Is this time really different? I will gradually exit the liquidity in the crypto space from May to June 2024.

What will be effective? Technical analysis, halving SF2 model, four-year cycle theory, macro analysis, on-chain data, etc., there is always something that has perfectly "phased in" during past cycles; mechanically seeking the end point like carving a boat to find a sword, this cycle may ultimately be ineffective.

For example, taking most indicators and cycles, the reference four-year halving has actually been advanced this time, just in a different form; since ETFs can boost Bitcoin prices from the demand side, it is actually similar to the past where the supply side was beneficial for prices. The supply-demand imbalance brought by the halving in April-May has been advanced to January with the ETF approval, and this is just one of the factors that need to be corrected. Other reference factors for supply imbalance include whether ETFs can bring sustained capital demand? Does the marginal reduction in supply-side halving and the increasing total market cap have little impact on the supply side?...

In general, considering the supply-demand imbalance, this "fast cycle" may end faster, possibly 1-2 quarters earlier, but this "slow cycle" long bull (tentatively assumed to exist) will recover faster under the influence of ETFs. However, after recovering to the "slow cycle" long bull, the difficulty of investing in the crypto space will rise to a king-level hell, second only to the stock market. How to participate and in what form needs to be considered.

Furthermore, with the increasing proportion of professional traders, many players reference the Federal Reserve, macro liquidity, and U.S. stock market indicators. Most market views believe that the liquidity expectations brought by the Federal Reserve's interest rate cuts will extend the bull market cycle. However, recalling the starting point of this bull market, which originated from the SBV Silicon Valley Bank crisis, is it the crisis that brought more capital inflow into Bitcoin or the increased liquidity from interest rate cut expectations? The starting point of confidence is worth pondering: is it the chaos of the external world or the tranquility brought by interest rate cut expectations?

Additionally, the chaos and misalignment among various macro cycles, economic cycles, and credit cycles mean that there are no fools in the market; let the anticipation of this interest rate cut be fully priced in, while the actual moment of rate cuts may signal the end of this fast cycle. When the external environment is flourishing, I do not believe it is the time for Bitcoin to shine. On the contrary, the more chaotic the macro and world situation, the more valuable Bitcoin becomes; this is an unchanging main line.

Considering the timeline, the halving at the end of April 2024, the Ethereum ETF deadline on May 23, and the first interest rate cut expectation in June, I will start to gradually exit most of the liquidity in the crypto space from May to June; then I will make a comprehensive asset allocation adjustment plan, thinking about risks, exits, and changes, retreating to advance.

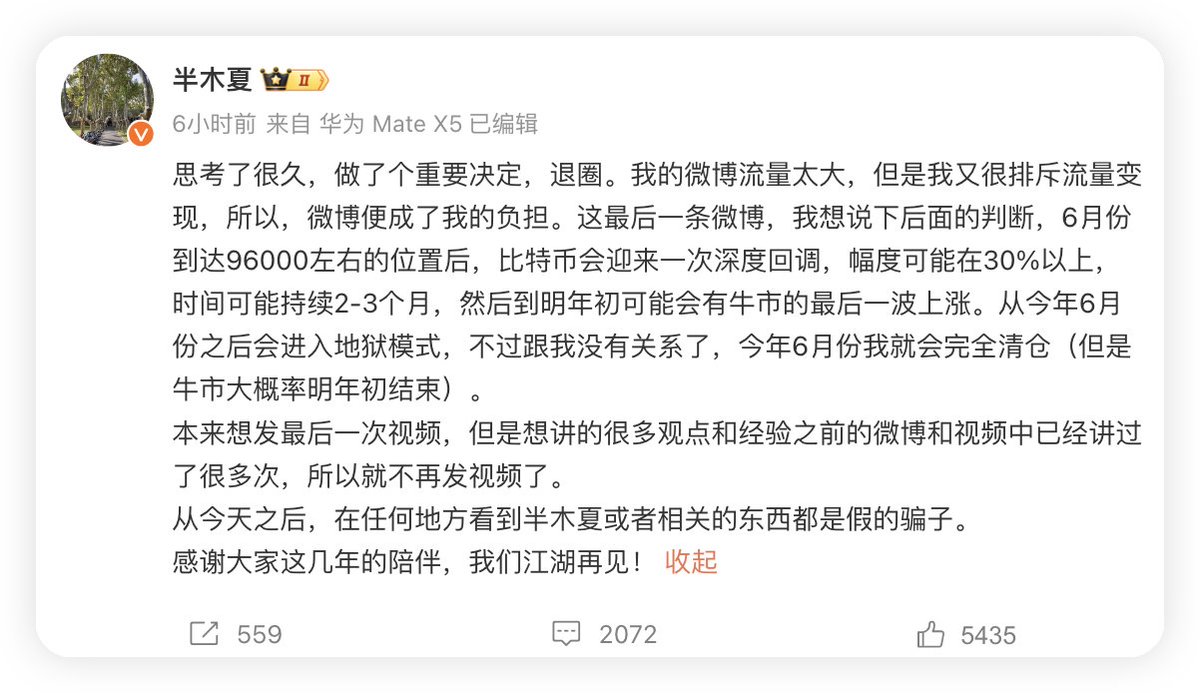

Interestingly, today I came across a tweet from senior HalfWS regarding exiting the crypto space; purely from the conclusion, I haven't seen any liquidity exit plans that are so advanced in the circle yet, which gives me confidence, but I wonder if there are any logical similarities.

After two weeks of silence, I will provide six clues that confirm the arrival of the altcoin season, which will be particularly valuable in the coming months, and I will release them in the next few days.

Show original

414.21K

487

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.