"Arbitrum: The Legend of the King of Scaling from Classroom Assignments"

#区块博士讲讲web3背后的故事

Origin: The "non-proper work" of the three scholars

The story starts with a Princeton classroom in 2015. When Edward Felten, a computer science professor at the time, was teaching an undergraduate course, he whimsically assigned "Moving Ethereum off-chain" to students as a final project. No one expected that this seemingly imaginative classwork would later become the prototype of a multi-billion dollar @arbitrum project.

The Felten professor is no ordinary person, he was a former deputy CTO in the Obama administration and has been studying blockchain economics since 2011. During his time at the White House, he realized that expansion would be the biggest bottleneck for smart contracts to reach the masses, and he was determined to make smart contracts "as interactive as the early Internet."

The two partners he worked with were also not simple! Steven Goldfeder, a PhD in cryptography who studies privacy currencies, is almost obsessed with "scalable and private" smart contracts; Harry Kalodner, a doctoral student specializing in blockchain economic incentives, later became the first author of the 2018 USENIX blockbuster paper.

@arbitrum @arbitrum_cn @KaitoAI

#区块博士讲讲web3背后的故事

Academic Breakthrough: A Paper That Changed the Industry

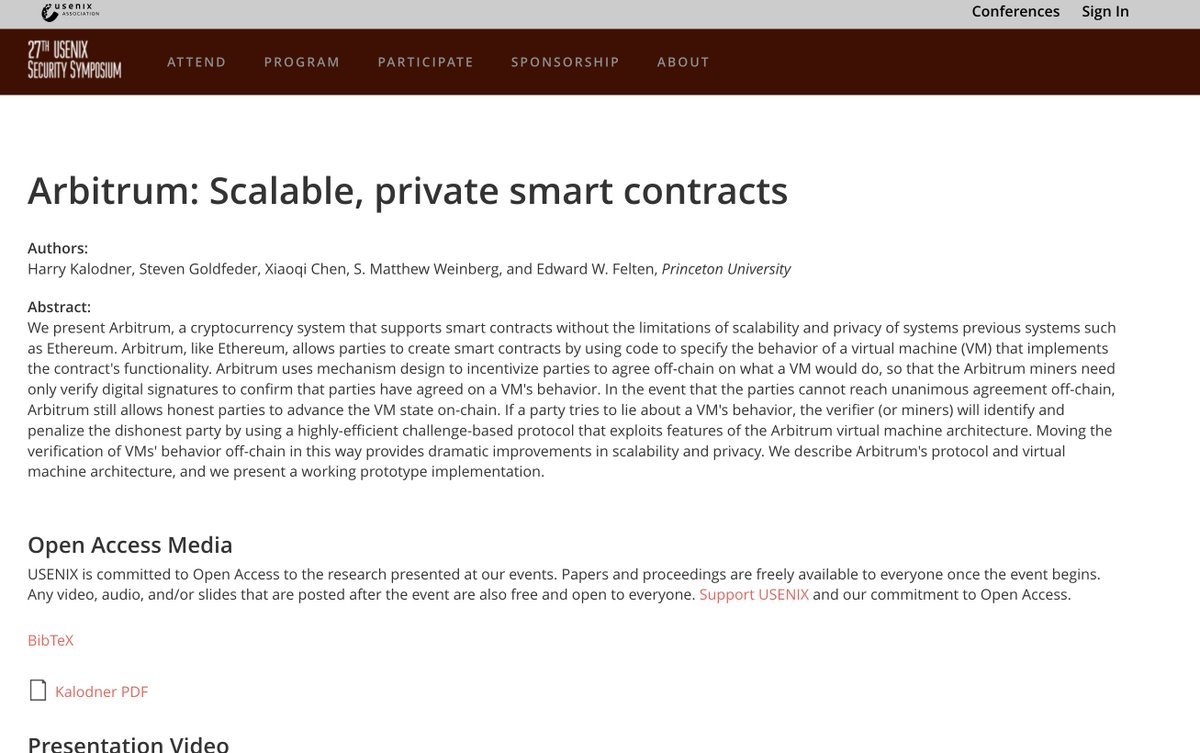

In August 2018, three individuals presented a historic paper titled "Arbitrum: Scalable, Private Smart Contracts" at the USENIX Security Symposium, introducing the AVM (Arbitrum Virtual Machine) and the challenge-arbitration mechanism for the first time. This is not an ordinary academic paper—it is the first publicly verifiable complete blueprint for rollup technology.

