4 reasons I'm bullish on Altcoins

(yes, bullish propaganda)

(1/4)👇

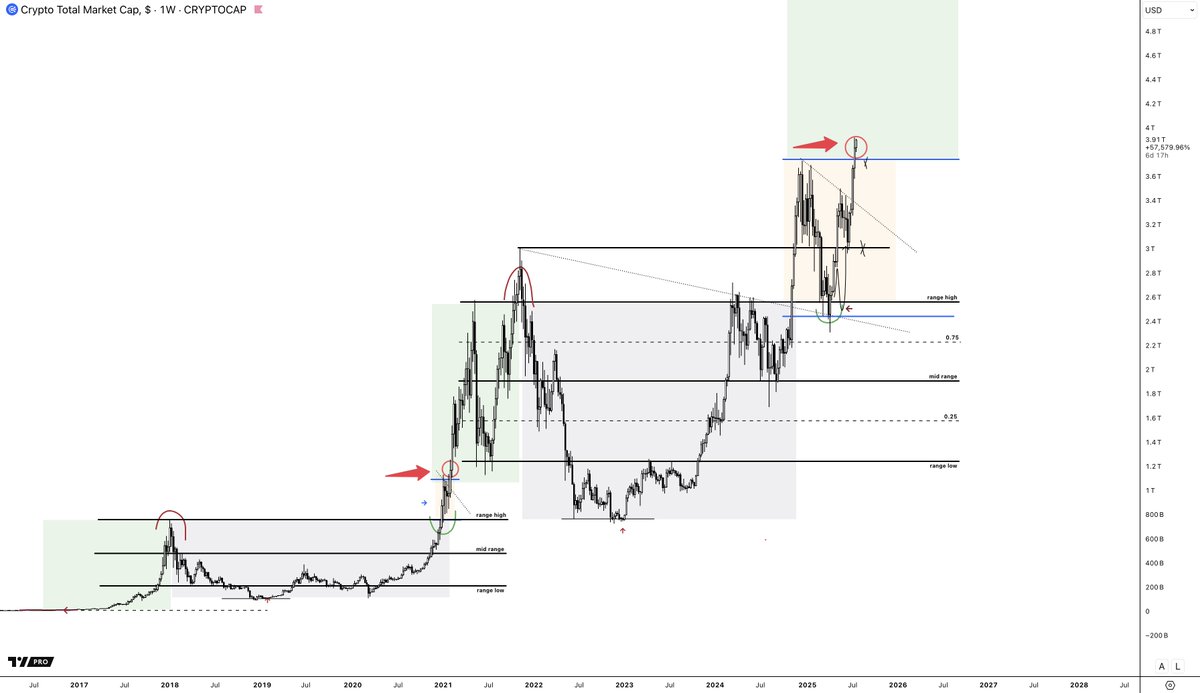

1. Market timing

We’re over 1000 days into the bull cycle now, and usually the part that’s pure terror for 95% of altcoins. Bitcoin pumps, dominance pumps with it, and ALTBTC pairs get wrecked for years.

At some point, people lose hope and think nobody will bid alts this cycle. They rotate back into Bitcoin.

That’s usually the peak frustration point for altcoins, which happens every cycle.

It often lines up with Bitcoin breaking into new highs and starting its first consolidation phase.

That first consolidation after the breakout is marked by the red circle.

But when that consolidation breaks to the upside and Bitcoin starts its second leg, historically, something magical happens:

> Bitcoin dominance starts to drop.

That’s exactly where we are now, and BTC dominance is already showing signs of weakness.

some notes;

> This is trading; we are betting on probabilities, and there are no certainties

> We just do our best to figure out what scenario has the best probability, and if good enough, we bet on it

> If we bet on something, you don't bet on it with a full portfolio; always keep a balance between bitcoin/altcoins

> We have always had our cycles being capped by the parabolic resistance line you can see on the Bitcoin chart. This line prevented Bitcoin, historically, from continuing, which also allowed money to flow into altcoins.

> I do expect in the next 1-5 years this line to break; this can also happen earlier and will influence the dominance chart pattern. I'm actively building a second, longer-term bitcoin stack for this scenario.

3. Total Market caps and money flow

> Total Crypto Marketcap

Breaking the highs into price discovery.

> Historically, this is the part where things go parabolic

> From a cycle perspective, this is where things go parabolic

> All lining up with market timing, bitcoin dominance, and ethereum.

> Total 3

This is the top 100 tokens minus Bitcoin and Ethereum. It's sitting at the range high resistance, but historically it lags behind Bitcoin and the total crypto market cap.

A breakout would open us up to a lot of Altcoin upside.

