[July 18 Options Expiration Data]

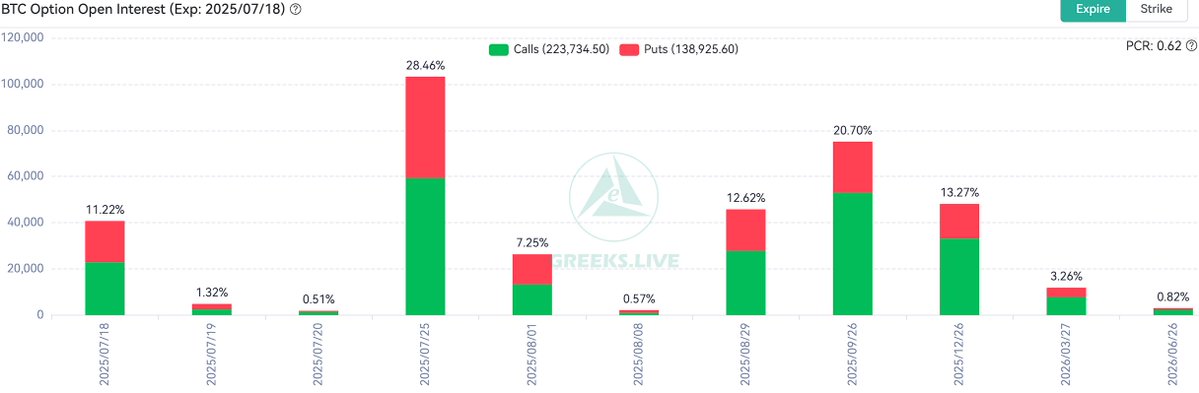

41,000 BTC options expired, with a Put Call Ratio of 0.78, and a maximum pain point of $114,000, with a nominal value of $4.93 billion.

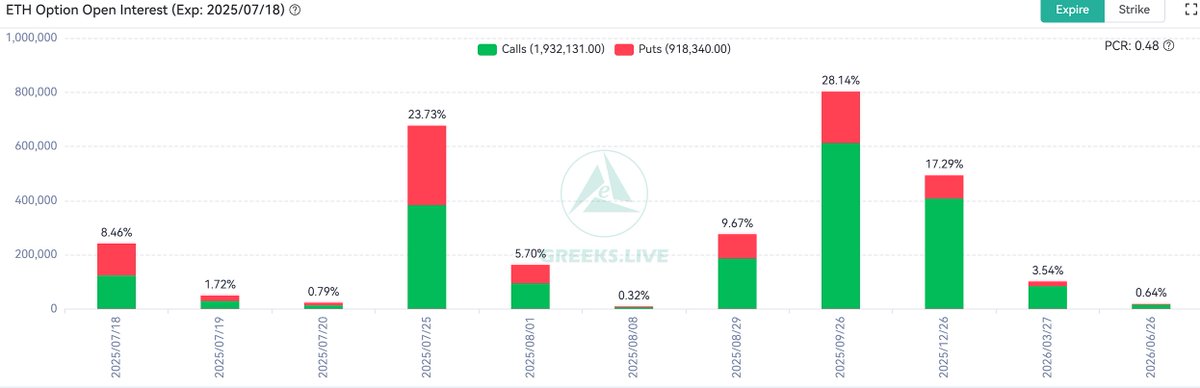

240,000 ETH options expired, with a Put Call Ratio of 1.0, and a maximum pain point of $2,950, with a nominal value of $880 million.

ETH takes over the bull market, breaking through $3,650, while Bitcoin remains volatile around its historical high of $120,000, with market sentiment shifting significantly to optimism. ETH is driving the entire altcoin market to warm up, with a steady rise and no pullbacks greatly encouraging market participants.

This week, nearly $6 billion in options expired, accounting for more than 10% of the current total open interest.

From the main options data, in terms of implied volatility, BTC's IV has slightly rebounded, with the main term IV maintaining at 40%, while ETH's IV has risen significantly, reaching as high as 70%. However, ETH has considerable room for both upward and downward movement, and sellers have not yet found the right time to enter the market.

In the past two weeks, there have been many large bullish trades, with most days seeing over 30% of the volume being large bullish trades in Bitcoin. The options market is starting to show some FOMO sentiment, and institutional investors are also becoming restless.

Show original

4.9K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.