Deflationary + Reserve Dual Driver: TRX's financial narrative is unfolding

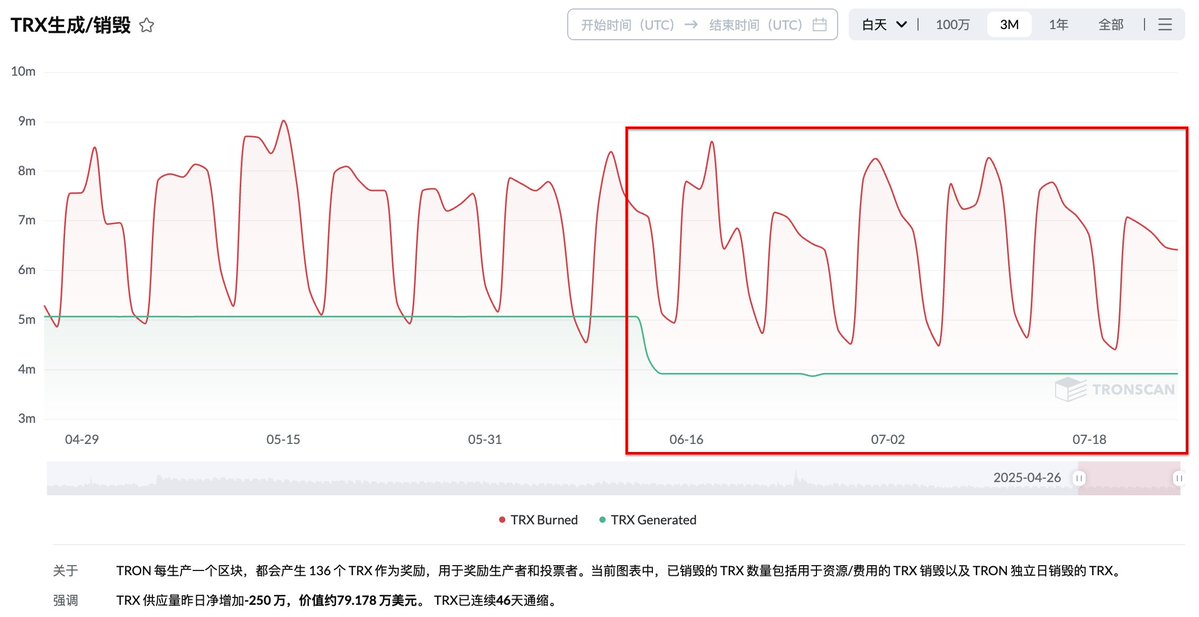

Since the passage of the reduction proposal in mid-June, the supply of TRX has changed significantly. Up to now, TRX has achieved a net reduction in supply for 46 consecutive days, and the daily burn volume continues to be higher than the new generation amount, forming a clear deflationary trend. This is not only reflected in the supply and demand data, but also in the market price.

As TRX becomes the reserve asset of TRON Inc, a Nasdaq-listed company, its financial attributes and value proposition take a significant turn. In the past, TRX served more as a medium for paying on-chain transaction fees, but now it has gradually transformed into a reserve asset similar to gold.

This shift elevates TRX's value anchoring from the original simple on-chain usage needs to a broader dimension of financial reserves and store of value.

Looking at the recent price performance of TRX, we can clearly see that the market is responding positively to this change. The deflationary trend, coupled with the shift in the identity of reserve assets, reinforces the market's perception of TRX's scarcity and gradually pushes the price out of a sustained upward channel.

A series of optimization measures in the TRON ecosystem, including production reductions, mainnet upgrades, and increased on-chain application ecological richness, are also supporting TRX's value base. The healthy development of ecology has consolidated the rationality of the identity of reserve assets.

This time, TRX not only experienced a reduction in production at the supply level, but also ushered in a reorganization of positioning and valuation logic. The market's reaction just proves the effectiveness of this strategy combination.

In the future, when the deflationary effect accumulates further, TRX's asset reserve attributes will also be more widely recognized, and today's trend may be just the beginning......

@justinsuntron @trondao #TRONEcoStar

Show original

16.09K

15

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.