Market investors are reluctant to pay attention to borrowing whales who borrow 1 million LAN at once to sell on your behalf.

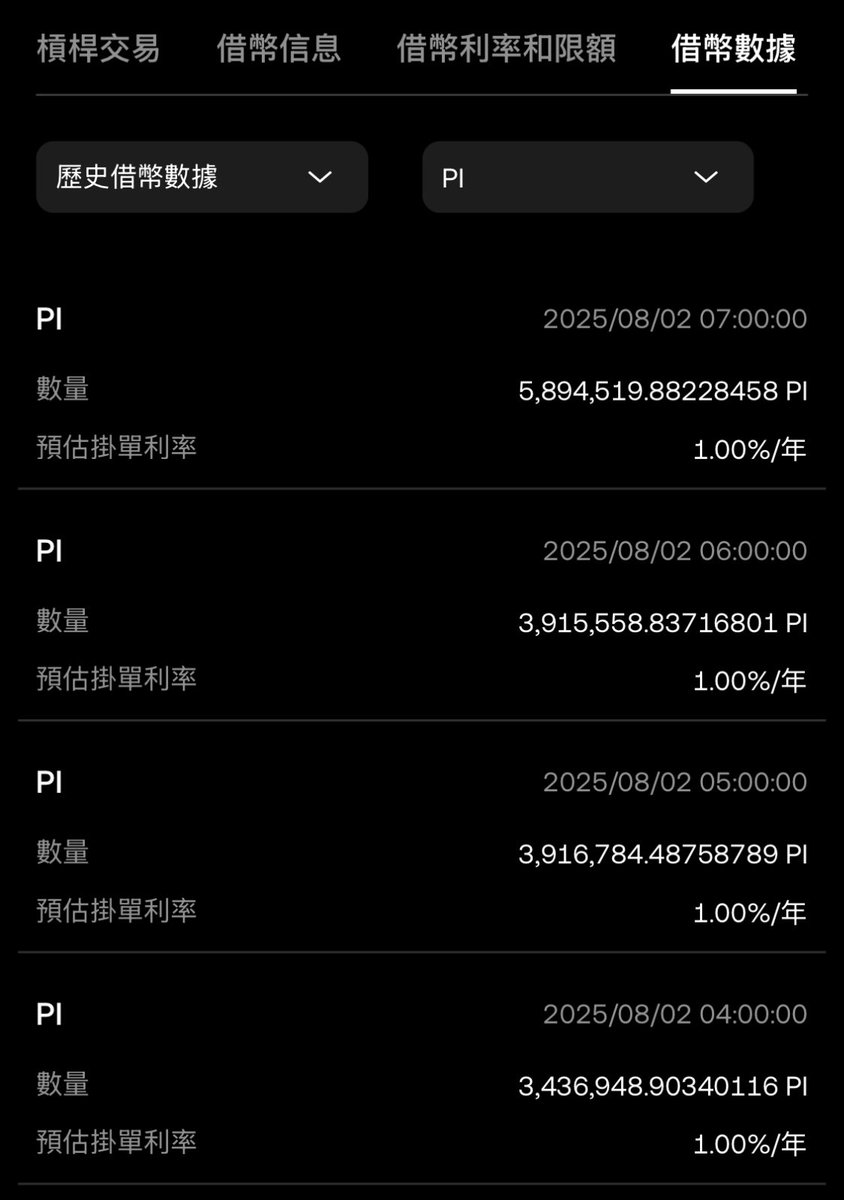

Just now, a borrowing whale seized the opportunity, borrowing 1.9 million PI from an exchange to sell on your behalf.

Yet, it’s clear the market will blame PCT for this issue again, and the bad actors will ultimately go unpunished. Because those staking on exchanges are complicit in the selling.

If community investors are unwilling to confront borrowing whales, they have no right to complain.

Should we demand that PCT ban exchanges from offering borrowing functions, and revoke their KYB status if they provide such functions?

If the community fails to consistently respond to countering whales, just wait for 0.1 to arrive.

A borrowing whale just seized the opportunity, borrowing 1.9 million PI from an exchange to sell on your behalf.

However, it is clear that the market will blame PCT for this issue again, and the bad actors will ultimately go unpunished. Because those staking on exchanges are complicit in the selling.

If community investors are unwilling to confront borrowing whales, then they have no right to complain.

Should we demand that PCT prohibit exchanges from offering borrowing functions, and if they use borrowing functions, should we revoke their KYB status?

If the community does not consistently respond to countering whales, just wait for 0.1 to arrive.

