CT is awfully quiet about stETH by @LidoFinance depegging, which has been steadily happening since Friday.

Currently, 100 stETH equals to 99.65 ETH, or a 0.35% depeg, and IMO, it's about to get worse 🚨

There are multiple reasons, covered below 🧵 & how you can profit👇

1. What caused this (slight) depeg?

Massive stETH sell pressure depleted the main @CurveFinance liquidity pool. It now contains 80% stETH, versus the targeted 50%, weakening the peg. In a StableSwapThings pool, things get out of hand quickly once the initial equilibrium is lost.

2. Why the sell pressure?

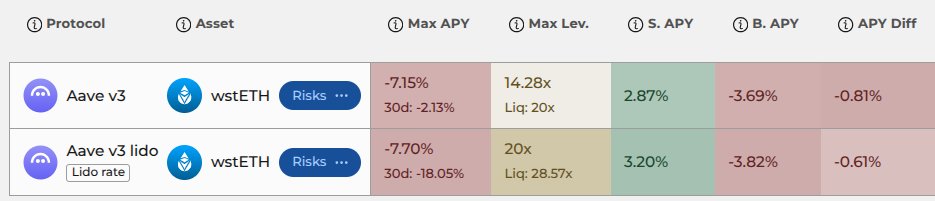

Many players looped stETH via @aave Core and Prime, borrowing ETH through tools like @DeFiSaver or @Instadapp. This strategy has been very profitable in the past few months, yielding double digits on ETH.

Since Friday however, borrowing interest rates shot up due to large withdrawals, making these positions (very) unprofitable. Hence, many loopers were forced to unwind to avoid incurring any losses. Loopers typically don't have liquid ETH inventory on hand to repay their debts, and are forced to sell stETH on the open market.

Coupled with increased stETH selling pressure from long-term ETH holders taking profit, we have a very sell-driven market!🔻

3. What about native stETH redemptions?

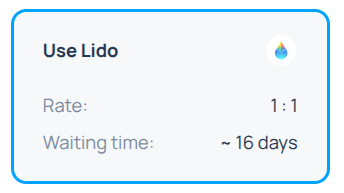

As you may know, you can natively unstake stETH in Lido for ETH at a 1:1 peg. The kicker is that this takes time... a lot of time!

The queue is currently at 16 days! And rapidly increasing due to more ETH validators exiting

4. This is precisely why the situation will worsen over the following days and weeks:

> Too much leverage in the system

> Not enough liquidity to deleverage

> Long native unstaking queue

A 10,000 stETH sale already leads to a 1% depeg. Now imagine what selling 190k stETH looped on Aave Prime does, or 2M ETH (yes that's $7.5B).

5. Is this cause for concern? 😱

No, not really. In the end @LidoFinance keeps working as expected. As long as you are not looping, you should be fine.

And you can even profit from it, quite safely👇

6. How to profit?

Buy the discounted stETH. Then simply wait until it eventually repegs, or natively unstake yourself in Lido.

At a 0.36% depeg and 16-day unstaking, that is a fixed APY of 8.2% on ETH. Not bad, huh?

And yes, this can take size😉

Before I forget, @OriginProtocol built a vault for this 🤯 so you can simply set-and-forget, without having to worry about redeeming yourself. It does it automatically!

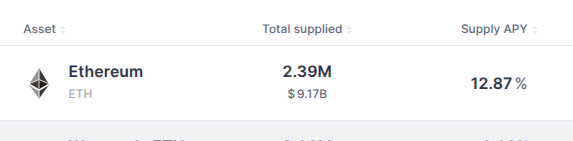

@LidoFinance Meanwhile, the ETH exodus from @aave continues. Best risk-adjusted yield in ETH at the moment 😎

37.46K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.