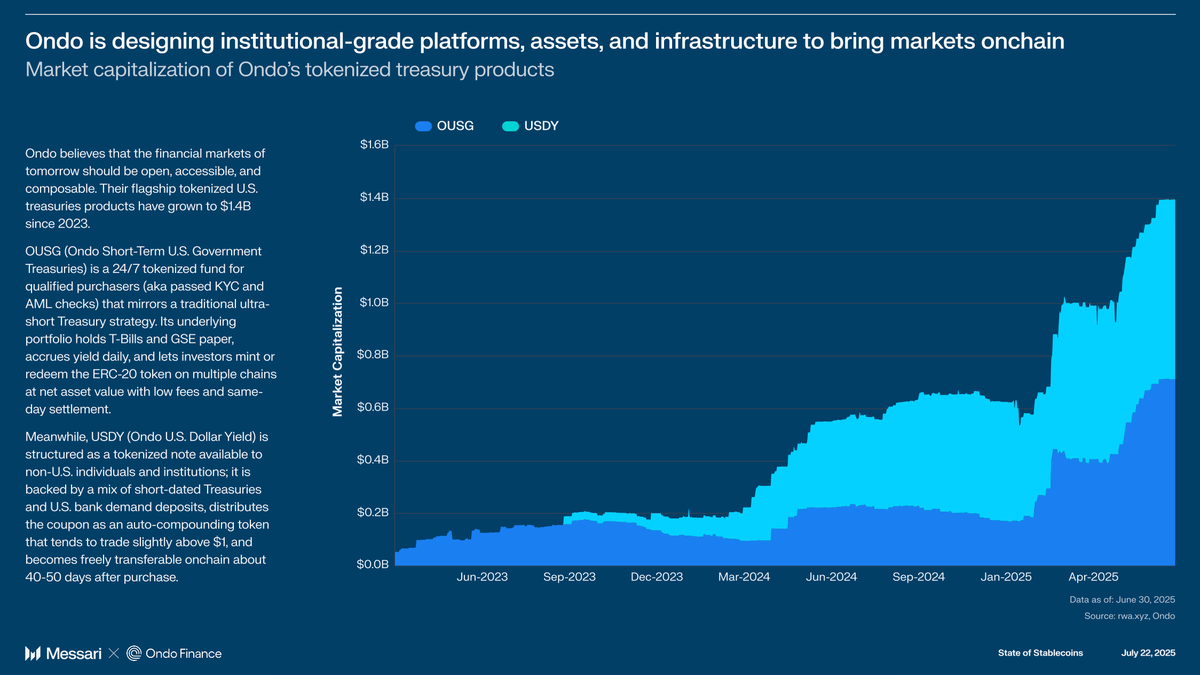

As detailed in @MessariCrypto’s latest report, the tokenization of financial assets is no longer theoretical. Ondo’s tokenized US Treasuries products alone have surpassed $1.4 billion since launching in 2023.

This growth is confirmation of a structural shift. As the report notes, “Tokenized treasury funds have become one of the fastest growing segments of RWAs.”

“Ondo is designing institutional-grade platforms, assets, and infrastructure to bring markets onchain,” starting with US Treasuries, and soon expanding to tokenized stocks, ETFs, and more.

Read the full report from @MessariCrypto: State of Stablecoins, featuring Ondo Finance and other key players shaping the tokenized finance landscape.

32.71K

828

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.