Recently, there are two mining options on the AVAX public chain that look quite good.~

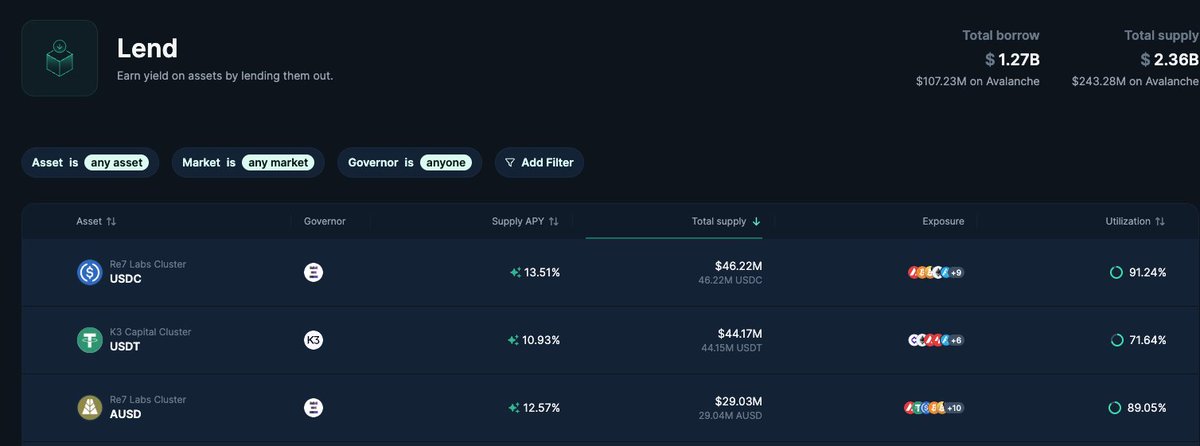

The first one is @eulerfinance. They should have received official subsidies from AVAX, and now simply depositing USDC yields 14%~

If you want to amplify your returns, you can also do circular lending, but the circular yield displayed by Euler is often not very accurate, so it's recommended to calculate it yourself first. Besides USDC, USDT and AUSD also have subsidies, and the capacity is decent.

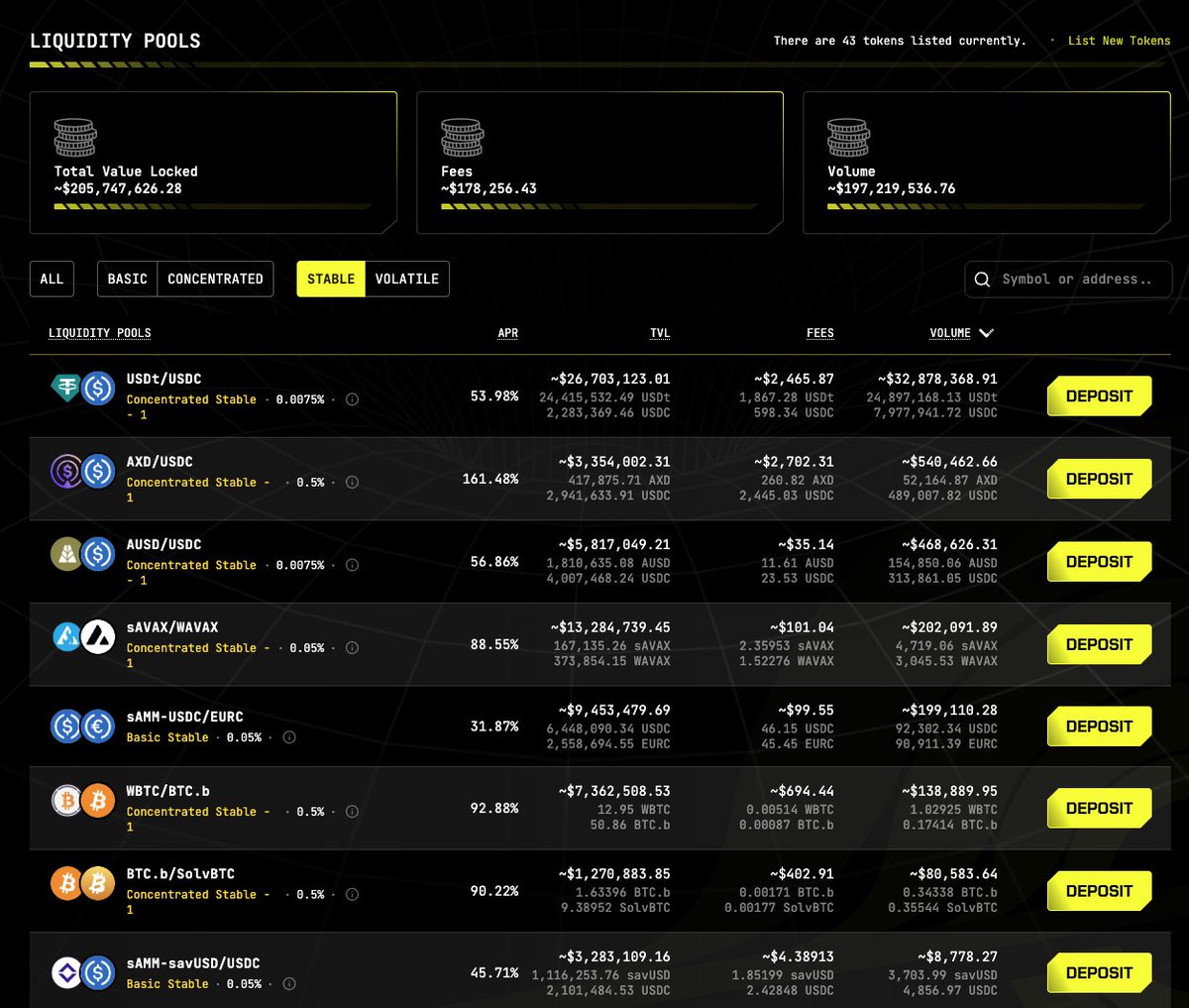

The second one is @BlackholeDex. This project surpassed Traderjoe shortly after its launch to become the leading DEX on the AVAX chain, with a TVL of 200M.

Several stablecoins have good yields, but be aware that it is a v3 concentrated liquidity pool, and the range needs to be narrow enough for the yield to be high.

If you're not worried about impermanent loss, you can choose the AVAX/USDC pair, and selecting a range of +/-10% can already yield 400% APR.

Show original

3.25K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.