The Ethereum FlyWheel has begun.

1. ETF

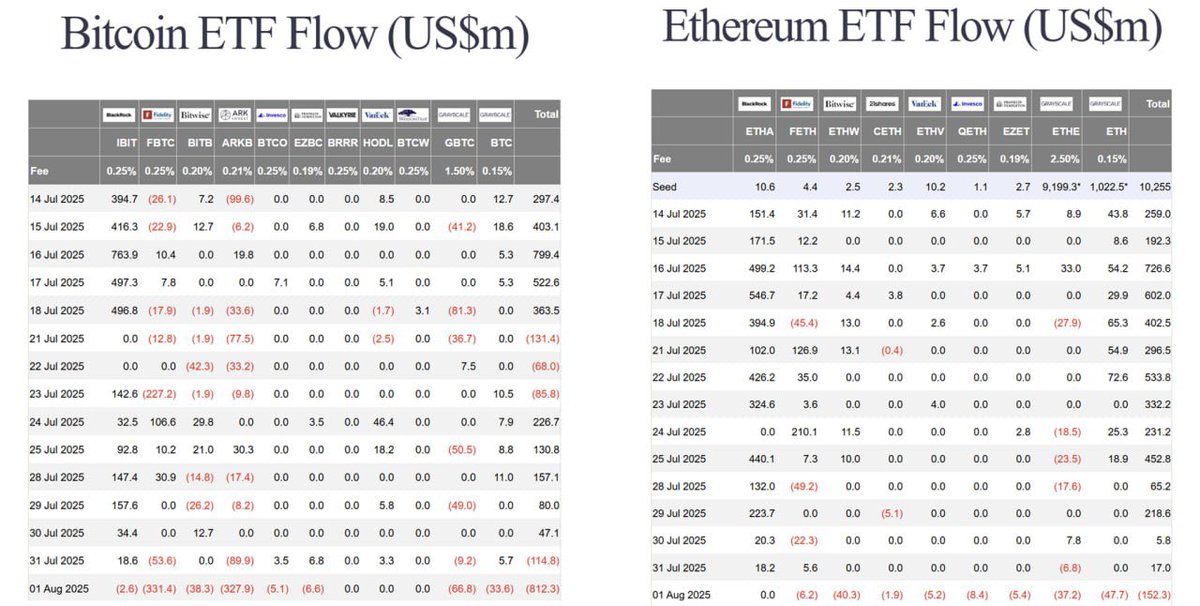

- Recently, there has been more inflow into Ethereum than Bitcoin in ETFs. Just considering last July, not only was the inflow greater than that of Bitcoin ETFs, but there were also many days when Ethereum showed tremendous inflow even on days when Bitcoin experienced outflows. And the speed of this is incredibly fast. This phenomenon indicates that Ethereum in the market is being absorbed rapidly by ETFs.

2. Strategic Ethereum Reserve

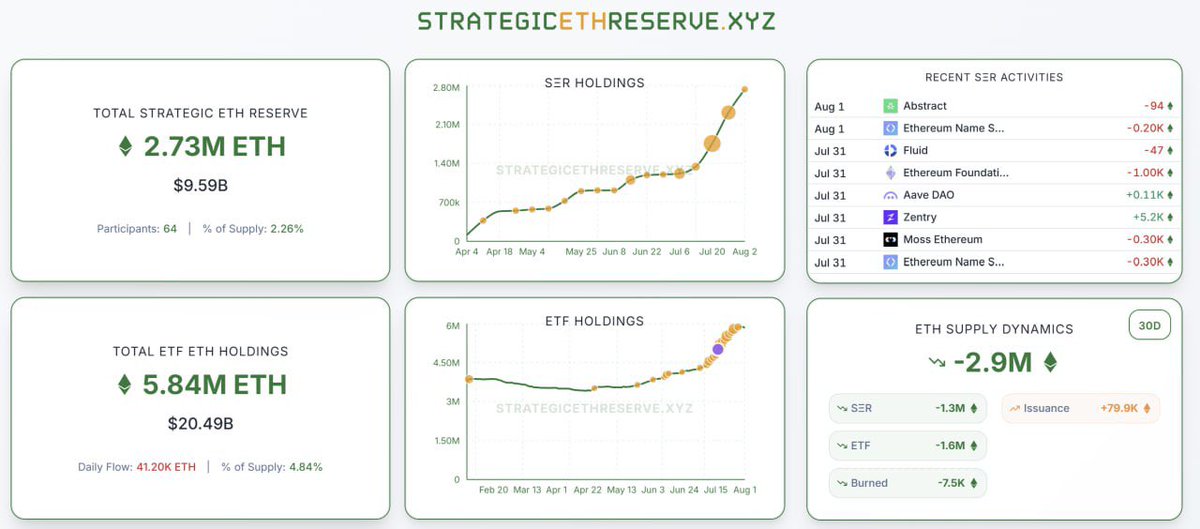

- Just as Bitcoin had Metaplanet and Strategica, recently, two companies have emerged in Ethereum: Sharplink Gaming and Bitmine. Sharplink Gaming announced a strategic purchase of Ethereum through $425M in funding on 5/27 and currently holds 464K Ethereum, while Bitmine announced a strategic purchase of Ethereum through $250M in funding on 6/30 and currently holds 625K Ethereum.

The only risk factor for these companies is the funding method for purchasing Ethereum or Bitcoin. Typically, they use methods like Pipe (Private investment in public equity) deals to buy shares at a low price from private equity and VCs, or the convertible notes method, which is mainly used by strategists, allowing them to convert bonds into shares after a predetermined period in the future. All these methods have the downside of increasing the number of shares later, diluting value, but this is resolved if the price of the cryptocurrency being purchased rises.

I believe that the Ethereum FlyWheel has started with the current absorption of Ethereum by ETFs and the Strategic Ethereum Reserve combined. Regardless of smart contracts or tokenization, there is just insane demand right now, and there is no infinite supply source to stop it. In fact, the Ethereum supply over the last 30 days has reached -2.9M. Has the Ethereum network been activated? Have amazing Dapps emerged? Has the gas fee increased, leading to higher burn rates? There is just insane demand occurring. I think the reason for the current price stagnation is due to selling pressure from existing staking amounts caused by price increases. The validator queue peaked at about 740,000, which is the highest ever, and this amount is certainly not small, so I believe this amount is coming to the market, combined with Bitcoin's weakness, and is taking a moment to catch its breath.

Do not doubt the Ethereum FlyWheel.

Show original

8.78K

66

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.