"REAL" meta where people have spent over 50m and none of these platforms have launched a token yet

TCG (pokemon) are new on-chain generating over $100m in volume in less than a year.

I covered

📍 What it is

📍 How it works

📍 Important statistics

📍 Revenue model

📍 Actionable

and token speculation

🧵open for a deep dive

@collector_crypt @phygitals @TCG_Emporium

🔹 Quick explainer?

First TCG means (Trading Card Game) so we're talking about the tokenization of physical trading cards (like Pokémon TCG) into digital assets on Solana.

Where users can:

• Own: Each card is a verifiable, tokenized asset.

• Trade: Use marketplaces or gacha (blind box) systems.

• Financialize: Collateralize cards for loans or use instant buybacks.

🔹 What's the TCG landscape like?

first of, there are 3 major highlighted TCG platforms live and actively generating revenue

📍 @collector_crypt- first mover, The clear market leader in tokenized TCG on Solana. CC has captured the community’s attention with its gacha-first experience, instant buybacks that keep users engaged, and an expanding marketplace.

📍 @phygitals - Phygitals leans on its accessible gacha model, also,

Each graded card is fully insured, securely stored in a facility physically.

📍 @TCG_Emporium - Emporium positions itself as a premium destination for high-value collectibles. While still building its user base, it blends gacha mechanics with a growing marketplace that caters to serious collectors chasing rare, top-tier cards,

