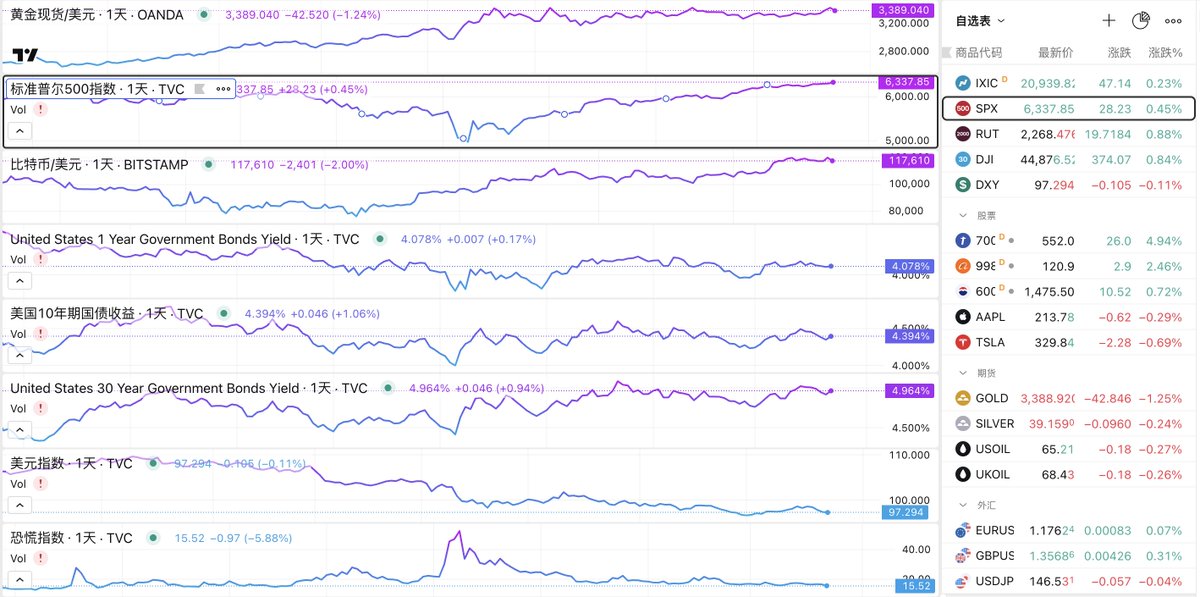

Global Market Dynamics on July 23:

1. Gold and the US dollar both fell, as the easing of trade tensions led to a decrease in safe-haven demand, causing both to weaken.

2. International crude oil prices remain stable around $68, maintaining relative resilience. If the US and Europe continue to impose secondary tariffs on Russian energy, energy prices are unlikely to drop in the short term.

3. The decline in relative safe-haven sentiment is associated with a decrease in demand for the dollar, leading to an increase in US long-term bond yields, with long bond prices slightly falling and demand weakening.

4. The easing of trade tensions has triggered a rise in the stock market; however, with Tesla and Google's earnings reports due to be released after the market closes today, the stock market will remain relatively cautious even with the trade easing.

5. The VIX index continues to fall to around 15.5, reaching a new low since February 1, 2025.

Assessment:

The signing of the US-Japan trade agreement has led to market expectations that US-EU trade tensions will ease, reducing global market safe-haven sentiment and increasing risk sentiment, resulting in a relatively normal trend.

The agreement on US-Japan tariffs may indicate that the US is nearing the end of its tariff negotiations in the Asia-Pacific region. With Japan secured, South Korea is left "alone and unsupported."

What Trump actually needs to do is quite simple: set high tariff targets and then slow down the imposition of tariffs through negotiations, with the aim of opening up the markets of the countries involved in the tariff negotiations.

The goal is to turn the US trade deficit into a surplus, and in doing so, the smaller allies will also be "grateful," referring specifically to the Philippines.

Japan actually wants to break free from the US to achieve economic independence, but unfortunately, without military sovereignty, economic independence is unattainable. Thus, Shigeru Ishiba has become the scapegoat.

Recently, Ishiba's approval ratings have plummeted significantly, mainly due to the rebound of inflation in Japan, leading to a sharp decline in the support rates of the two ruling parties.

In this round of trade negotiations, Ishiba stated that Japan sacrificed its agriculture in exchange for a reduction in US tariff quotas, while the 50% tariffs on automobiles and steel still remain. In the future, Japan's inflation is bound to rebound further, posing an even greater threat to the government's rule. Therefore, the best solution may be to use Ishiba as a "sacrifice" to quell public anger.

The next focus of negotiations will be on the Asia-Pacific region, including South Korea, Thailand, and India, as well as major allies like Australia and Canada. Besides China, Europe is a key focus of Trump's trade negotiations this time! After all, it is essential for future major US exports.

20.19K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.