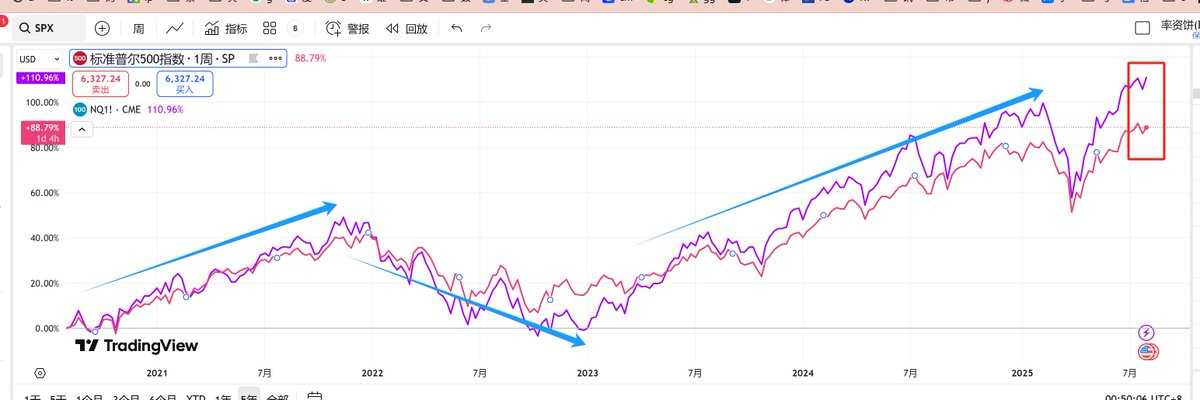

In the past 5 years, the Nasdaq 100 index has typically been higher than the S&P 500 during uptrends.

Conversely, during downtrends, the Nasdaq 100 index has been lower than the S&P 500.

This may be because the U.S. stock market has been primarily led by technology stocks in recent years.

Additionally, when the Nasdaq 100 is significantly higher than the S&P 500, the U.S. stock market tends to reach a temporary peak. Currently, the Nasdaq 100 is quite a bit higher than the S&P 500.

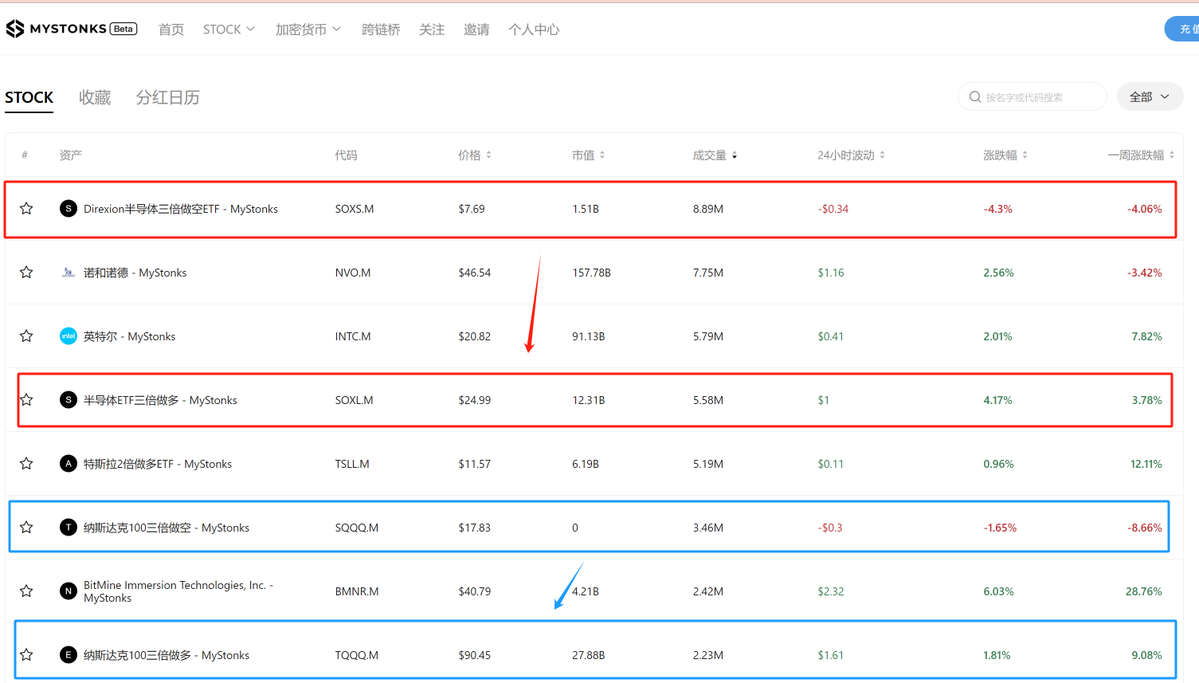

Pay attention to the stock and cryptocurrency platform @MyStonksCN. Trading volume in the last 24 hours:

The trading volume of the semiconductor triple short ETF is more than three times higher.

The trading volume of the Nasdaq 100 triple short is also more than three times higher.

Previously analyzed, the P/E ratio of the S&P 500 is relatively high.

So, assuming there are no black swan events, and the U.S. stock market does not crash or correct, what will happen in the crypto space?

In fact, without needing screenshots, everyone should have felt that BTC is clearly correlated with the U.S. stock market. However, the decline represented by ETH has not been able to keep up with the rise of the U.S. stock market.

Therefore, if the U.S. stock market does not crash and only undergoes a rational correction, the overall crypto market may experience fluctuations instead of declines.

Of course, I am referring to August; September is a sensitive month for policies, so further discussion is needed.

Just a random analysis, not investment advice.

15.37K

25

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.