Some feedback regarding Lair Finance.

I've been using the system for about a day, and here are a few noticeable points I've organized.

1. Portfolio management and reward claim?

In the case of @LairFinance, the current portfolio shows assets related to Bera when you click on the wallet in your account. However, the Earn section for rewards is currently marked as coming soon, so it's not clear whether rewards are accumulating. The visibility of rewards is psychologically very important, so even if claims are not possible yet, having visible figures is definitely necessary.

For example, in the case of Pendle, most rewards are paid in Pendle, which are then converted and shown as tokens or stablecoins that have entered the Pool. Although there is the hassle of checking prices using an oracle in between, it is very convenient for users as they can intuitively see their earnings, making it very good from a UX perspective.

2. Check the Bera -> iBGT swap ratio

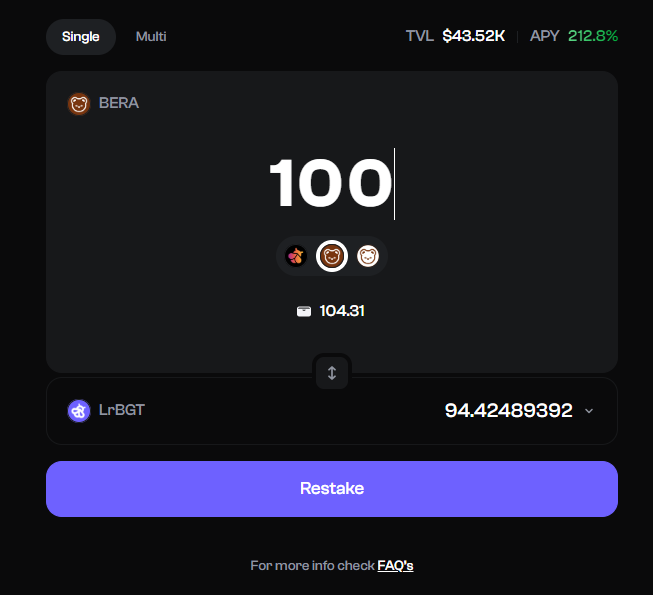

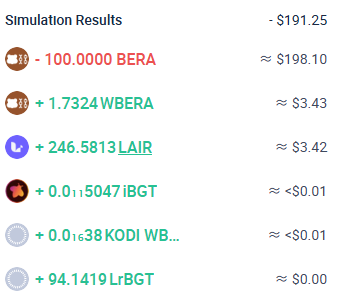

I haven't yet found or understood the exact logic, but when I converted 100 Bera to LrBGT on Lair Finance, it converted to about 94.5 LrBGT. Additionally, I received wBERA and LAIR, but I'm not sure if this is due to a poor swap ratio or if it's given as an additional reward.

