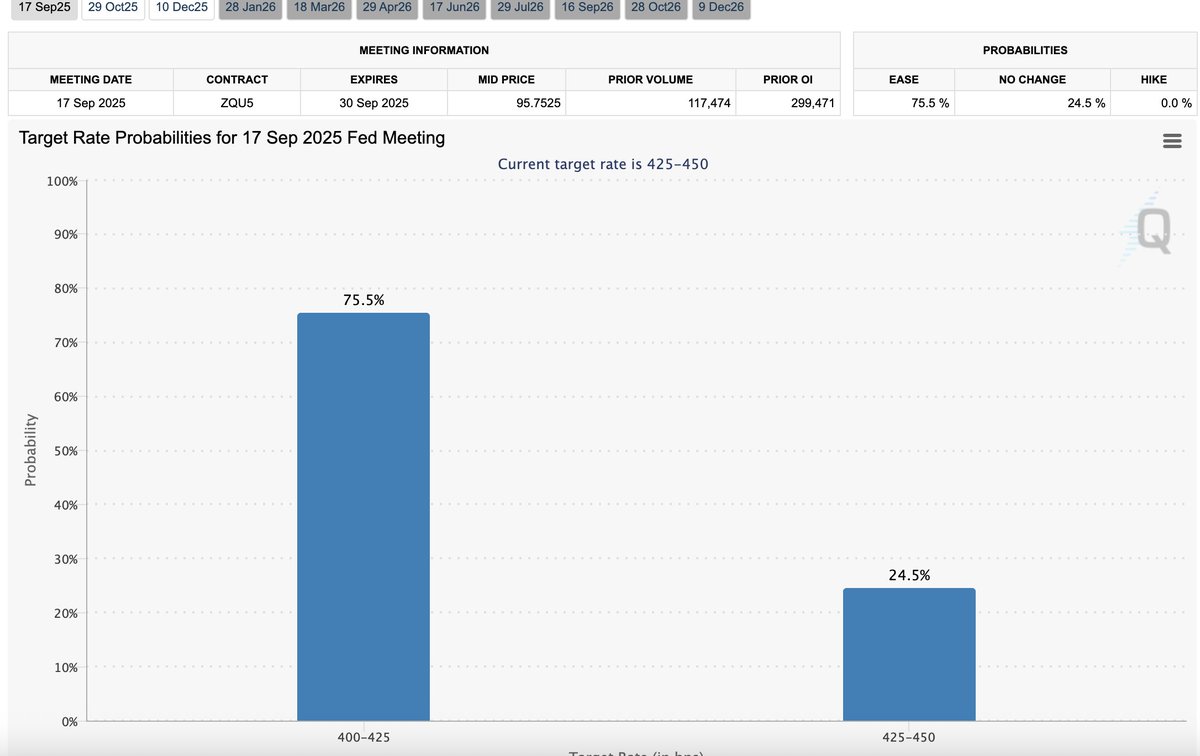

Currently, the price has started to shift from a 100% bet on interest rate cuts to a 75% bet on a 25bps cut, with the expected volatility from Jackson Hole on Friday already reflected in the prices. This creates a new battleground.

From a technical perspective, after BTC broke new highs, it showed short-term overbought conditions, with the RSI exceeding 80 at one point. The current pullback is mainly to digest profit-taking. If BTC can maintain above the previous high support zone, it is expected to challenge higher targets again after consolidation.

As for ETH, it recently successfully broke through the key resistance of $4300, but after failing to break the historical high of $4800, it has pulled back. Currently, ETH has temporarily stabilized at a key position, which means the bullish trend is still intact, and it is expected to challenge previous highs again and continue its upward momentum.

In addition to BTC and ETH, market focus is also shifting towards more promising public chain projects, such as SOL. As a new trading option launched on the Futu platform, SOL has a relatively low price and a more friendly entry threshold. At the same time, SOL's activity in the ecosystem and potential institutional entry show medium to long-term growth potential. Additionally, Futu supports trading in AVAX and LINK, providing investors with a more diversified crypto asset allocation.

Show original

49.46K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.