Arguably, ETH has way better hard asset properties than BTC:

- lower inflation (0.7% vs. 0.8% rn, with more on-chain activity ETH will even get deflationary of like 1%)

- real yielding 2.3% (again, more activity = more real yield, likely 4%+, can be juiced with EigenCloud)

- most permissionless asset to be used in DeFi, leading to decreasing supply on markets

- similar / higher liquidity than BTC

Think Matt knows this, but won't be communicated offensively to not endanger BTC ETF flows ;)

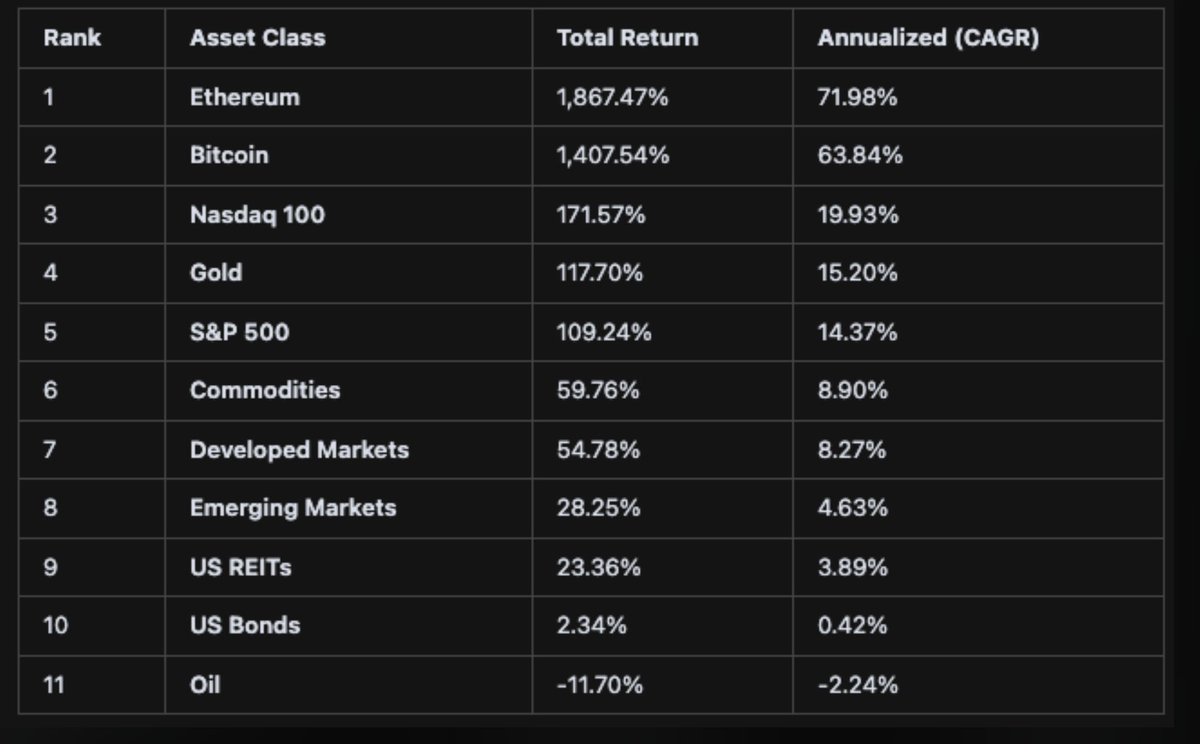

Asset class returns since the start of 2020 tell you a very clear story: What's worked best is "tech" (ETH + QQQ) and "hard assets" (BTC + GOLD).

Feels like this story will last the entire decade.

4.39K

74

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.