关于 OpenEden 的稳定币,很多人不知道它的架构是怎么样的,这里来做一个分析。

首先 OpenEden 的稳定币叫做 $USDO ,wrapped 版本叫 $cUSDO 。

之所以要有 wrapped 版本,是因为 USDO 是锚定 1 美金,但是它自带 3.9% 的原生利息,每天以 rebase 形式发放(也就是余额自动增加)。

而 warp 后的 cUSDO 是一个标准的 ERC-20 代币,不再自动增加余额,而是靠每天自动涨价达到相同效果。

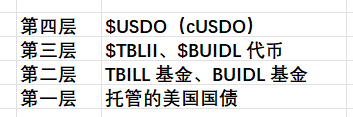

此外,从架构来说 USDO 的抵押物和 USDT、USDC 不同,USDO 的抵押物依然是代币。

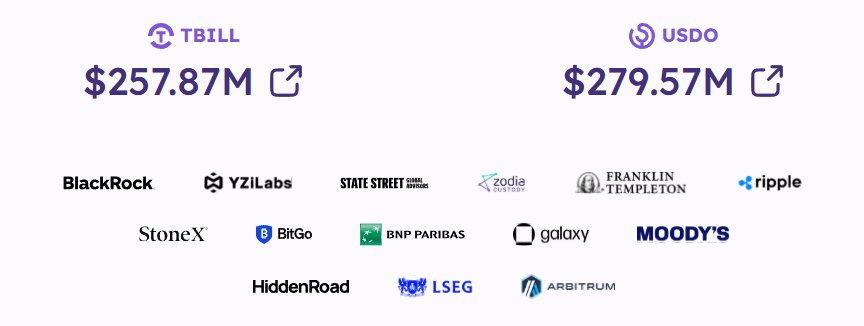

目前 USDO 的 TVL 已经涨到 280M,它的抵押物 91% 来自 $TBILL,剩余 9% 则来自 $BUIDL $VBILL 等,这些也都是美国国债 RWA 代币。

其中 $TBILL 也是 OpenEden 发行的,它有一套完整的合规、审计和信息披露架构。而 $BUIDL 大家更熟悉,它是贝莱德发行的一支代币化基金,这个基金的底层资产也是美国国债。

所以基于这种架构,USDO 的优势之一就是相比于其他稳定币,人们更加不用担心黑客的问题。毕竟最坏情况里,黑客也只能利用智能合约,却拿不走底层的国债,这些国债都托管在传统机构手里,足以应对突发情况。

另外,四层架构也给其他公司使用 TBILL 带来了可能性,就和 USDO 会用 BUIDL 一样,这些国债 RWA 代币也会得到更多的可组合性。

其他关于 OpenEden 的介绍可以参考 CoinDesk 这篇采访↓

7.65K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.