Interestingly, when Pantera Capital wanted to invest, they required the team to run the paper's code in an AWS testing environment. Goldfeder took on this challenge, working tirelessly for 48 hours to fix compatibility bugs, ultimately securing the term sheet. This $3.7 million seed round financing marked the official transition of @arbitrum from pure academic research to commercialization.

Key Decisions in the Technical Roadmap

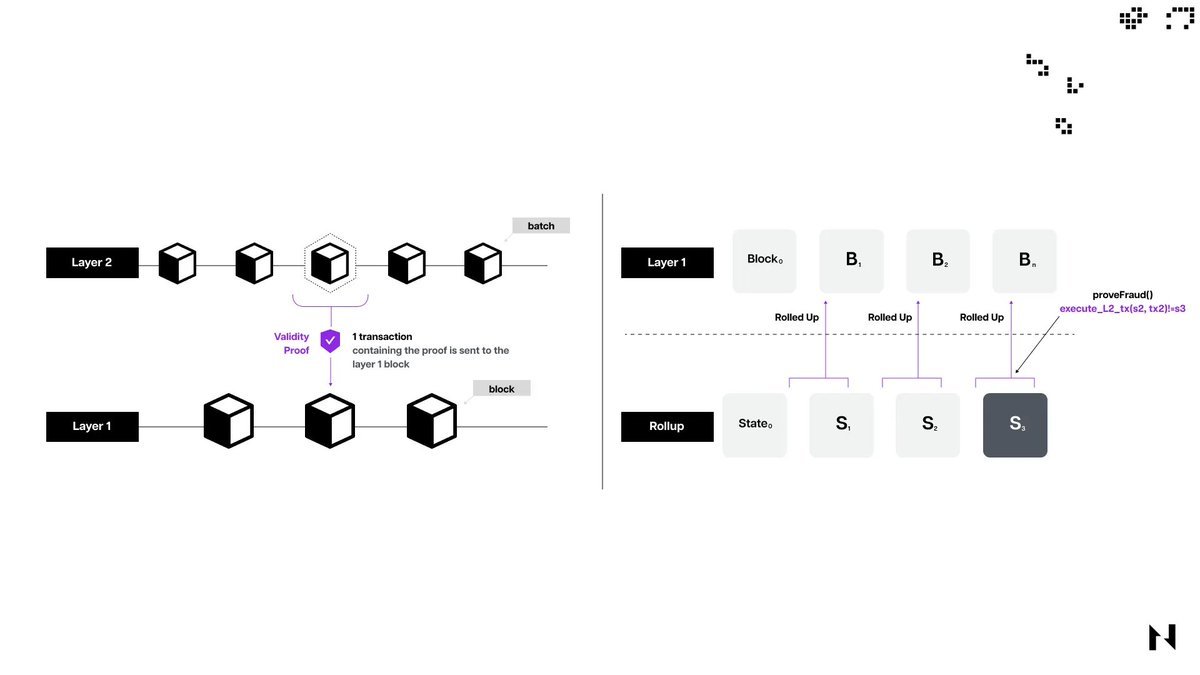

In the flourishing landscape of scaling solutions in 2019, why did @arbitrum choose Optimistic Rollup over the more popular Plasma or ZK solutions in academia at the time?

The answer lies in the deep reflections of the founding team: they believed that during the Ethereum PoW era, Fraud Proof could be implemented more quickly than ZK proofs. More importantly, the multi-round dispute game designed by Arbitrum can run on WASM, allowing verification code to be developed in a general-purpose language rather than custom assembly, which lays the foundation for long-term maintenance.

This technical choice has since proven to be wise. The multi-round interactive Fraud Proof adopted by @arbitrum can narrow the dispute scope down to a single instruction, while the single-round Fraud Proof of its competitor Optimism, although faster, incurs higher costs.