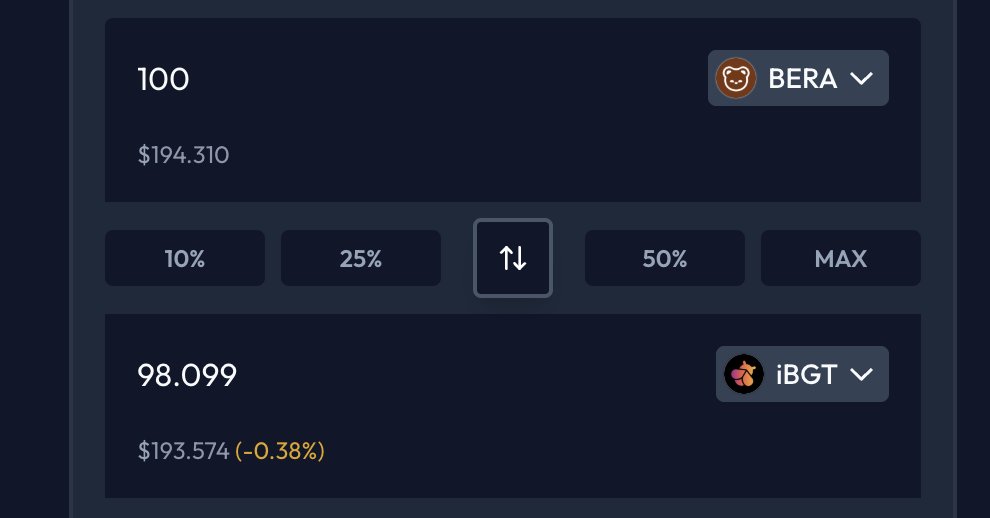

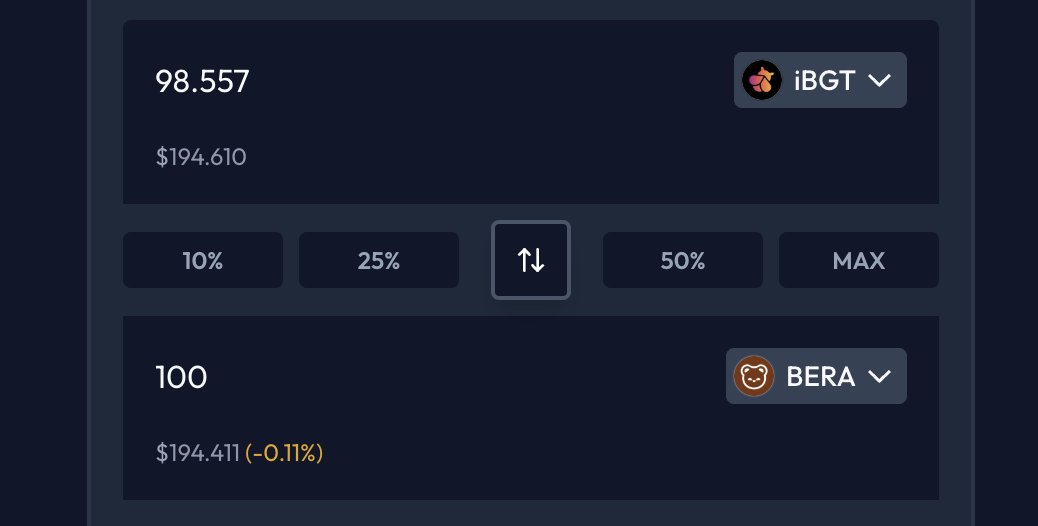

When I go to @KodiakFi, I can see that 100 Bera converts to 98.099 iBGT.

There is a slight swap loss, but I can see that it can be converted back to Bera for a similar amount.

3. Differences in the system

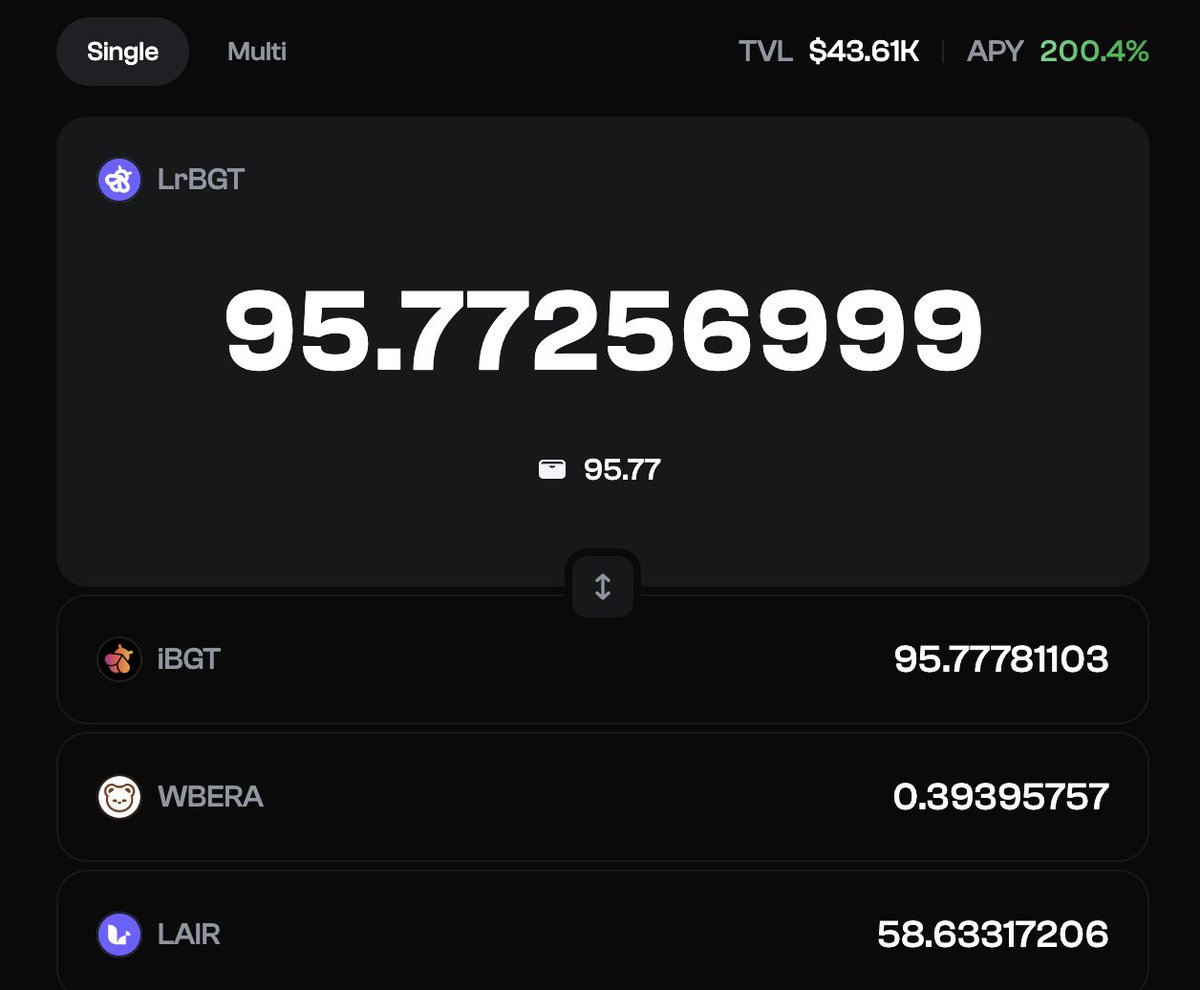

Looking more closely at the system, the answers start to emerge. First, when converting iBGT directly to LrBGT, the ratio is coming out accurately.

