KINETIQ — The Kinetic Engine of the Hyperliquid Ecosystem

🚀 KM! So excited to see Kinetiq (@kinetiq_xyz) becoming the first @HyperliquidX ecosystem project to hit $1B TVL — and in just three weeks since launch! What a milestone. Massive props to @0xOmnia and the team.

This is why I believe Kinetiq deserves deep attention — and here’s my breakdown.

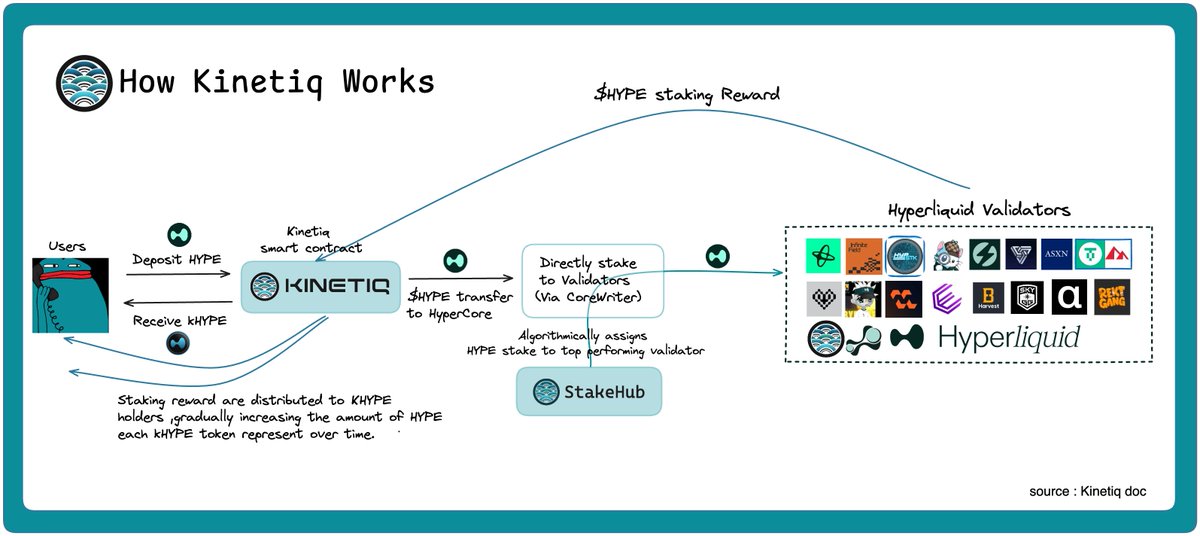

1. How Kinetiq works

Kinetiq is a native Hyperliquid LST (Liquid Staking Token) protocol designed to fully meet user needs with a complete staking and liquidity solution.

Unlike other LST projects, Kinetiq natively integrates with the Hyperliquid PoS network. Users simply stake their HYPE to Kinetiq and receive kHYPE — the liquid-staked version of $HYPE.

Behind the scenes, Kinetiq’s contract autonomously delegates staked HYPE to the top-performing validator, ranked by StakeHub based on five key metrics: Reliability, Security, Economics, Governance, and Longevity.

Even more impressively, staking to HyperCore is powered by CoreWriter — a native Hyperliquid system feature that allows HyperEVM contracts to write directly into HyperCore. This means all validator delegation happens fully on-chain, with no off-chain trust assumptions.

Kinetiq is the one of first HyperEVM protocol to adopt CoreWriter for validator delegation, enabling trustless, automated HYPE staking.

👀If you want to dive deeper into CoreWriter, check out @djenn’s excellent explainer:

