I've been tracking the ve(3,3) meta for a while and I think it’s finally arriving at scale.

Why? Because the DEXs that print and share real fees are starting to launch.

@Uniswap is generating $660M/year in fees. But who captures it? In most cases, not the users.

Now @Catex_Fi on Unichain flips that script.

▸ It's the first ve(3,3) DEX on Unichain, and the only one positioned to capture ALL Uniswap fees on this chain.

▸ Rewards started on Day 1: $veCATX holders earn fees, incentives, and rebases from the start.

▸ It mirrors the Lynex-Fi strategy on Linea, but with faster cycles and deeper value flow.

Here’s what stands out in @Catex_Fi:

1/ Fast governance → Epoch 1 voting already started.

2/ Dual rewards → LPs earn both $UNI and $oCATX.

3/ $veCATX holders direct emissions → creating a programmable liquidity layer.

I’m already staking some $CATX.

If you're wondering what to do with your airdrop:

→ Holding = zero yield

→ Locking = voting power + emission share + passive income loop

You don't just farm here, you vote, direct incentives, and own the fee machine.

This is how #DEXs should work.

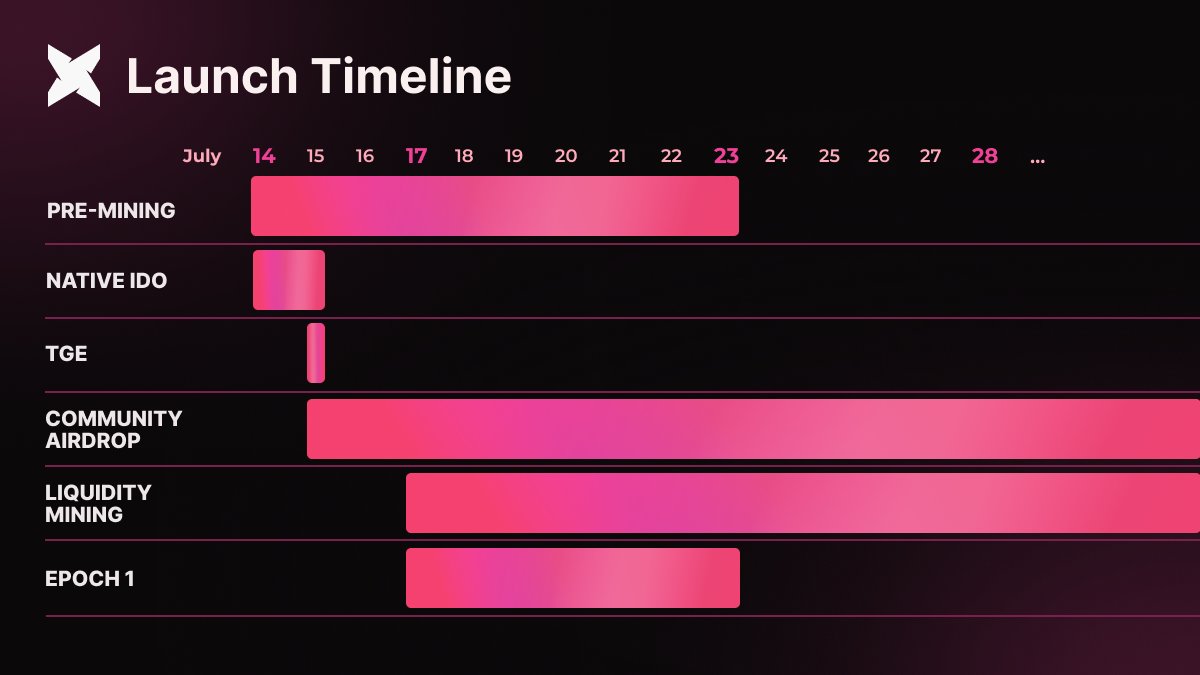

From TGE to Epoch 1, we’re laying out exactly how the next few days unfold.

veCATX voting, liquidity mining, airdrops — all kicking off in rapid sequence.

If you’re participating, this is your blueprint.

If you’re watching, this is your wake-up call.

📖

12.86K

102

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.