I’ve been running numbers on a Falcon + Pendle + PancakeSwap LP stack, and the blended yield profile is honestly compelling right now.

This is the best Falcon + Pendle + PancakeSwap LP Profit Optimization Strategy, you couldn’t find nowhere else.

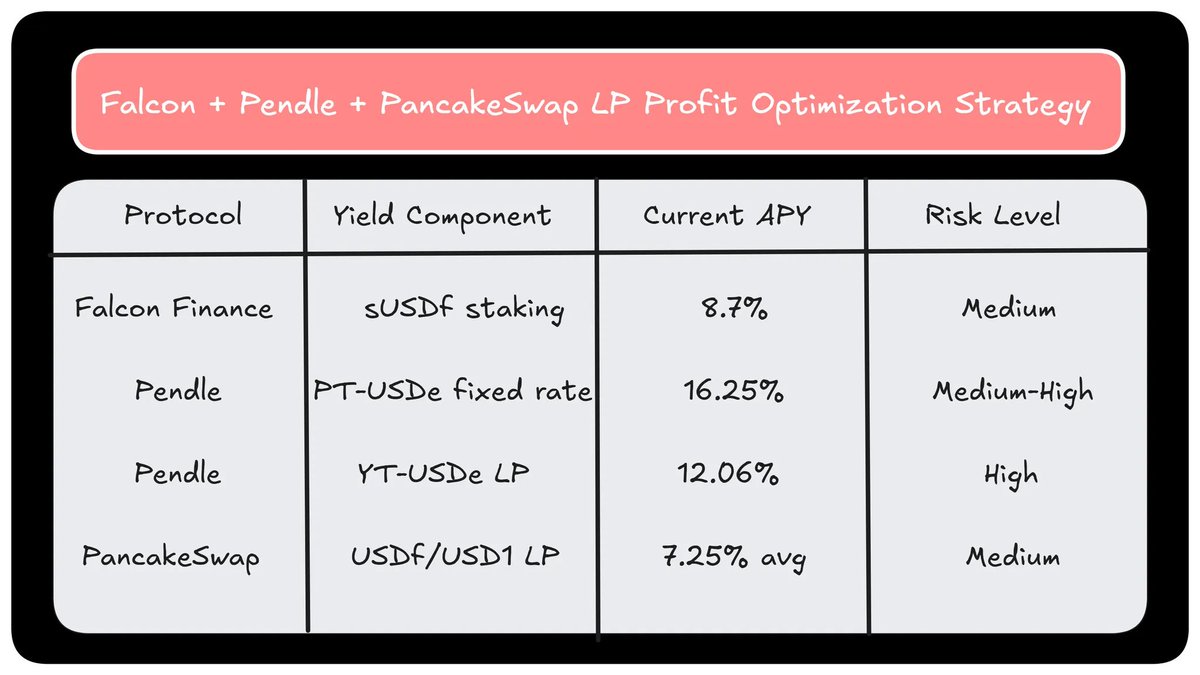

First thing first, here’s what I’m seeing:

– @FalconStable (sUSDf) → 8.7% base APY

– @pendle_fi (PT/USDe) → up to 16.25% fixed rates

– @PancakeSwap LP (USDf/USD1) → ~7% fee + farm rewards

Stacked together, that’s 12-15% net returns on stable-backed positions with deep liquidity:

→ $1.34B USDf market cap (peg holding at $1.0000)

→ $9.1B Pendle TVL (88% on Ethereum, growing +30% MoM)

→ $2B PancakeSwap TVL, with boosted incentives live on USDf pairs

The framework I use:

Phase 1: Foundation Setup

– Mint #USDf - Current peg: $1.000029 with $17.16M daily volume coinmarketcap

– Stake to sUSDf - Earning 8.7% APY base yield

Choose Pendle Strategy:

– Fixed-rate play: Buy PT-sUSDf at discount for 8-12% additional locked yield

– Yield-long play: Buy YT-sUSDf for leveraged exposure to rising yields

Phase 2: Liquidity Optimization.

PancakeSwap V3 LP - Provide USDf-USD1 liquidity in concentrated ranges

– Pool liquidity: $20.66M (Uniswap V3 USDf/USDT equivalent)

– Daily volume: $14.9M providing strong fee generation

– Target APY: ~7% from swap fees + farm rewards

Phase 3: Advanced Compounding.

– Harvest and Restake - Weekly compounding of LP fees and Pendle incentives adds 1-2% annualized return

Risks are there:

– PT/YT liquidity decay near maturity

– impermanent loss on LPs

– active management required

But IMO the risk-adjusted return profile here is much stronger than sitting idle in vanilla stable staking.

I’m personally positioning into this stack as a mid-term yield play, keeping allocations flexible across chains (BNB for liquidity, ETH for Pendle depth).

This is the kind of multi-protocol optimization that separates passive farming from real yield strategy.

Show original

54.73K

97

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.