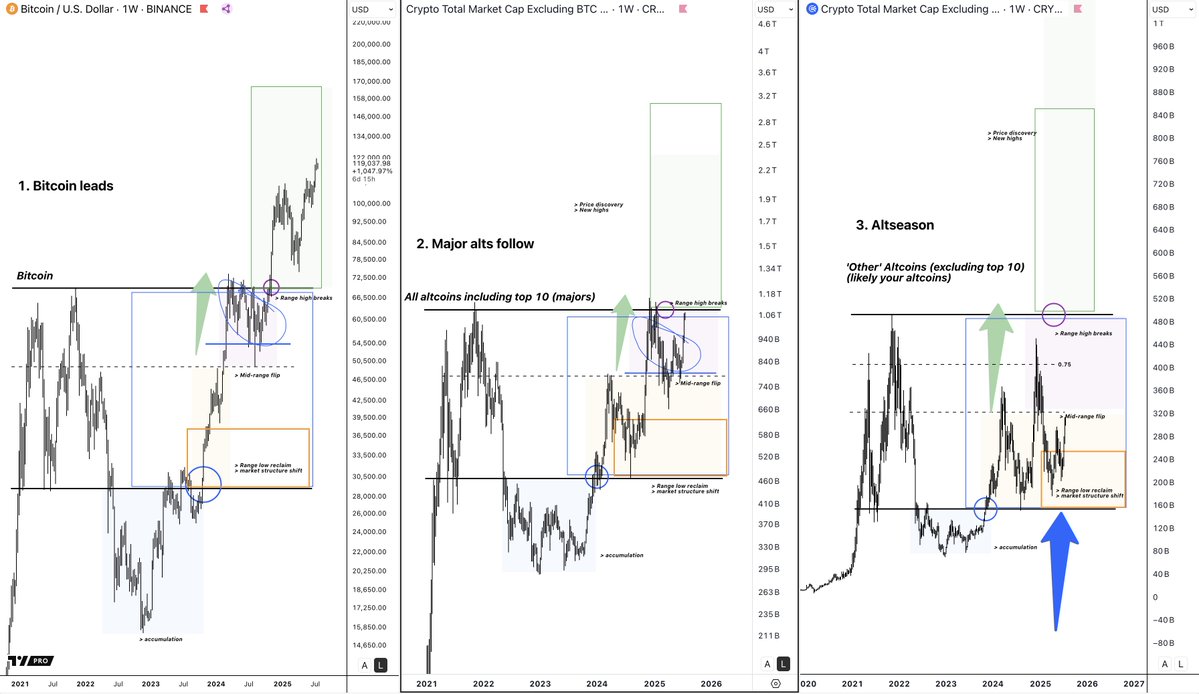

> The money flow

Early in the cycle, Bitcoin goes, majors (total 3) follow, and lastly the rest of the Altcoins (others chart)

They form a similar range and cycle pattern, but just lag behind.

As we are in a late part of the cycle, I think it's time for them to catch up soon. They always catch up every cycle again.

