On @MMTFinance

I estimated the FDV based on TVL,

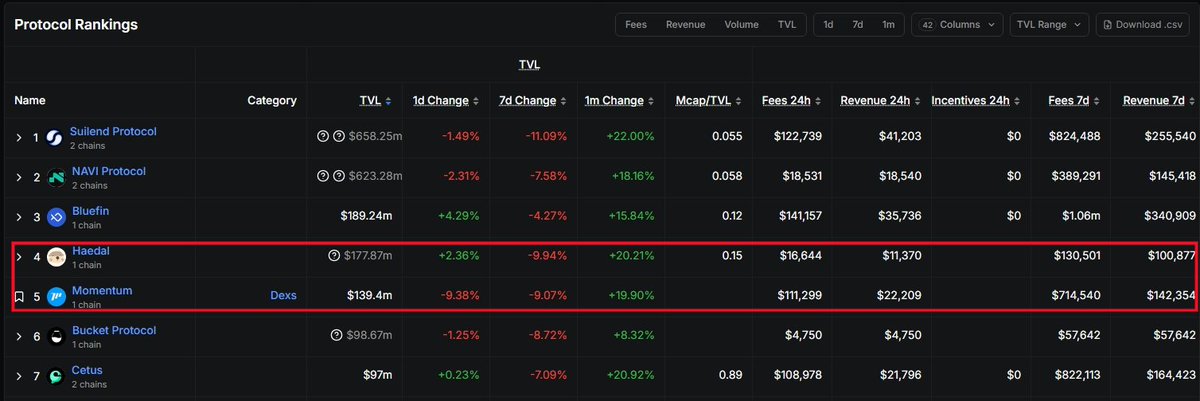

and applied it to the Haedal project, which is in the same DeFi sector.

Haedal: TVL 177M -> FDV 137.89M

It's a lower figure than the conservative standard (1:2).

Is this the bottom for Haedal?

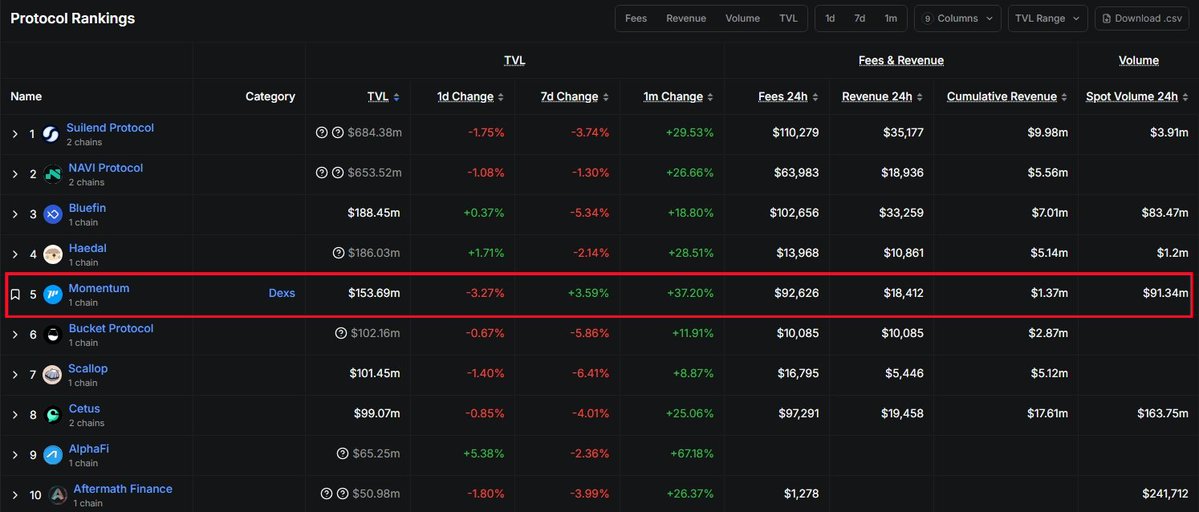

Momentum MMT CLMM ve(3,3)

Expected FDV based on TVL from @MMTFinance

TVL $153.69m

FDV ratio compared to the average TVL of DeFi projects (TVL:FDV Ratio)

Conservative standard (1:2) → FDV approximately $300M

Mid-level (1:3~1:5) → FDV approximately $450M ~ $750M

Optimistic / Top DeFi level (1:7~1:10) → FDV approximately $1B ~ $1.5B

Actual application example

Velodrome (Optimism) FDV is about 4~5 times compared to TVL

Pendle initially at 1:1~2 level → currently over 1:10

4.72K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.