"The Scaling War": Open vs. Gradual Positive Showdown

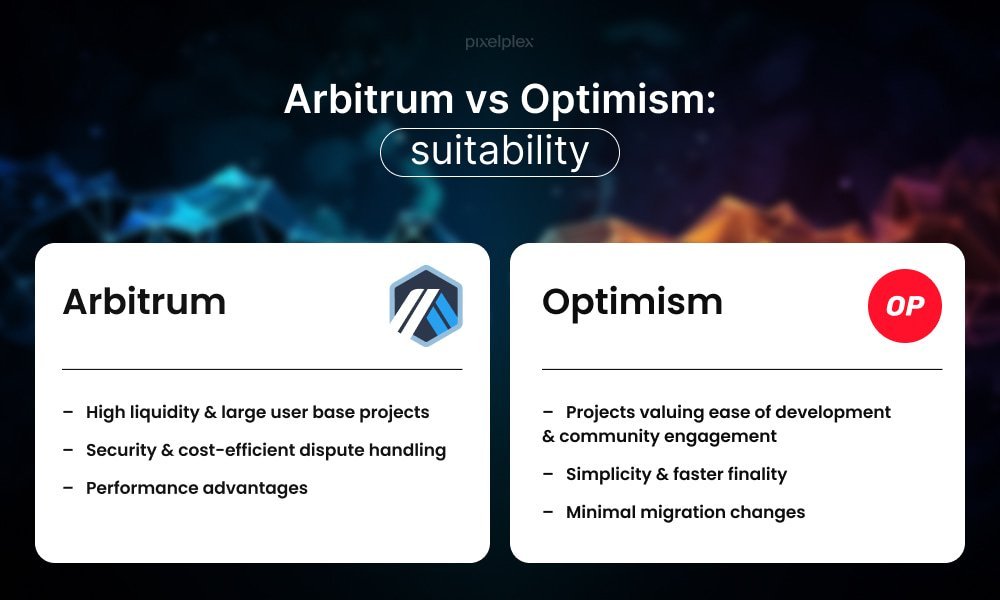

The L2 battle of 2021 is considered one of the most intense technological competitions in blockchain history. When Arbitrum officially launched its mainnet on August 31, it chose a "big open" strategy—deploying over 400 DeFi projects all at once, attracting $2.9 million in TVL within 24 hours.

