Continue to update $SBET progress

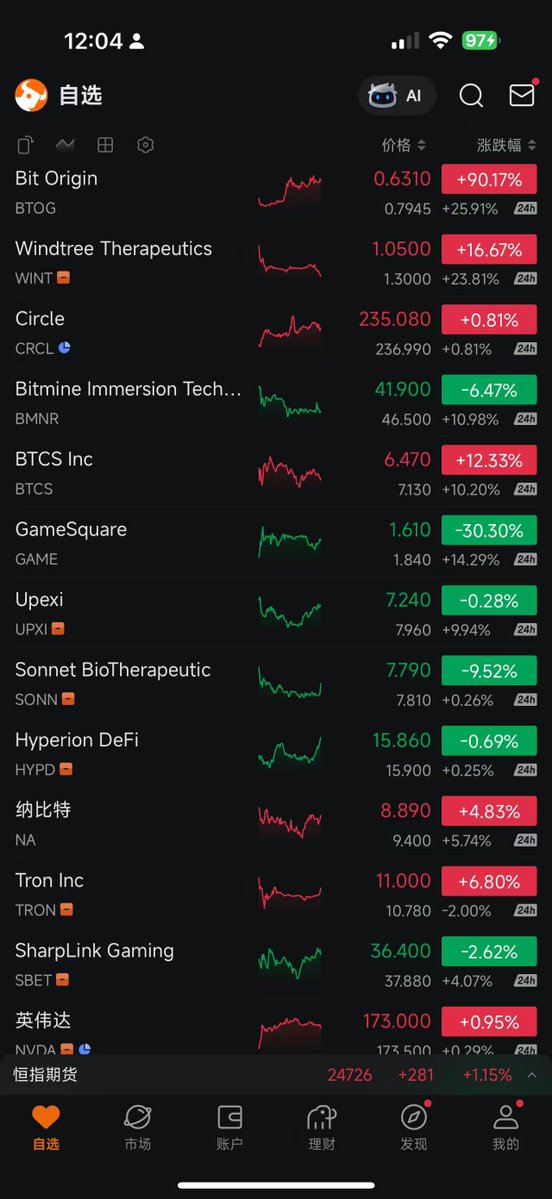

Yesterday, the U.S. stock crypto sector pulled back, and $SBET plummeted from 42 to 32.4 before the market, which is certainly not the worst.

One of the triggers appears to be the surge the day before yesterday @GSQHoldings $GAME announced the exercise of an over-allotment option ("greenshoe") to issue an additional 1.26 million shares, a public offering that is often seen as diluting existing shareholders' equity, and $GAME plunged 30% in anticipation.

The shock to $SBET was @SharpLinkGaming announced that it would raise the ATM program cap from $1 billion to $6 billion, and $721 million in shares were sold.

There is a precedent for the market to follow in the market that the company will raise further funds through further issuance in the future, which will further dilute the equity of existing shareholders:

On June 12, 2025, SharpLink's filing of S-3 registration documents (involving the resale of shares and warrants issued by a $425 million PIPE) sparked fears of dilution, causing the stock price to plummet 75% in after-hours trading, from $33 to about $10.

But in my opinion, it's actually a good place to buy for two reasons:

1. It is necessary for SharpLink to continue to raise funds, and in order to learn micro-strategies to realize the flywheel, it is necessary to keep buying, buying, buying.

Yesterday, their official tweet also mentioned that the first goal is to buy 1 million ETH, and at present, only 221 million of the funds raised before they have been used in their account (another 115 million have just been spent).

If you don't continue to raise funds, where will you get the money to buy them? So yesterday's news actually strengthened my determination to continue to step on the flywheel in the future of SBET.

2. The reason for the panic in the market is because of the collapse of similar news in June, and this time and that time. If only you knew the reason for people's fear, after all, blindly following the herd will not make a lot of money in the financial markets.

