Circular lending can be considered a relatively difficult stablecoin strategy to manage, and if you're not careful, you might end up losing to wear and tear.

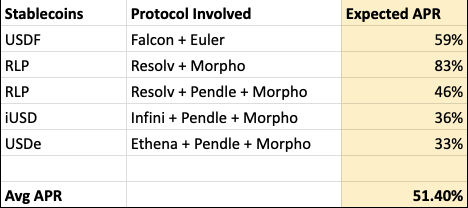

Here are a few circular lending opportunities that I currently find to be relatively stable and offer good returns 💰

The APY is around 30% - 80% 🧵👇

2/🧵The first one is $USDF from @FalconStable.

USDF is a stablecoin created by the DWF team, backed by a market-neutral arbitrage strategy, with a base yield of about 12%.

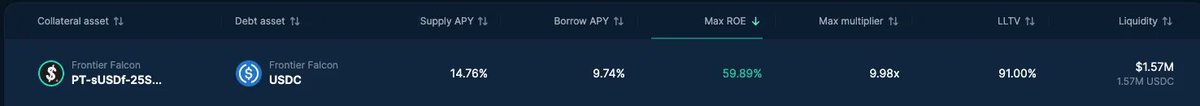

Currently, PT-SUSDF on @pendle_fi can be used as collateral to borrow USDC on @eulerfinance.

The PT yield is 15%, and the USDC interest is 9.7%.

➡️ With full leverage, the APY goes directly to 59%.

3/🧵 Next up is $RLP from @ResolvLabs

The $RLP is backed by funding rate arbitrage, with an annualized rate reaching as high as 27% in the last 7 days!

📌 Aggressive strategy: Directly stake $RLP at @MorphoLabs and borrow $USDC at 13% interest.

➡️ With 5x leverage, the APY shoots up to 83%!

📌 Conservative strategy: Use PT-RLP from @pendle_fi (locking in 17.8% yield) to stake.

➡️ Even with leverage, the APY is still around 46%.

4/🧵The next one is $iUSD from @0xinfini.

The principle of Infini is quite simple; users can choose different staking periods to earn DeFi yields, somewhat like a bank's fixed deposit. Currently, the TVL is 60M, and it also operates its own points system.

We can utilize the PT-iUSD on @pendle_fi to lock in a 14% yield, and then borrow USDC at an 8.4% interest rate on @MorphoLabs.

➡️ After 5x leverage, the annual return is 36%.

5/🧵Finally, @ethena_labs's Usde

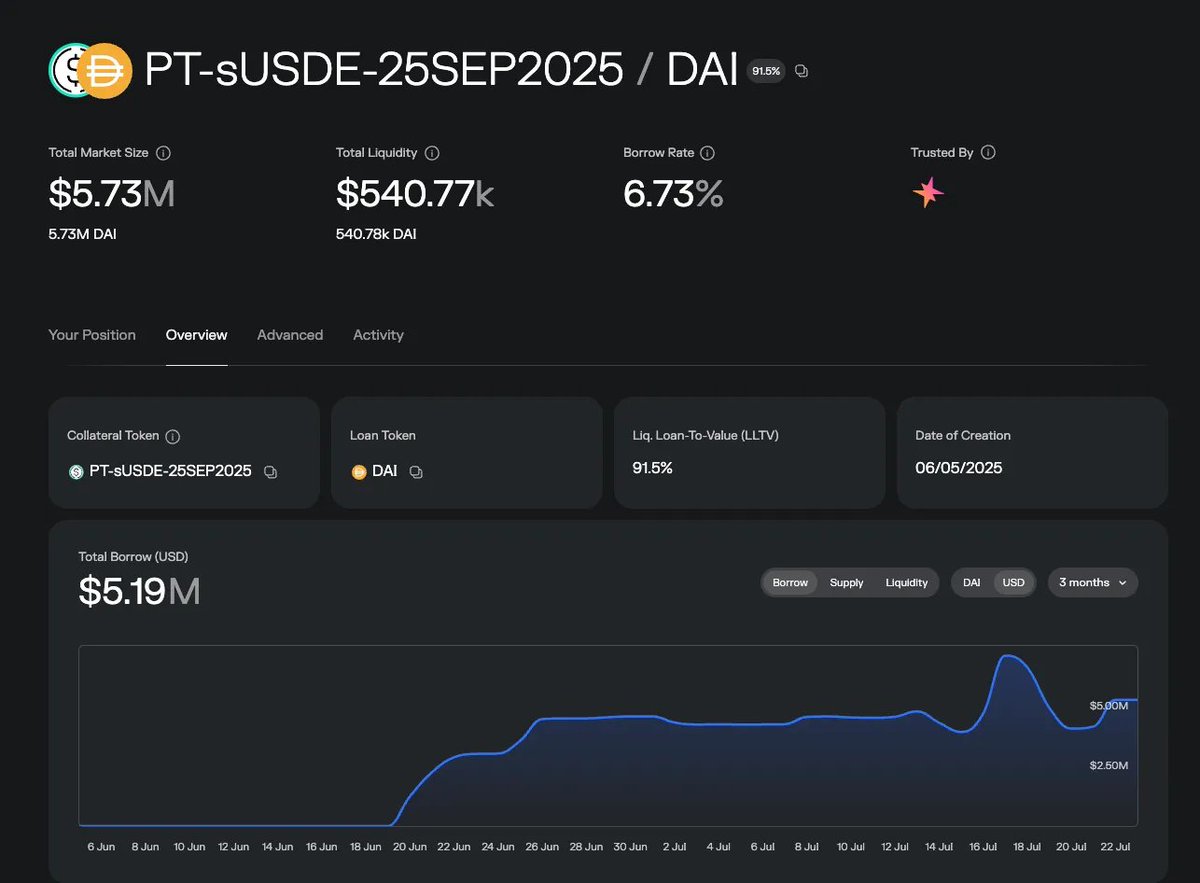

Recently, Ethena's price momentum has been strong, with the total supply of usde surpassing 6.2B. @pendle_fi PT-sUSDe (maturity date in September) yields 12%, and you can borrow DAI on @MorphoLabs with an interest rate of 6.7%.

➡️ 33% annualized return after 5x leverage.

6/🧵 Just a reminder, the strategies mentioned above all carry risks, such as interest rate fluctuations and stablecoin price decoupling, so make sure to do your research before participating.~

It took me longer than I expected to consolidate this article, and if you find the content useful, I hope everyone can give it a like and help share it out. 👍

10.48K

52

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.