Seems like a massive repricing event is inevitable.

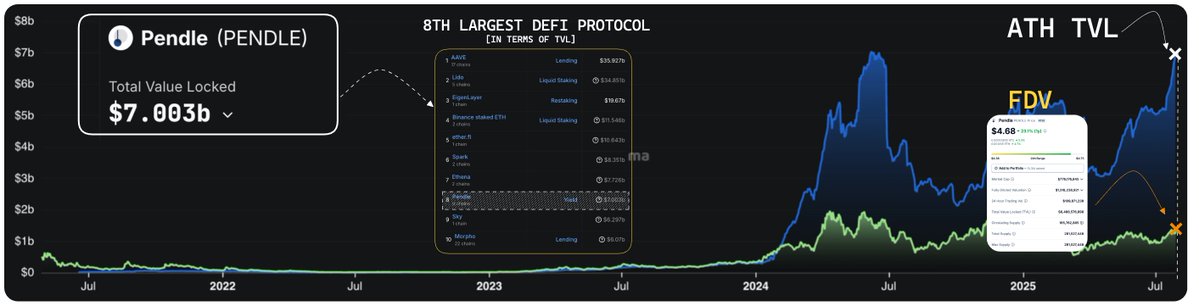

Look where @pendle_fi stands today:

🔸ATH TVL ($7B) as the 8th largest DeFi protocol

🔸King of yields established as the go-to sector-value discovery platform for all emerging narratives

🔸Incoming first-of-its-kind yield trading w/ margin via V3 Boros

🔸Institutional forefront integration on @convergeonchain with day-1 pre-deposits enabled on @Terminal_fi's LP tokens

🔸vePENDLE at ATH supply

🔸Best stablecoin beta bet (thesis by @GLC_Research attached below)

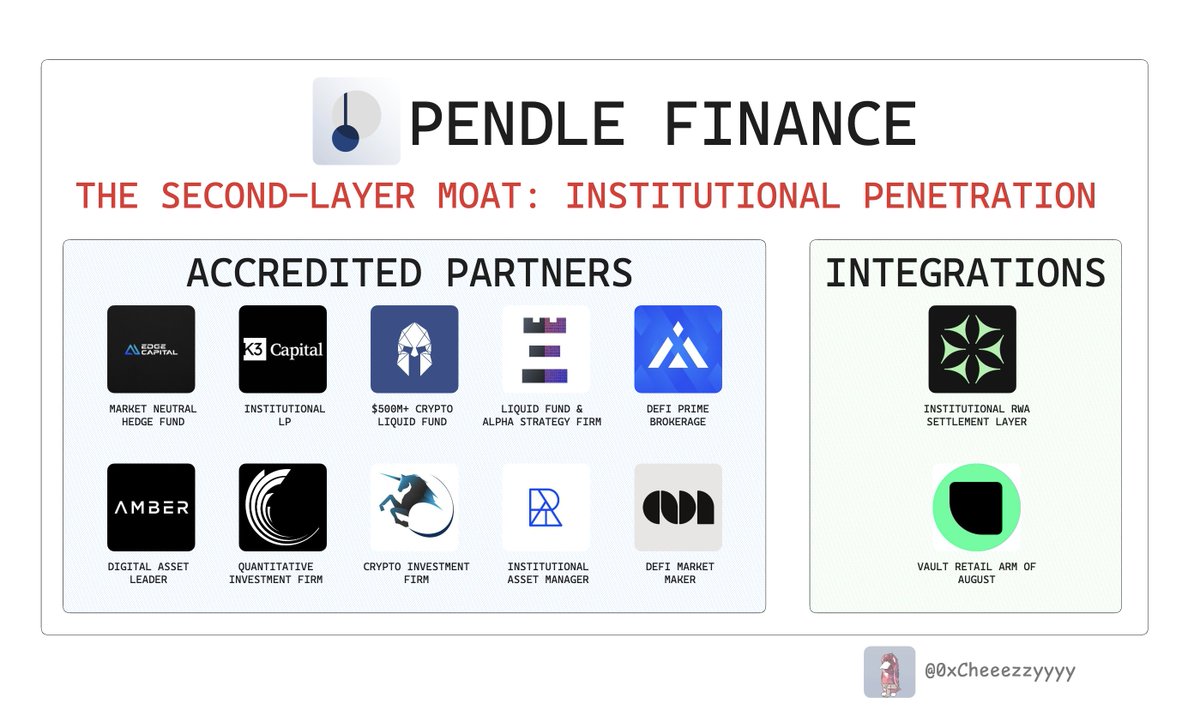

On top of all these, Pendle's institutional moat beyond DeFi is heavily underway.

This second-order moat sets Pendle in its own league.

Wtv clones out there isn't the same, you can't just for a 'pendle'.

Pendle is no longer just a 'yield tokenisation platform', its made up of the brand & ecosystem that it has built over the past 2 years since V2 launch.

Send it higher, $PENDLE.

h/t @DefiLlama @coingecko for insights & references

On Pendle's unmatched institutional penetration:

On deep institutional penetration:

It's a fact that @pendle_fi has quietly built DeFi's strongest moat around narrative-driven yield discovery.

Now, it’s entering a stage 99% of protocols never reach: Institutional Infrastructure.

IMO this is the real unlock, where it cements a second-layer moat through strategic CeFi/TradFi partnerships with accredited entities:

🔸Edge Capital: Market-neutral hedge fund (mEDGE tokenised strategy vault → access to insti-grade strategies)

🔸 @k3_capital (Institutional LP): Utilise PT for fixed-yield strategies

🔸 @TheSpartanGroup ($500M+ crypto liquid fund): Dynamic yield strategies

🔸Republic Digital (Insti asset manager): Fixed yield investments

🔸@ambergroup_io (Digital asset leader): Pendle as core component of on-chain treasury

🔸@caladanxyz (DeFi market maker): Yield products as treasury management strategy

🔸@FasanaraDigital (Quantitative investment fund): Fixed yield strategies via PT

🔸@august_digital (DeFi prime brokerage): Democratise PT yield access to institutional client base w/ @upshift_fi vaults integration for retail

🔸 @Re7Capital (Liquid fund & alpha strategy firm): Leverage on PTs for enhanced delta-neutral strategies

🔸@DeFianceCapital (Crypto investment firm): $PENDLE position + stablecoin yield farming

Notably, Pendle is formally recognised on the institutional front with its core debut on @convergeonchain for yield trading on RWA-Fi assets.

This is huge given how @ethena_labs @Securitize is behind this initiative.

In case you can't see, Pendle is no longer just a protocol.

It’s becoming THE standard for yield as a product.

Pendle.

you're welcome @PendleIntern

16.38K

151

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.