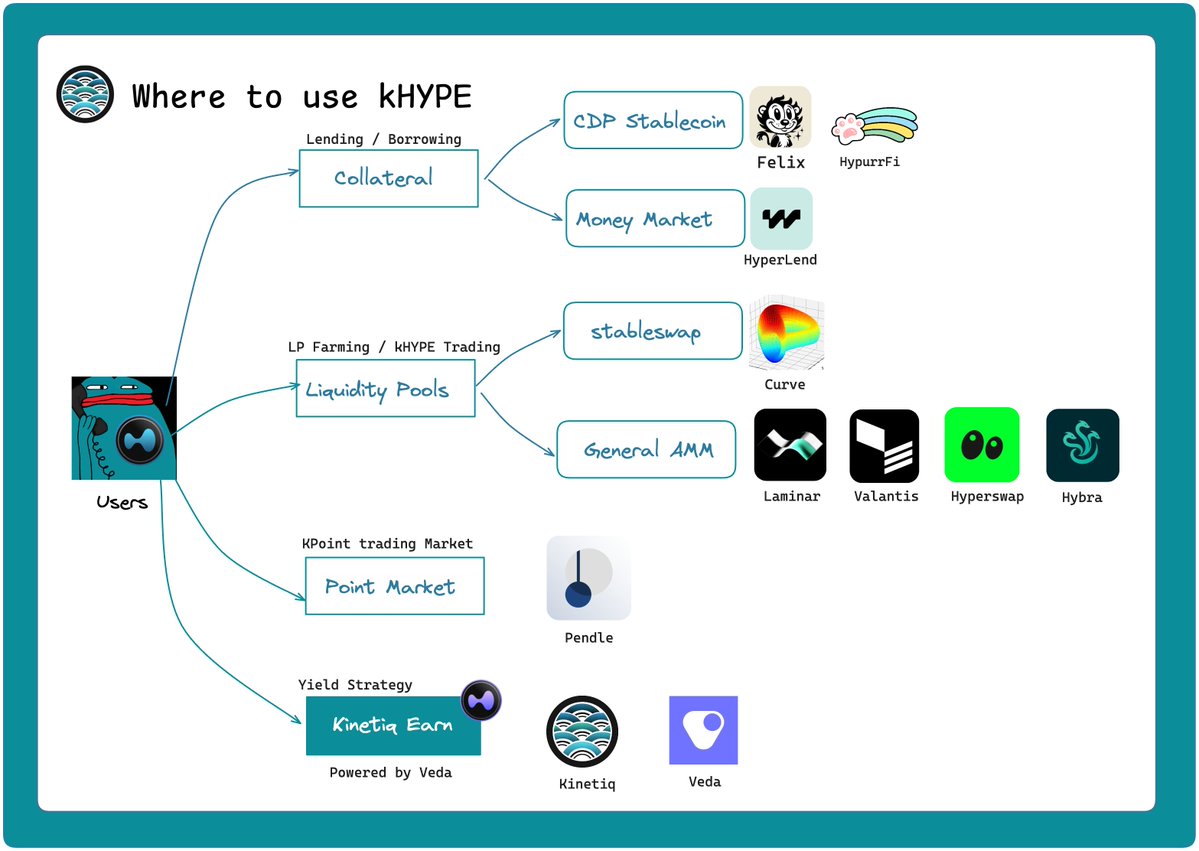

2.The Multiple Usage of kHYPE from the first moment of launch

One of Kinetiq’s strongest moves was launching with deep ecosystem integration. From day one, kHYPE has been usable across the HyperEVM DeFi landscape:

A. Collateral

Accepted as collateral on money markets and CDP protocols like @felixprotocol, @HypurrFi, and @hyperlendx.

B. Liquidity Pools

Tradable on stable AMMs like @CurveFinance and on general-purpose AMMs like @laminar_xyz, @ValantisLabs, @HyperSwapX, and @HybraFinance.

C. Pendle Point Market

Integrated with @pendle_fi’s point market for kPOINT rewards.

- Buy YT tokens with kHYPE to earn points.

- And PT tokens of kHYPE also offer a 12% fixed APY.

🔗 Explore the market:

Here pls allow me to say thanks for Pendle @tn_pendle your team is the god for any kind of scenario of interest or yield

D. Kinetiq Earn

- Powered by @veda_labs, Kinetiq Earn optimizes kHYPE (and HYPE) yields across top HyperEVM DeFi protocols, targeting the best risk-adjusted returns.

- Current TVL: $196M with ~6% estimated APY.