#PI

#pi

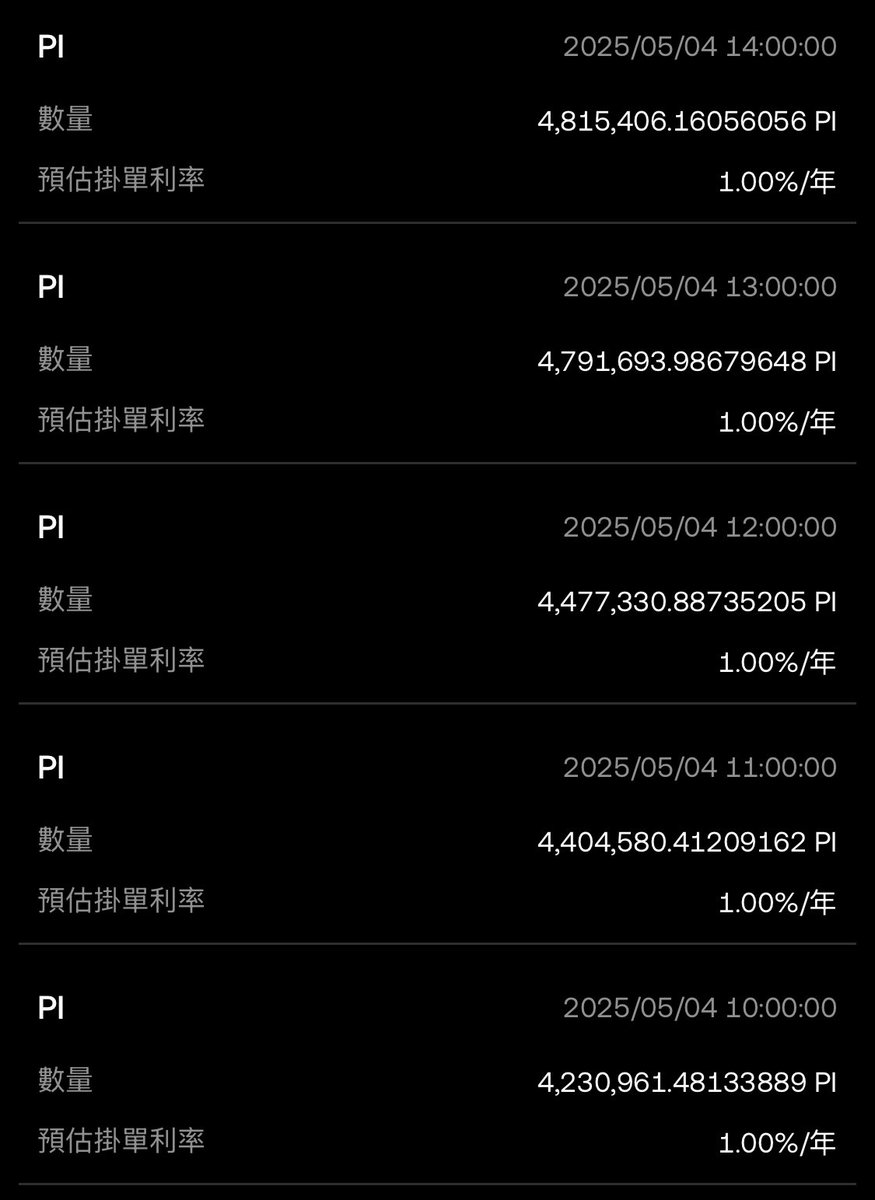

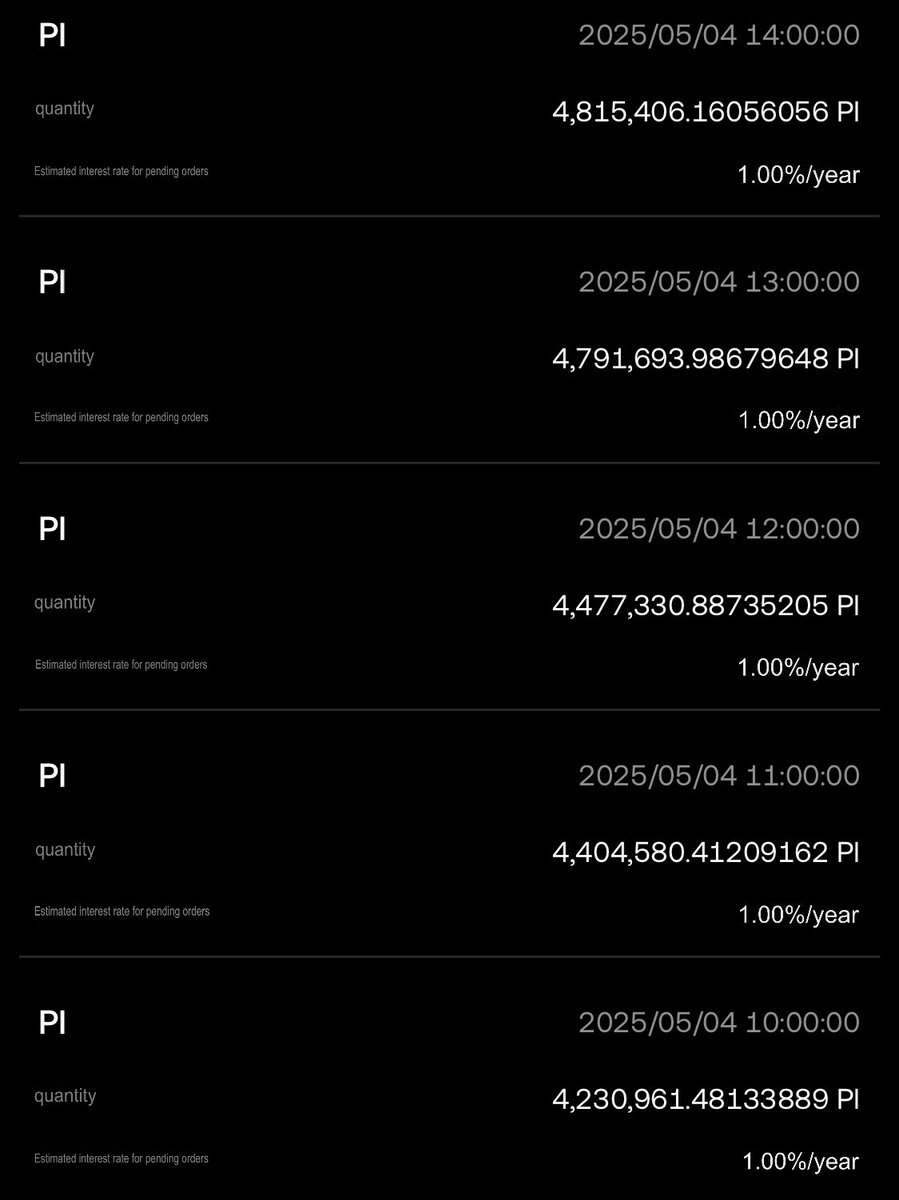

Whales borrowing PI are borrowing millions of PI at a time from the lending pool to sell them on your behalf.

Thank you to GCV for taking this issue seriously and actively promoting it.

Do not stake Pi on exchanges or use Yu’ebao, as whales are borrowing millions of Pi from lending pools to sell on your behalf.

You invest in Pi hoping for price increases to gain profits. However, the more you stake, the more you enable whales to suppress the price.

Many believe long-term investment means expecting the ecosystem to bear merchants’ costs indefinitely to support the price. Merchants cannot withstand long-term price losses and will eventually exit entirely, causing the ecosystem to collapse.

Like now, if Pi’s price is lower than electricity costs, miners have no reason to pay 1 yuan to the power company for 0.5 yuan worth of Pi.

Smart people know they can buy 1 Pi directly instead of halving their returns. Thus, miners will also collapse, and the ecosystem will die.

Methods to counter whales:

1. Do not stake Pi on exchanges. Do not use Yu’ebao to stake Pi.

2. Drain the exchanges’ lending pools. Convert 1% APY low returns to 34% accelerated mining rewards.

3. Whenever data shows whales borrowing and selling Pi, causing price dips, it’s an opportunity to buy low. Let’s agree to buy at low prices, pull the price up, and make the whales lose money.

Thanks to GCV for also taking this issue seriously and promoting it.

Don't stake your PI on the exchange, and don't use your remaining coins, because whales are borrowing millions of PI at a time from the lending pool to sell them on your behalf.

