The Rise of the King of Web3 Social Infrastructure

After in-depth research, I found that @UXLINKofficial is definitely a severely underestimated potential stock, the data is astonishing.

1️⃣ Core Data and Technological Innovation

First, let's look at the core data:

◻️ The largest Web3 social platform globally, with over 800,000 monthly active users.

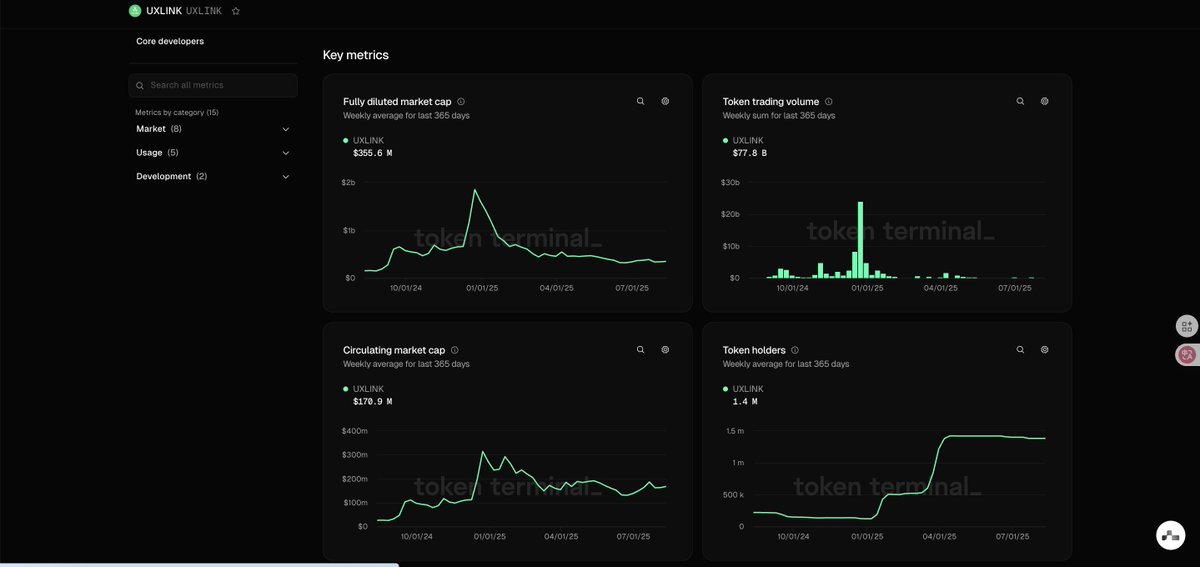

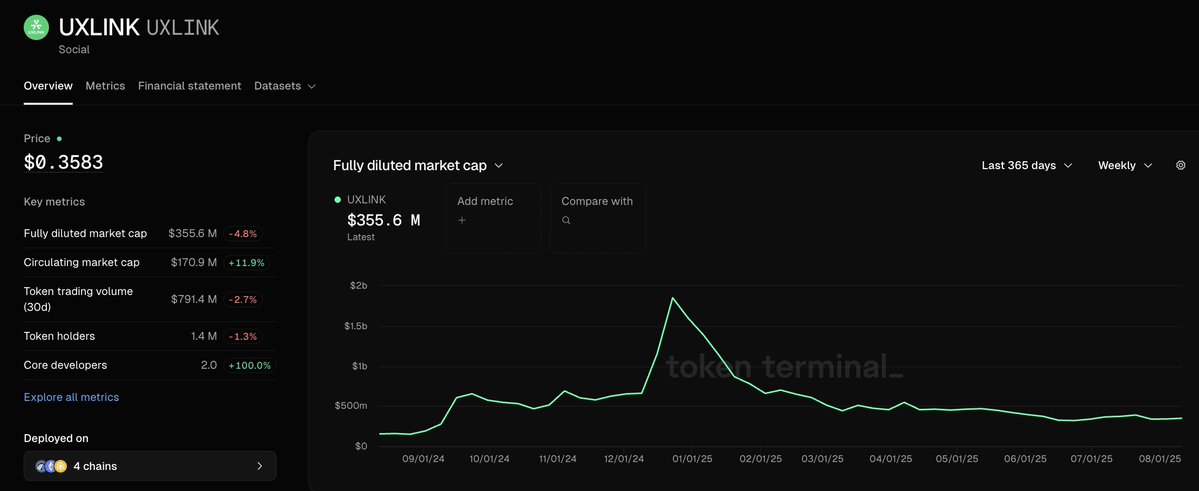

◻️ Market cap of only $160 million, FDV $390 million.

◻️ 24-hour trading volume of $17.86 million, with a circulation rate of only 41%.

◻️ Token price at $0.39, with 9 times the space to its historical high of $3.68.

The technical architecture crushes similar projects.

UXLINK is not just a simple social platform, but a revolutionary Web3 social infrastructure.

Core Innovations:

🔥 Bi-directional social relationships: Unlike traditional one-way following, it builds a true friend-based social network.

🔥 Abstract social accounts: Lowers the entry barrier for Web3, allowing ordinary users to enter seamlessly.

🔥 One-click Gas solution: Supports USDC for Gas fees, completely addressing user pain points.

🔥 Social data protocol: Provides developers with a complete social infrastructure.

2️⃣ Product Upgrades, Token Economics, and Ecological Layout

The latest major upgrade has impressed me.

The newly released AI growth agent is simply a killer application, driven by DeepSeek V3, capable of automating user growth tasks and significantly reducing operational costs.

There’s also the upcoming social growth layer testnet, the world's first Layer designed specifically for social growth, with "one account" + "one Gas" functionality that will redefine user interaction.

The design of the token economics is exquisite.

Total supply of 1 billion tokens, with a very reasonable distribution structure:

◻️ Community 65% (40% for users + 25% for ecosystem builders)

◻️ Private placement 21.25%

◻️ Team 8.75%

◻️ Treasury 5%

Dual token model: $UXUY points + $UXLINK governance token, maximizing transparency and fairness.

The ecological cooperation layout is incredibly strong.

Collaborating with R2 to launch R2USD real returns, providing stable returns for millions of users.

Secured investments from top institutions like Animoca Brands and Labs.

Established extensive cooperation with major global blockchain development teams.

The roadmap for 2025 is ambitious:

✅ Launch of the social growth layer mainnet.

✅ Launch of PayFi applications and credit cards.

✅ User scale aiming for 100 million.

3️⃣ Investment Logic, Risks, and Conclusion

The investment logic is clear and straightforward.

The Web3 social track is on the brink of explosion, and UXLINK has already secured an absolute leading position.

With a deep technological moat, strong user growth, healthy token economics, and powerful institutional backing.

The current price of $0.39 is severely underestimated relative to its technological strength and market position. Once the social growth layer goes live and PayFi applications are implemented, a valuation reassessment is inevitable.

⚠️⚠️: The competition in the Web3 social track is fierce, and attention must be paid to user retention rates and the actual implementation of use cases.

Overall rating: Strongly optimistic ⭐⭐⭐⭐⭐

What do you think about the investment value of UXLINK? Will social infrastructure be the main line of the next bull market?

#UXLINK

@Bantr_fun new platform to follow

@Morph_ZH @MorphLayer project activities to follow

$Morph #bantr #Morph

Show original

23.4K

35

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.