Why tokenized money market funds are a revolution and why they could threaten banks

🧵 To unfold

You've probably caught a glimpse of it in recent months; there's been a lot of talk about stablecoins.

But in my opinion, they are just a first step towards something much deeper.

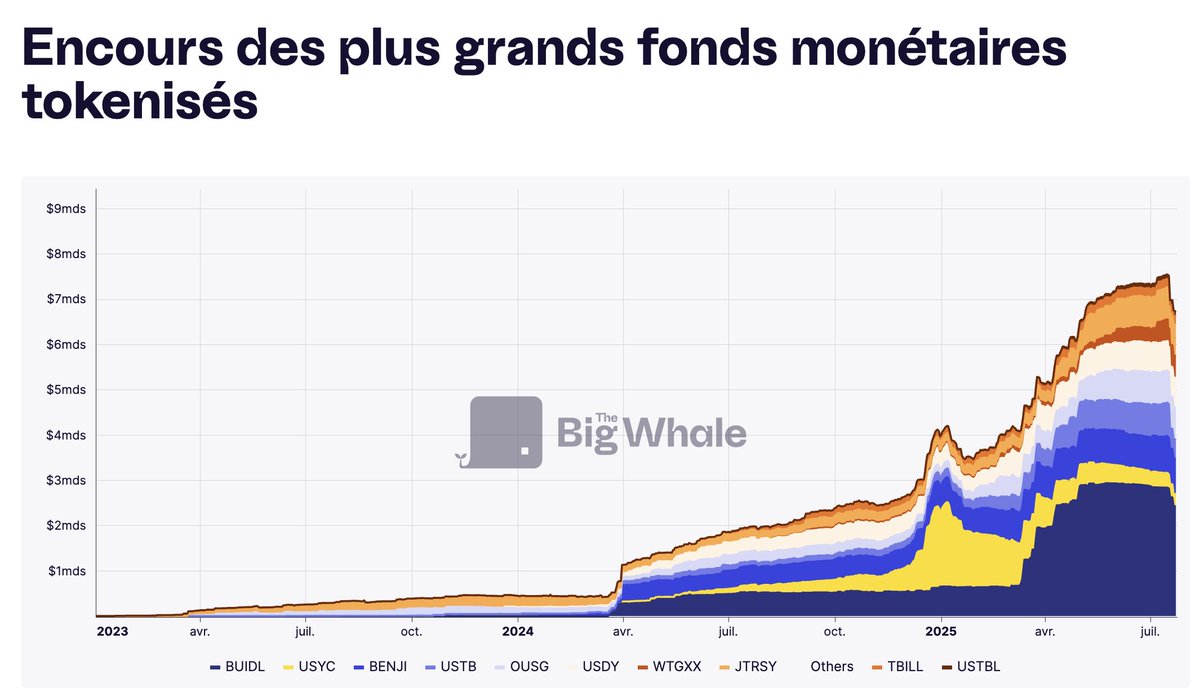

More and more players are exploring a new financial instrument: the tokenized money fund, which is a fund invested in US Treasury bills... but transposable on a blockchain.

Result: a liquid, secure asset that is instantly transferable and yields returns.

Unlike traditional stablecoins, which generally do not generate returns for their holders, these tokens are backed by income-generating assets.

The average yield on money market funds is around 4%, compared to less than 0.6% for a traditional savings account in the United States.

The largest fund of this type, BUIDL, launched by @BlackRock, has already surpassed 2.4 billion dollars.

And Larry Fink, its CEO, does not hide it: "One day, tokenized funds will be as familiar to investors as ETFs."

In Europe, players are already well established, such as the French @Spiko_finance, who offer products backed by US Treasury bonds or European sovereign bonds.

The real issue?

These products could also serve as means of payment, just like stablecoins.

And this dual function (payment + yield) could disrupt the current balance of the banking system.

According to @ababankers, if individuals transfer only 10% of their $19 trillion in deposits to these new instruments, the average funding cost for banks would rise from 2.03% to 2.27%.

A modest increase, but one that could cut into a significant part of their margins!

For banks, the risk is therefore not (yet) a massive outflow of deposits

But a slow erosion of their economic model, even as stablecoins continue to grow.

You can monitor all this data through the tokenization dashboard of @TheBigWhale_ and enjoy the content developed by our research (articles, surveys, briefings, reports)

👉

9.67K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.