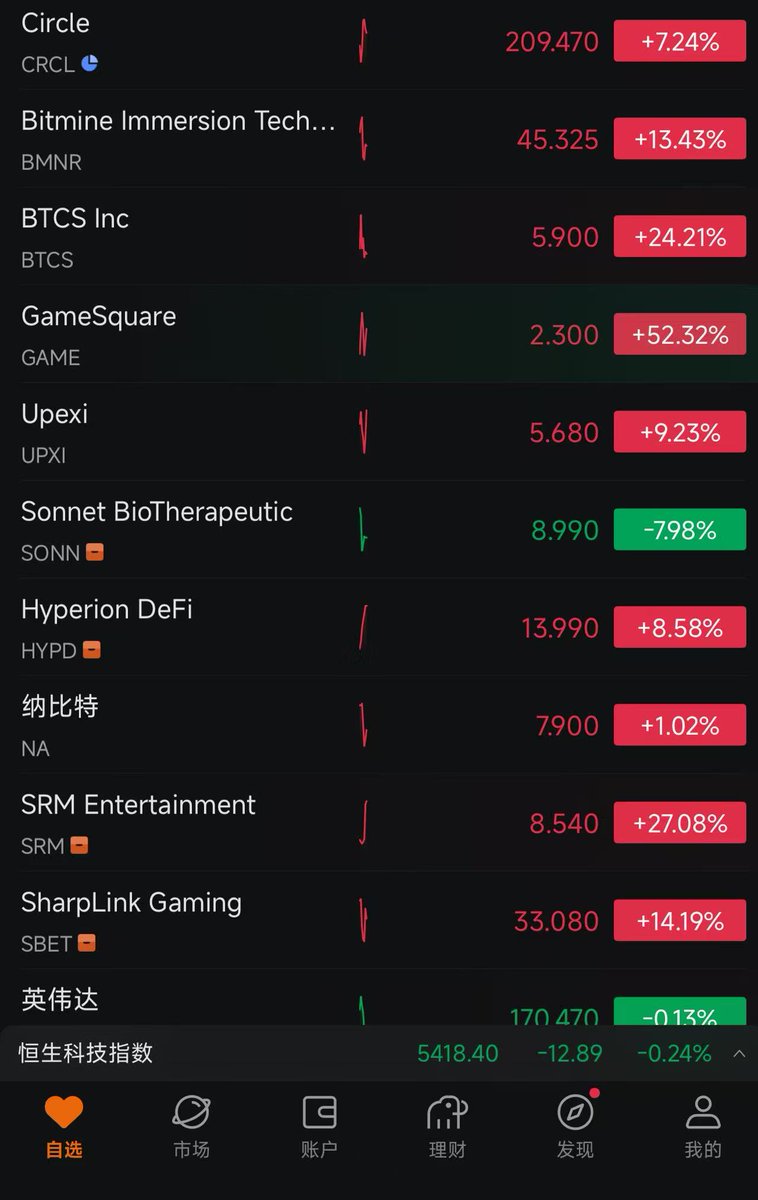

I just took a look at the pre-market and it has risen back to 38, and I bought it okay last night.

~~~~~~~~~~~

At present, I still bet on the $SBET, and the micro-strategies of the other $SOL $Hype $BNB $TRON are slightly ambushed, but only when the $SBET road is cleared, and the miracle of the second micro-strategy and the myth of getting rich appear, the others can be opened to the ceiling.

At the same time$ETH it can also better form a joint force to rise under its continuous buying, buying and buying, driving the overall cottage sentiment.

So, let's wish it the best of luck

Today's U.S. cryptocurrency sector... Lose your marbles

It's hard to say whether the copycat season in the currency circle has come, but the copycat season in the U.S. stock market has come properly. Before I knew it, my position in coin stocks had begun to grow visibly with the naked eye.

It's all speculation, in fact, you shouldn't have too many preconceptions about currency stocks, and it's actually pretty good to see spot leverage that won't blow up.

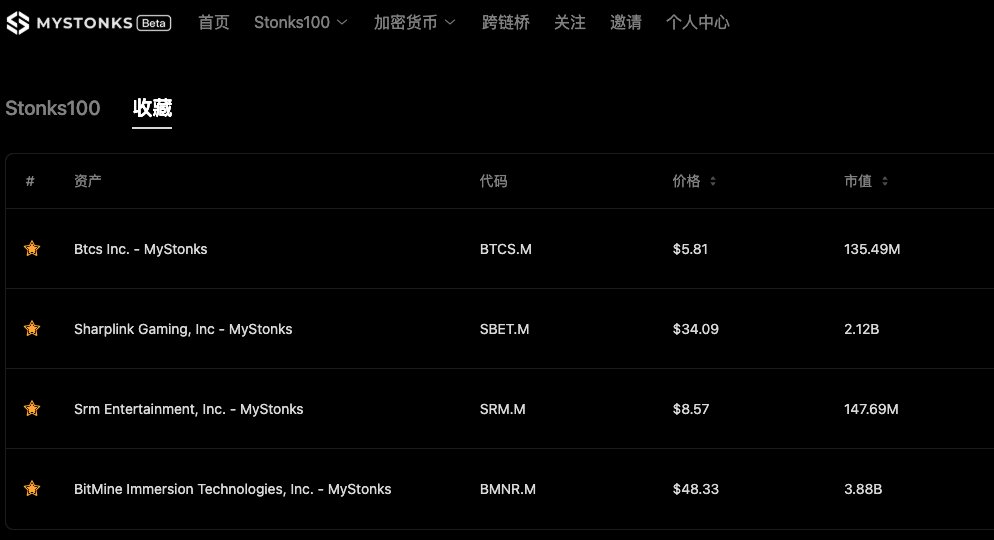

Two days ago, I shared my optimism about $SBET after some friends asked how to buy if they didn't go to Hong Kong to open an account, I experienced it myself today and found that @BTCBruce1's mystonks did meet the demand.

At a time when @xStocksFi is still stupidly listing traditional top U.S. stock tokens, what we need is the hottest coin stocks.

So you can try mystonks, link to solana wallet, do KYC, and you can buy popular U.S. stocks. However, they are opening and closing with the US stock market, not 24-hour trading, and need to get used to it.

Portals:

35.4K

75

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.