iBGT converts at 95.25%

wBERA at 2.36%

LAIR tokens at 2.38%

This means that when minting LrBGT, LAIR tokens are always forcibly swapped. Initially, I thought that LAIR was being airdropped additionally, but that wasn't the case. For people like me who are using the system for the first time, there can be confusing parts, and while it may seem like an additional reward, it turns out to be a forced token swap, which I believe requires sufficient education and notification for users before use.

For example, Lair Finance is expected to provide restaking for Injective, but if I am forced to buy LAIR tokens at 2.38% during the restaking process of my $INJ, I probably won't restake even if the APR is high. The reason is that while liquidity for Injective is high, I cannot control the liquidity of Injective at that time for LAIR. Currently, the TVL of Bera can fill itself in Injective, so as liquidity increases, the risk also increases.

The protocol design is quite innovative. It forces the purchase of its own tokens when minting restaking tokens, creating automatic demand for them. However, I leave this feedback thinking that this could potentially become a barrier to liquidity inflow in the long term.

For reference, both the Kaia chain and Berachain currently have completely empty leaderboards.

Since there are no rewards, it seems that no one is paying attention and yapping, so the Mindshare itself appears to be very low.

I wrote a post about @LairFinance in the morning, and as of the 7th, Berachain ranked 69th, while Kaia even ranked 20th on the 7th and 33rd on the 30th, making quite a splash(?).

After buying Bera, the price has already dropped, so I will quickly put it into restaking to receive APY.

I know that the Bera chain has the Bera token and the BGT token, but I was unsure how to acquire and bring BGT, so I was contemplating what to do. Fortunately, Lair Finance allows not only BGT but also BERA and wBERA to be restaked directly.

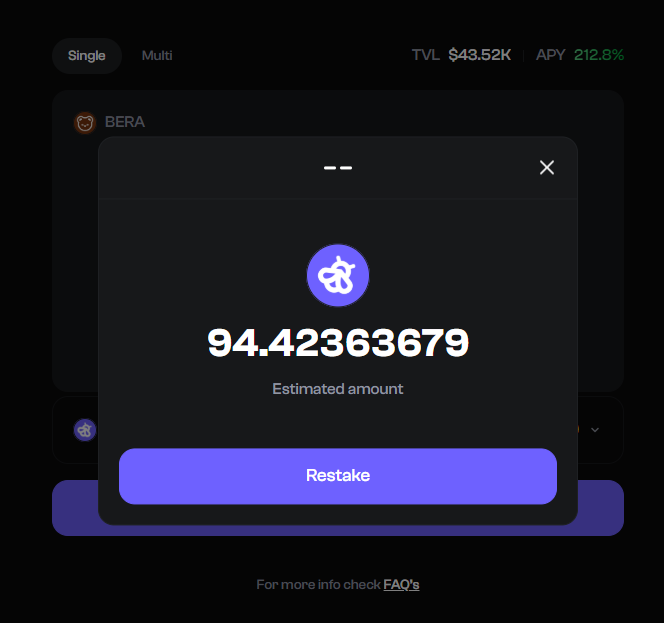

I am staking a total of 100 BERA and receiving 94.4 lrBGT. Currently, I am not sure if it is due to the price difference between BGT and Bera or if lrBGT is increasing in value based on APY.

One peculiar thing is that it felt like they were giving tokens at the same time as restaking. The screen above was what I saw just as I was about to approve in the Rabbit wallet.

So... are they giving WBera, Lair, a bit of iBGT, and fully giving LrBGT?

I was curious if that was true, and indeed WBERA came in, so I restaked it again. And, oh? When I restaked, they gave me LAIR tokens again? This time it seems they are not giving WBERA.

Looking at this, it seems they are giving out tokens completely to encourage restaking since the TVL is low right now. The APY is in the 200% range, and if you put it in, it gives a crazy efficiency of 3.4% back in tokens, haha.

Anyway, after restaking, I easily became a LAIR holder.

Later, they said they would also give KAIA and INJ as restaking rewards, so this DeFi that is quietly active is giving out a lot to revive the dApp ecosystem, haha. I'm at a moment of contemplating whether to buy more Bera and leverage short it.

4.26K

6

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.