At the forefront of AI-driven DeFi, @Bitcoin_Sage delivers a masterful analysis of @Almanak__’s vision. Few possess the capability to not only see, but also truly understand the transformative potential ahead. 👇

I watched someone build a delta-neutral yield farming strategy in 27 minutes today.

Not code it. Not plan it.

Just build it. Test it. Deploy it. Live on Arbitrum...

Most insane thing is, they barely wrote any code. @Almanak__'s AI swarm did everything.

-----

Cursor for quant finance

This isn't another "AI will trade for you" extraction scheme. I've worked over a year with Almanak, and what they've built is fundamentally different.

While folks are panicking about prompt injections and LLM hallucinations losing their funds, Almanak built something boringly brilliant:

AI that writes deterministic, verifiable code that humans review before deployment.

Think Cursor for quant finance. Not a black box that YOLOs your money.

------

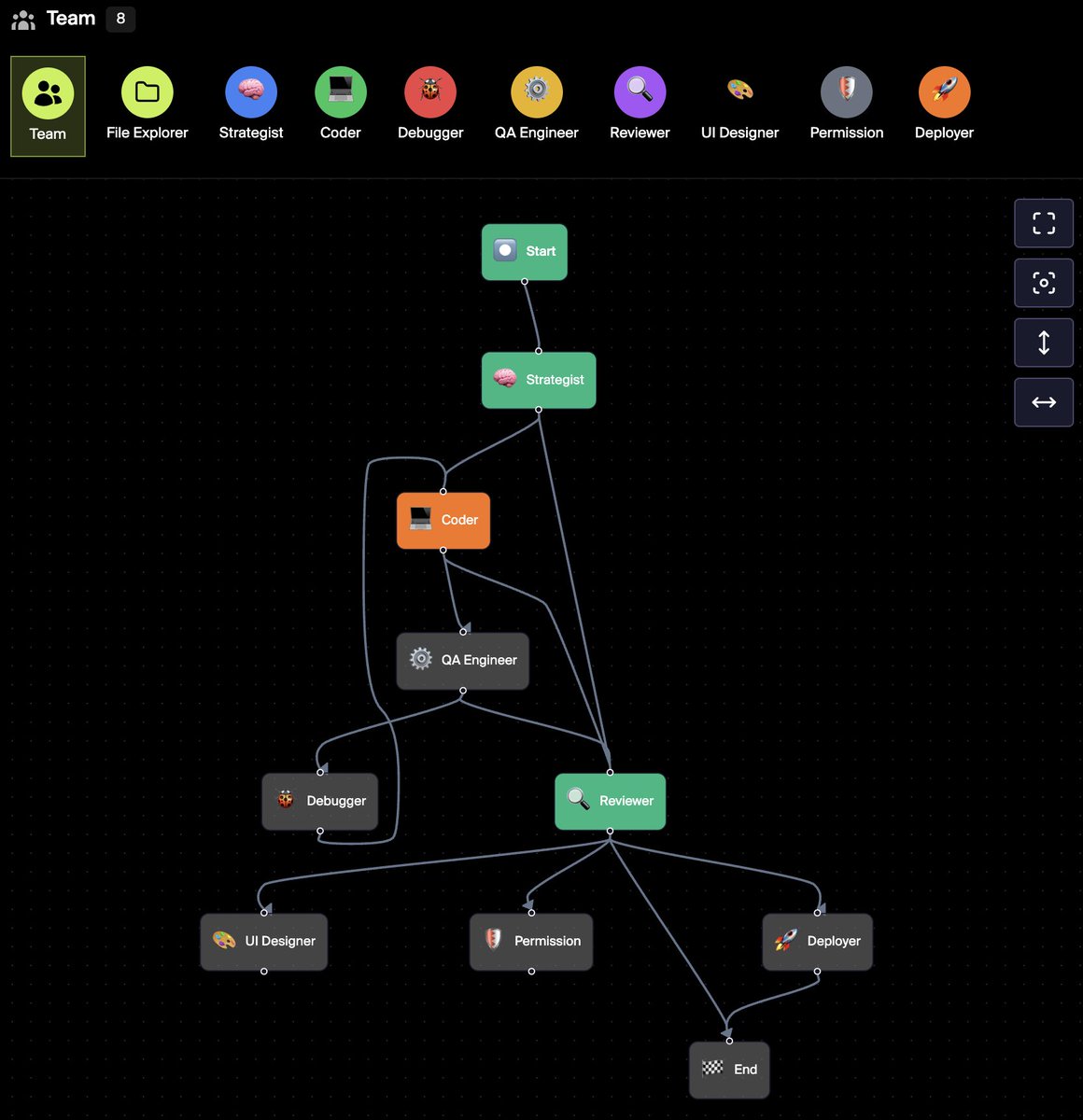

Here's what happens

You: "Build a strategy that LPs on UniV3, rebalances based on volatility, and hedges on Hyperliquid"

18 specialized AI agents activate:

- Strategist designs the architecture

- Coder writes the Python

- QA Engineer runs Anvil simulations

- Debugger fixes issues

- Reviewer ensures quality

- UI Designer builds dashboards

27 minutes later: Full production-ready strategy with permissions fully setup.

I've watched them do this live and have done it myself. Multiple times. It's still a bit rough around the edges, but it really works.

-----

The numbers

1. Time from idea to deployment: 30 min (was 2-4 weeks)

2. Current TVL: >$25M

3. Number of public strategies live: 1

4. Cost to build a strategy: <$10 in compute

5. Token launched: No (👀)

That $25M TVL? One vault. Pre-token. Pre-hype.

When the token launches and everyone gets access to create their own strategies and optionally create a public vault it gets crazy...

-----

Tokenomics

@Almanak__'s tokenomics are next level Curve Wars:

- Strategy creators earn emissions based on TVL + performance.

- LPs deposit capital and earn yield.

The killer feature: Protocols can bribe for "agentic traffic."‼️

Imagine Berachain paying $ALM stakers to direct AI strategies toward their chain. Or a new protocol bootstrapping $1B in TVL by incentivizing AI-managed liquidity.

Every protocol will want this. Almanak becomes the kingmaker.

------

"But why won't someone just copy this?"

They've been building for 3+ years, thinking about this 24/7. The moat:

- Strategy framework

- Agent swarm (18 specialized agents with deep DeFi knowledge)

- Execution infrastructure (Safe + Zodiac + Legoon + Enso + monitoring + dashboards)

- Network effects (strategies + vaults + LPs + protocols)

Good luck.

----

Bear vs Bull

The bear case: "AI strategies could fail and lose money."

The bull case: Even if AI powered strategies manage merely 5% of DeFi's $150B TVL, and Almanak captures 30% market share (while it being the first mover), that's $2.5B TVL.

Current TVL: $20M.

Current token: None.

Current competition: Outside of prop funds and individuals with years of experience, there isn't any. Almanak is the first mover.

The asymmetry is insane..

----

In short

What I foresee will happen when Almanak executes well:

💠Every degen becomes a quant.

💠Every protocol gets AI-powered liquidity.

💠Every strategy competes on pure performance.

@Almanak__ is building the infrastructure layer for the next $1T in AI-managed capital.

And they're shipping. Today. With $25M already trusting the system.

The token isn't even live yet.

We're very very early.

7.84K

66

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.