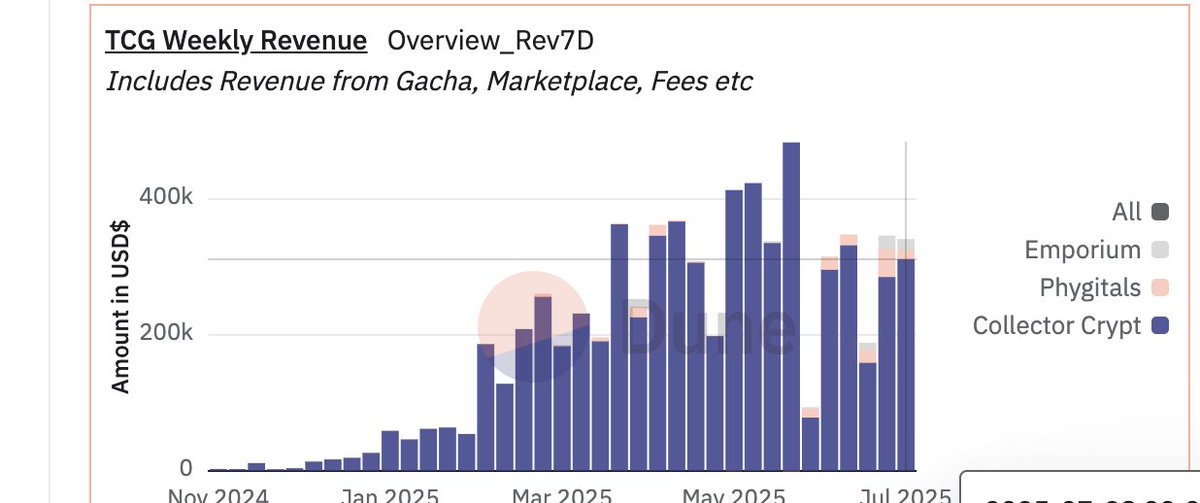

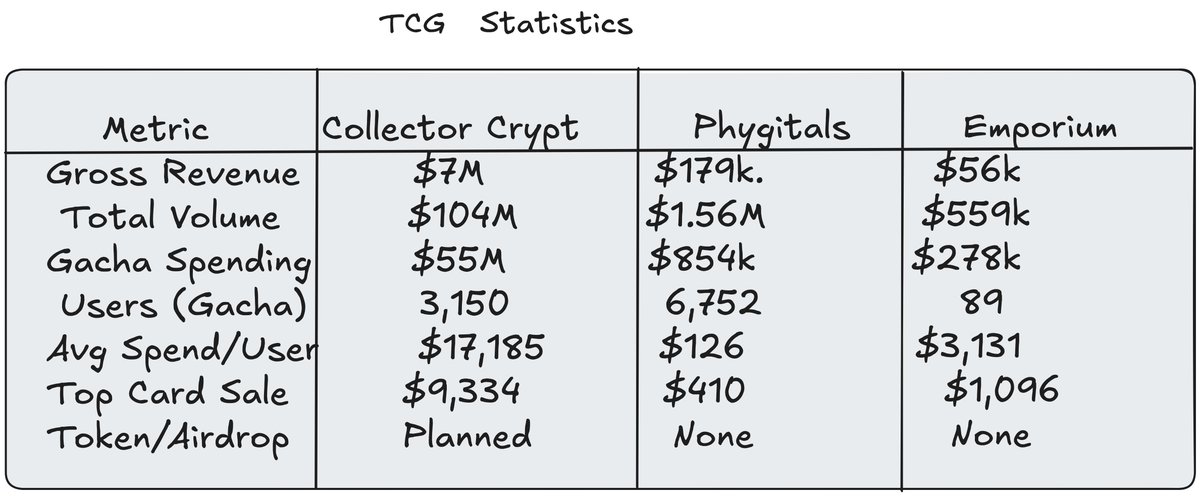

🔹 Statistics

In comparison, Collector crypt takes about 90% of the market share, Phygitals following the same protocol model falls behind, while Emporium is the latest platform with a slightly different model...

• Collector crypt- $104m, 3k users

• Phygitals- $1.5m, 6.7k users

• Emporium- $500k, 89 users

you might be wondering how CC has more volume with fewer users, it's in the quality of the users spending on CC with their no. 1 wallet peaking over $3m on gacha spending...

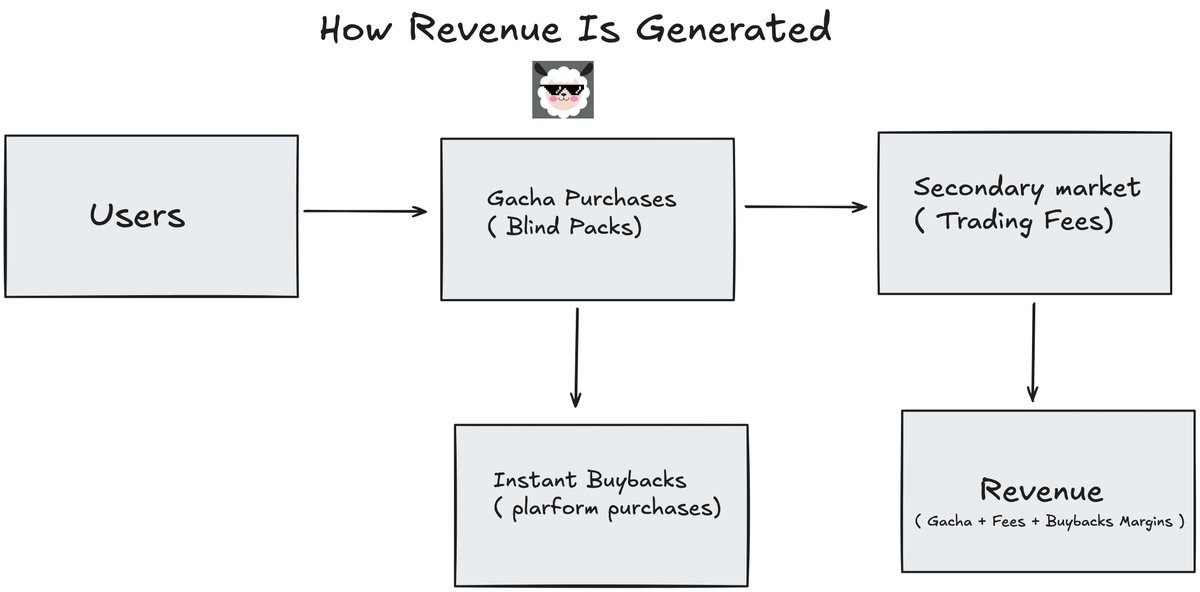

🔹 Revenue model

• How do they generate revenue?

( if you already read how it works)

• Users

This starts with collectors or players who want to engage with TCG assets (like Pokémon cards)

• Gacha Purchases (Blind Boxes)

Users spend money (often in $SOL) to open gacha (blind boxes).

• Instant Buybacks

After opening, users can instantly sell cards back to the platform at a set percentage (often 80–85% of market value)

• Secondary Market (Trading Fees)

Users who don’t sell back can list cards on the marketplace to trade with others. ( fees are charged for each successful trade)

TLDR

The platform earns revenue from:

• Gacha spending (blind box sales)

• Trading fees (on secondary sales)

• Buyback margins (difference between buyback price and resale price)

This should be clear yeah?

2.81K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.