Today's hot-off-the-press quarterly Messari report on Solana:

1. Overall Network

• Solana continues to position itself as one of the most active L1 blockchains.

• During Q2, prices and network metrics remained robust overall, maintaining growth momentum despite market volatility.

• Particularly, with the announcement of the consensus mechanism upgrade (Alpenglow), a more successful update has been made in terms of speed and finality.

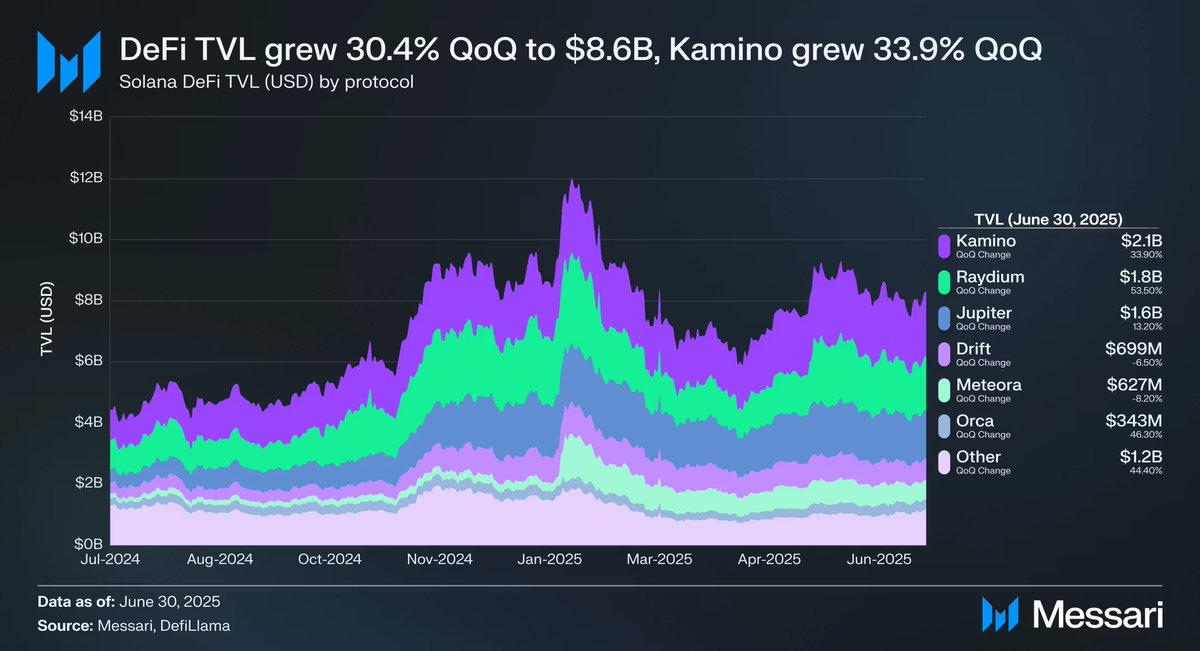

2. DeFi Sector

• TVL: $8.6B (up +30.4% from the previous quarter)

• The DeFi TVL in the Solana ecosystem has significantly increased, with a steady influx of both users and capital.

- Kamino: the biggest beneficiary. It grew by +33.9% QoQ, emerging as a key player in Solana DeFi.

- The combination of Solana's strengths in low fees and high TPS has led to active use of liquidity pools and automated strategies.

3. Application Profitability

• Application Revenue Capture Ratio: skyrocketed from 126.5% to 211.6%.

• This metric shows how much revenue apps running on Solana are generating compared to actual user activity.

• Surpassing 200% indicates that it's not just about increased transactions, but that user activity is directly converting into revenue.

4. RWA

• RWA tokenization is one of the most notable narratives on Solana.

• Total on-chain RWA value: $390.6M → QoQ +23.9%

• Major projects:

- Ondo Finance → USDY ($175.2M), OUSG ($79.6M)

- "Real asset tokenization" is actively progressing on Solana, especially with dollar and treasury-based tokens growing.

- This shows that Solana is not just a DeFi and meme coin chain, but also serves as a link to traditional finance (TradFi).

5. Technological Innovation: Consensus Protocol Alpenglow

• The new consensus protocol "Alpenglow" proposed by Anza is a game-changing upgrade for Solana.

• The current average transaction finality time is about 12.8 seconds. With Alpenglow applied, it will be reduced to 100–150ms.

• This essentially means near-instant finality, which is a significant advancement for high-frequency services like financial applications, games, and exchanges.

• It is expected to enhance not only speed but also security/stability.

6. Institutional Entry: Solana Staking ETF

• June 2025: Rex-Osprey Solana Staking ETF to launch in the U.S.

• The first staking-based ETF in the U.S. → allows traditional financial investors to gain exposure to Solana without directly entering.

• This strengthens Solana's position in the regulated market and signifies that Solana is becoming the second major chain to be integrated into the institutional framework, following the ETH ETF.

Solana is establishing itself not just as a fast L1, but as a next-generation global payment and asset platform encompassing DeFi, finance, apps, and institutional frameworks.

@solana is the new NASDAQ.

Messari State of Solana Q2 report just dropped.

TLDR? TVL up 30.4% QoQ and ~$2.5B average daily DEX volume

accelerate 🏎

5.44K

24

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.