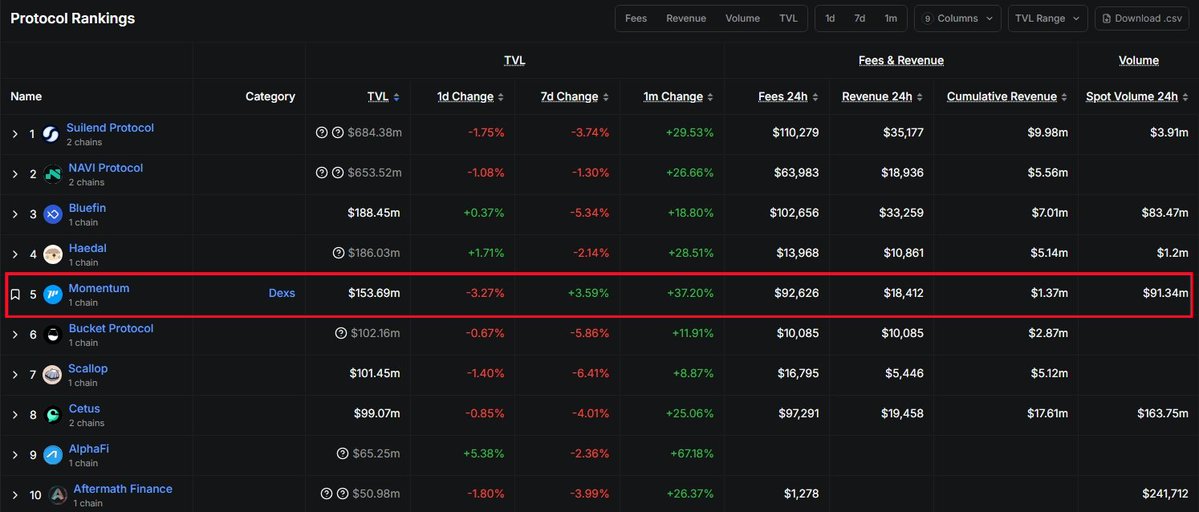

Expected FDV based on TVL from @MMTFinance

TVL $153.69m

FDV ratio compared to the average TVL of DeFi projects (TVL:FDV Ratio)

Conservative standard (1:2) → FDV approximately $300M

Mid-level (1:3~1:5) → FDV approximately $450M ~ $750M

Optimistic / Top DeFi level (1:7~1:10) → FDV approximately $1B ~ $1.5B

Actual application example

Velodrome (Optimism) FDV is about 4~5 times compared to TVL

Pendle initially at 1:1~2 level → currently over 1:10

What are the keywords that Momentum often mentions?

I asked Grok.

Sui: Emphasizes the network and ecosystem, frequently appearing based on projects.

DeFi: Centered around DeFi activities such as infrastructure, BTCfi, and future vision.

Liquidity: Core functions like engines, pools, and concentrated liquidity models.

MMT: Mentioned in terms of tokens, rewards, donations, and campaigns.

BTCfi: Related to Bitcoin DeFi, such as the BTC DeFi hub and the launch of xBTC.

xSUI: Liquid staking token, emphasizing staking and pools.

@MMTFinance

The best thing when yapping is to lightly touch on the keywords mentioned by the project.

1.34K

24

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.