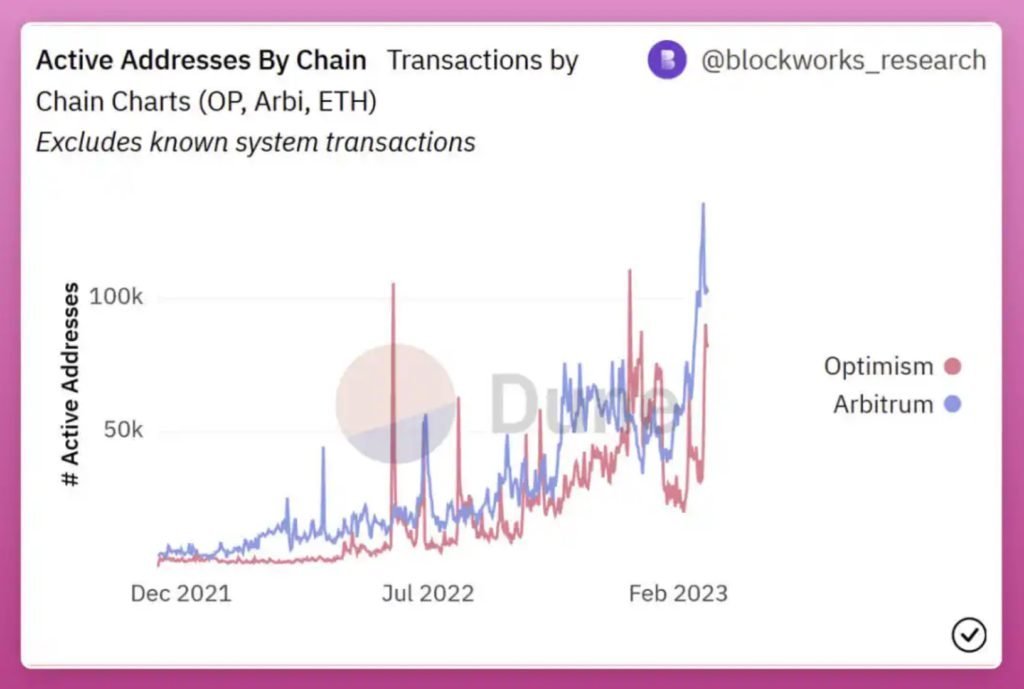

In stark contrast, Optimism still adopted a whitelist model, allowing only a few protocols to participate. This "open ecosystem vs. gradual rollout" showdown ultimately ended in victory for @arbitrum. As of real-time data in August 2025: @arbitrum has a daily transaction volume of 2.96 million, 420,000 active addresses, and a TVL of $4.12 billion, leading Optimism by a wide margin.

An interesting detail on the day of the mainnet launch: Felten put a label saying "Nitro Fuel" on the office water cooler, hinting at future upgrade plans. This meme continued into 2024 and would also appear in the official blog.

The "flip" of DAO governance and self-rescue

On March 16, 2023, the release of the $ARB token was supposed to be a highlight moment for @arbitrum, but it turned into a governance storm. The foundation announced an airdrop of 12.75% (1 billion tokens) while transitioning Arbitrum One/Nova to DAO governance.

However, the first proposal AIP-1 required the foundation to first use 750 million $ARB, sparking strong controversy in the community over "spending money before voting." Faced with opposition from the community, the foundation was ultimately forced to split the proposal, introduce a 4-year lock-up mechanism, and lower the proposal threshold from 5 million ARB to 1 million ARB.

This "flip" instead showcased the self-correcting ability of decentralized governance.

Technological Breakthrough: "Apollo Program" Level Upgrade

There are three key breakthrough points in the technological development history of @arbitrum, each of which is a milestone:

1. Nitro Upgrade (August 31, 2022): Proudly referred to by the team as the "Apollo Program of L2." This upgrade replaced the WASM kernel and introduced calldata compression, with the official claim of a 7-10x increase in throughput and a significant reduction in costs. Most dramatically, the entire network migration was completed in one day without any major issues.

2. Orbit Release (October 2023): Allows any project to launch custom L3 using the Nitro stack. The CEO described this as "enabling developers to have DAO-level capabilities on their own."

3. Stylus Launch (August 2024): Runs a WASM VM in parallel with EVM, allowing developers to write smart contracts in Rust/C/C++. Official cases show a significant reduction in gas costs for complex cryptographic algorithms.

From academic to frontrunner

Looking back on this legendary journey, @arbitrum's success is not accidental. From classroom assignments in 2015 to the King of Expansion in 2025, this project perfectly interprets the development path of "academic-driven→ capital boosting the →ecological flywheel".

The three founders' deep academic backgrounds allow them to remain forward-looking in their technical route choices, while their long-term belief in the Ethereum ecosystem allows them to stay in the right direction in the face of fierce competition. Every key decision—whether it's multiple rounds of Fraud Proof's technical choices, the "big open" launch strategy, or the self-correction after the DAO governance turmoil—reflects the team's risky and pragmatic nature.

It is this series of seemingly inadvertent yet precise choices that make @arbitrum stand out on the competitive L2 battlefield and become one of the most exciting chapters in Ethereum's scaling story.

@arbitrum The legendary journey of Polkadot @Polkadot: From the pain of forking to the king of multi-chain

#BlockchainDoctor talks about the story behind web3

The legendary journey of Polkadot @Polkadot: From the pain of forking to the king of multi-chain

🎭 Prologue: The "rebellious" path of Ethereum's CTO

In 2017, when the entire crypto world was still debating the scalability issues of Bitcoin and Ethereum, a programmer named Gavin Wood made a bold decision—he would leave the Ethereum he had built himself to create a better blockchain world.

This former CTO of Ethereum did not leave out of anger, but out of ambition. He saw a fatal problem in the blockchain world: all blockchains are isolated islands, like ancient city-states, each governing itself and unable to communicate.

19.65K

74

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.