Over the last month, the stablecoin sector set several notable records.

Let's take a closer look at the numbers👇

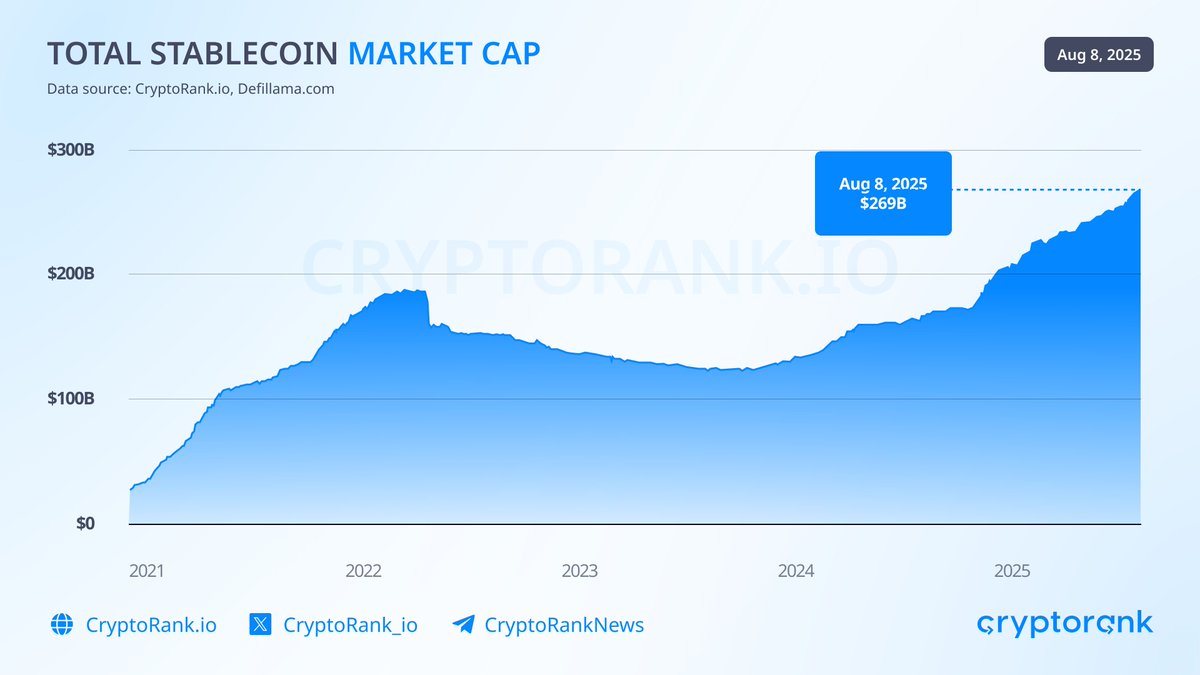

1. Market cap

The total stablecoin market cap reached an ATH of $269B, with July seeing a 5% growth compared to June. Exactly one year ago, on August 7, the number was standing at $166B, or 39% below the current level.

$USDT remains the dominating asset, capturing 61% market share with $164.7B market cap. As usual, it's followed by $USDC with ~24% share.

Over the last 30d, @ethena_labs' $USDe supply grew by an impressive 84%. Its market cap is now at $9.78B, making $USDe the third-largest stablecoin with 3.6% market share.

As of August 1, the total supply of stables on @ethereum was $136B, making it the absolute leader, accounting for 52% of the market. It is followed by @trondao (32%) and @BNBCHAIN (4.2%).

2. Activity metrics

In July, stablecoins reached an ATH of 44.8M in active addresses.

$USDT (30.2M), $USDC (12M), and $USD1 (0.87M) had the highest number of interacting addresses.

@BNBCHAIN led with 14.7M active stablecoin addresses, followed by Tron (9.9M), @0xPolygon (5M), and @solana (4.2M).

Over the past 30 days, stablecoin transactions totaled 1.3B.

3. Volume

Stablecoin volume hit an ATH of $1.5T in July, up 18% month-over-month and nearly 50% compared to July 2024.

$USDC accounted for almost half of the volume (48.76%), followed by $USDT (27.4%) and $DAI (17.6%).

4. What's next

The stablecoin sector accelerated the growth after the GENIUS and CLARITY Acts provided regulatory clarity and leading stables, with fully collateralized and compliant issuers set to benefit the most.

Meanwhile, non-collateralized algorithmic stablecoins, those with insufficient or risky collateral, and non-compliant offshore issuers face significant regulatory risk.

Regulation is likely to consolidate market share among top issuers while limiting riskier models.

Anyway, with clear rules, record numbers, and shifting market power, the sector has a strong foundation for further growth. At the current pace, the total stablecoin market cap could reach $300B by year-end.

9.88K

188

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.