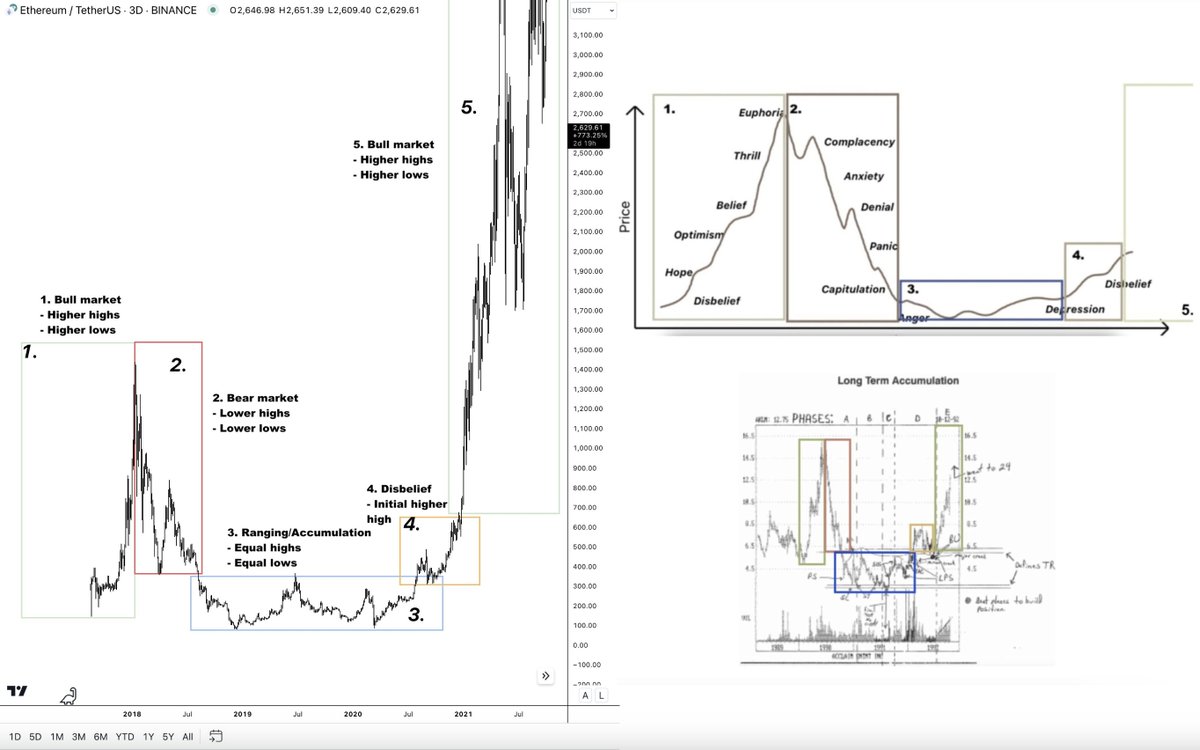

4. Altcoin structures

Everything moves in similar cycles and range structures.

You want to get exposure at stage 3 or 4, around or below the range lows.

This is where the big moves to the upside originate from, and where you get the best risk-reward.

A LOT of Altcoins are at this point, and ethereum, for example, just rallied from there. Most of the time, Ethereum goes first, and the rest follow later.

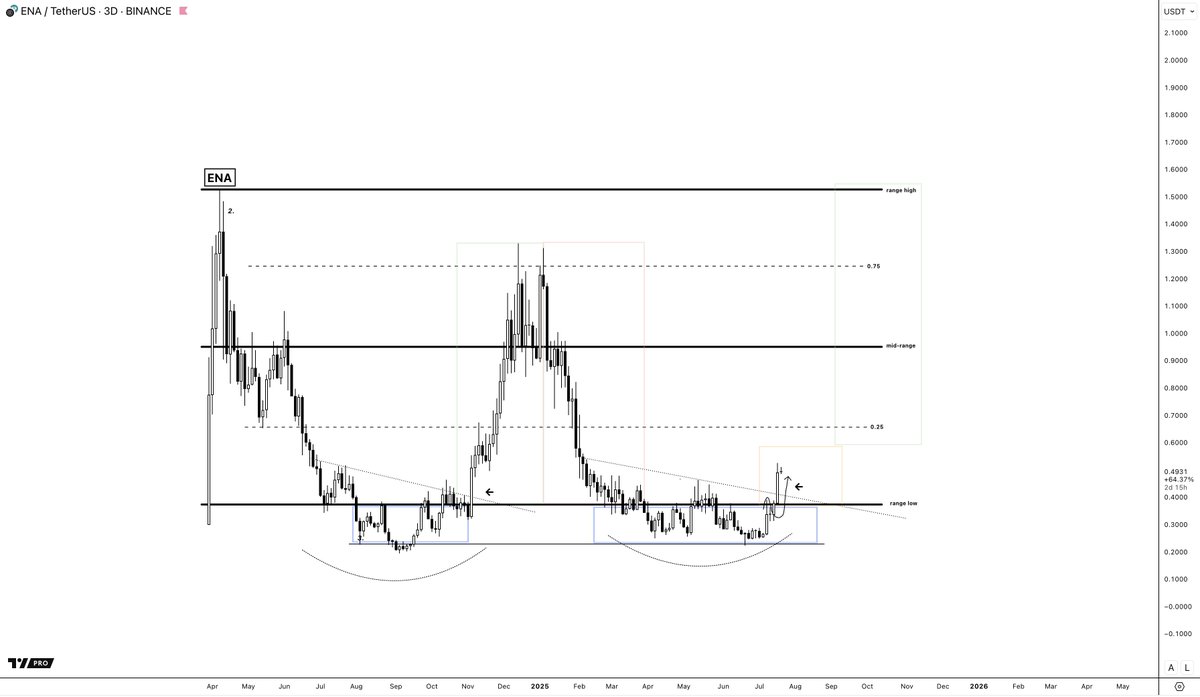

ENA as an example (but many are here)

Extra notes:

> Don't bet on things with 100% (keep a balance)

> It's betting on probabilities, and even if it's in your favor, it's never a certainty

> This is not an entry now thread, it's an analysis of the broader macro altcoin market. We have been rallying, and at some point, sharp pullbacks are expected.

Find a setup, stick to your tokens with some patience, and don't use leverage.

It's looking good, fam.

89.94K

728

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.