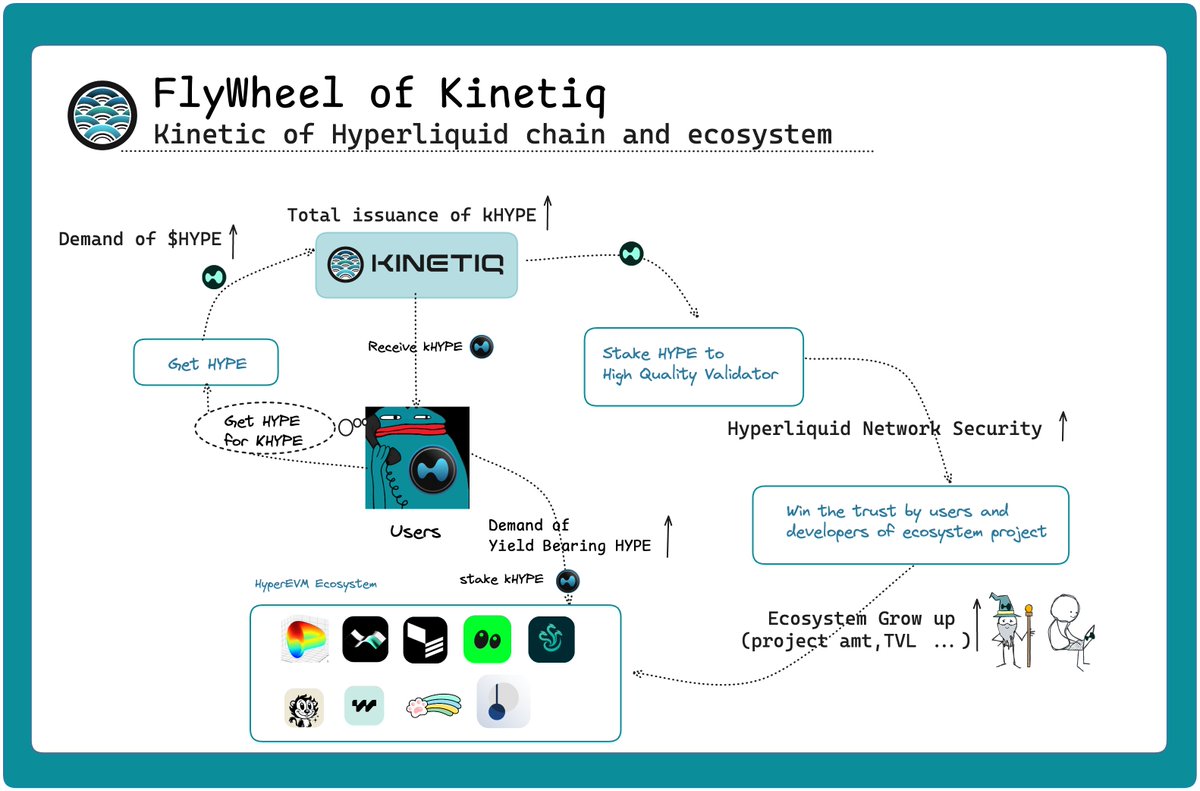

3. The Kinetiq Flywheel — Powering Hyperliquid

Kinetiq creates a self-reinforcing loop that benefits users, validators, and the entire ecosystem.

A. Users (HYPE Holders)

- Yield — Stake HYPE via Kinetiq to top validators and earn rewards.

- Liquidity — Hold kHYPE to keep assets liquid while still earning staking yield.

B. Validators (Network Security)

- Continuous delegation incentives drive validators to maintain top-tier uptime and performance.

- Enhances trust in Hyperliquid’s PoS network, attracting both developers and users.

C. Ecosystem Developers & Projects

- More liquidity in kHYPE fuels DeFi participation.

- Early-stage incentives like kPOINT boost adoption.

- Strong validator performance encourages long-term builder confidence.

By simplifying liquid staking while integrating deeply across DeFi, Kinetiq has become the kinetic engine driving Hyperliquid’s growth.

And the flywheel is just starting — expect more innovation, integrations, and ecosystem impact from Kinetiq soon.

Special thanks to @0xOmnia for the quick responses and insights.

Do let us know if you are running or about to run a project on Hyperliquid (HyperEVM).

Recommended reading

- For kPOINT's value estimation : Well read from @0xlykt 's post

Show original

1.03K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.