StablecoinX just announced it’s going public through a SPAC, planning to buy $360M worth of $ENA.

This could redefine how institutions gain crypto exposure.

Let’s break it down in simple terms👇

2/ Ethena Foundation created StablecoinX as a dedicated crypto treasury, funded by $360M from respected investors like Dragonfly, Ribbit Capital, Pantera Capital, ParaFi Capital, Haun Ventures, Polychain Capital, Galaxy Digital, Wintermute, among others.

StablecoinX will list publicly on Nasdaq under ticker $USDE.

StablecoinX Inc. @stablecoin_x has announced a $360 million capital raise to purchase $ENA and will seek to list its Class A common shares on the Nasdaq Global Market under the ticker symbol "USDE", which includes a $60 million contribution of ENA from the Ethena Foundation

Equity markets will now have direct access and exposure to the most important emerging trend in all of finance:

The growth of digital dollars and stablecoins.

To bootstrap its acquisition strategy, StablecoinX Inc. will use all of the $260 million cash proceeds from the raise (less amounts for certain expenses) to buy locked ENA from a subsidiary of the Ethena Foundation.

Starting today, the Ethena Foundation subsidiary (via third-party market makers) will use 100% of the $260 million cash proceeds from the token sale to strategically purchase $ENA across publicly traded venues over the coming weeks, further aligning the Foundation’s incentives with those of StableCoinX shareholders.

The planned deployment schedule is approximately $5m daily from today over the course of the next 6 weeks. At current prices $260m represents roughly 8% of circulating supply.

Importantly, the Ethena Foundation has the right to veto any sales of $ENA by StableCoinX at its sole discretion. Ideally, tokens will never be sold with a sole focus on accumulation.

To the extent StableCoinX subsequently raises capital with the intent of purchasing additional locked ENA from the Ethena Foundation or its affiliates, cash proceeds from those token sales are planned to be used to purchase spot $ENA.

StableCoinX's treasury strategy is a deliberate, multi‑year capital allocation strategy that will enables StableCoinX to capture the enormous value of the secular surge in demand for digital dollars while compounding ENA per share to the benefit of shareholders.

3/ Its explicit purpose is using those public funds to buy back and hold Ethena’s native token, $ENA, and run ENA staking and validator infrastructure.

The immediate plan: buying $260M worth of ENA (~8% of circulating supply), injecting a predictable daily $5M bid into the market for 6 weeks straight.

4/ Why now?

The GENIUS Act recently legalized stablecoins in the U.S., recognizing them as critical financial infrastructure.

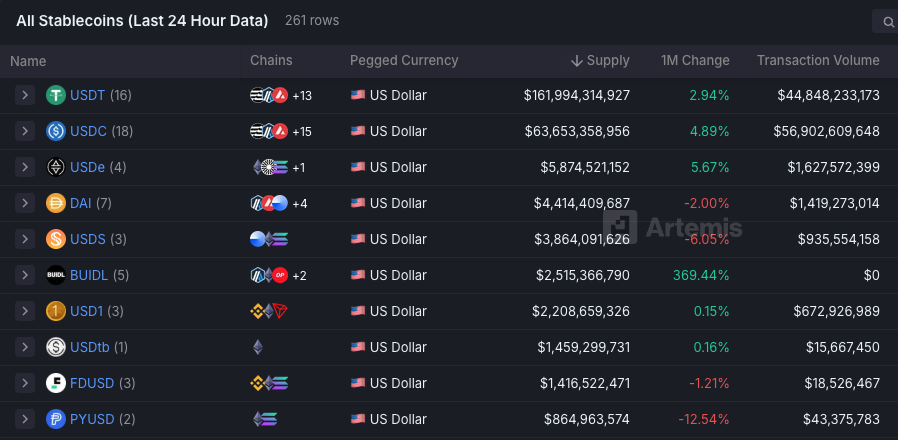

@ethena_labs is the third-largest stablecoin issuer after Tether and Circle, sees a massive opportunity here, aiming to position $ENA as a core institutional asset.

5/ The bull case is clear:

- The guaranteed daily buying pressure creates an immediate price floor for $ENA.

- Major institutional backing and influential crypto players signal significant credibility.

- Listing publicly makes StablecoinX a clean institutional entry point into stablecoins.

6/ But it’s not without risks:

Funding token buybacks with public market cash can look financially engineered, inviting regulatory scrutiny or skepticism from sophisticated investors.

Will markets trust that the valuation is driven by real adoption, not just financial engineering?

7/ Plus, regulators (especially post-GENIUS Act) may closely examine whether this buyback is genuinely in public shareholders’ interests or simply inflating token prices.

Transparency, compliance, and careful governance will be absolutely critical here.

8/ The questions:

Can Ethena turn this ambitious strategy into sustained adoption and real utility, proving StablecoinX is more than just a trading play?

Will revenues generated by staking and running validators (part of StablecoinX’s strategy) be reinvested in Ethena’s core infrastructure and benefit all ENA holders?

9/ If so, @stablecoin_x could pave the way for other high-quality crypto projects looking to bridge TradFi and crypto markets.

It could set a benchmark for how crypto can leverage public equity markets for sustainable growth.

6.33K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.