You are bullish on PI and invest in PI in the hope that the price will rise in order to make a profit. However, the more you stake, the lower the price will be for you to be held down by the whales.

Most people think that the investment is long-term, and they expect the ecology to consume the cost of merchants for a long time to carry the price for you. Merchants are unable to resist long-term price losses, and will eventually withdraw completely, and the ecology will collapse.

Just as the price of PI is now lower than the electricity bill, then miners do not need to pay 1 yuan to the power plant to get 0.5 yuan of PI.

Smart people know that you can get 1pi by buying PI directly, why halve it yourself. As a result, the miners will also collapse and eventually the ecology will die.

Ways to fight whales:

1. Don't stake PI on exchanges. Don't use Remaining Coin Treasure to stake PI.

2. Clear the exchange's loan pool. The low yield of 1% APY is converted to 34% mining growth rate.

3. Whenever you see a whale borrowing PI and selling it from the data, it is an opportunity to buy at a low price. Let's agree to buy at a low price, pull up the price, and let the whale lose money.

#pi

The amount you lost in liquidation was taken away by the lending whales. And you are still cursing PCT.

The lending whales just pat their backs and say thank you, and then thank the exchange for providing the lending feature that led to your liquidation.

The borrowing whale borrowed a total of five million coins to sell off, which is the result of investors liking to stake for a little interest.

Investors who stake are all accomplices in the market crash, and yet they are blaming PCT.

61.8K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.