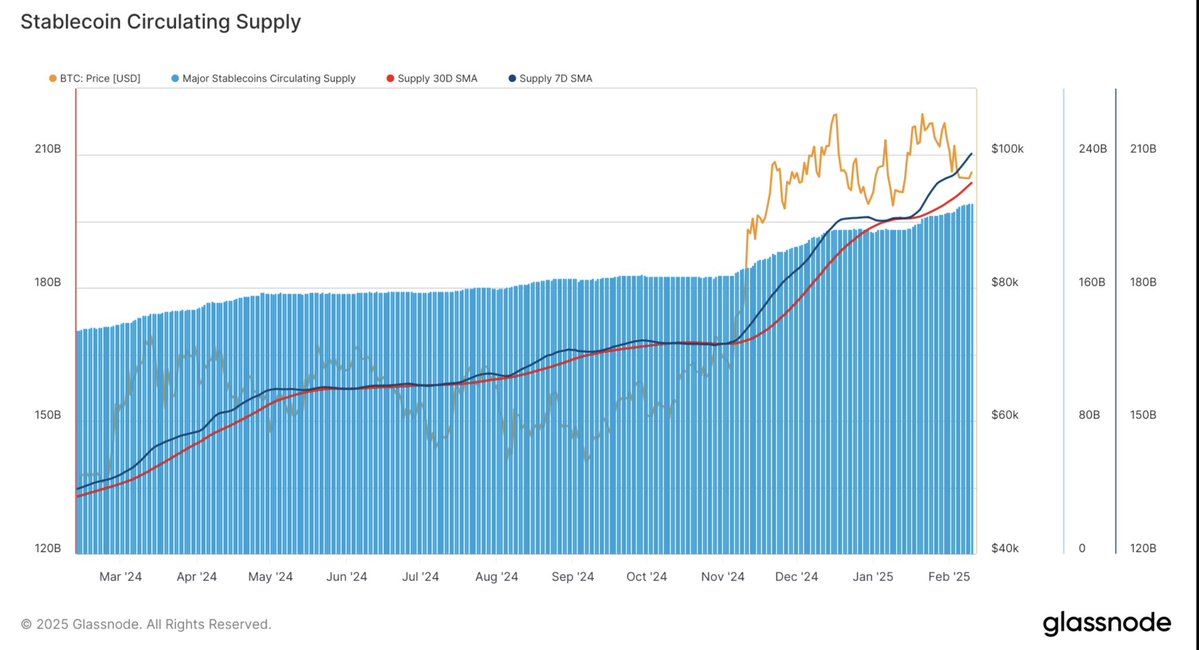

Been following stablecoins closely this cycle, and the trendline in 2025 is getting clearer:

Supply is nearing $250B, on-chain volume crossed $27T last year, and for the first time we’ve got real regulatory clarity:

• In the US, the GENIUS Act is setting strict 1:1 reserve rules and audit requirements.

• In the EU, MiCA is fully live, giving stablecoin issuers a regulatory path to operate across Europe.

Now the market’s shifting toward yield.

Oh and USDY by Ondo, the largest tokenized Treasury product onchain ($685M+), is launching on Sei.

Might sound like “just another integration,” but I actually think it’s a big signal.

Sei, for example, is quietly stacking real infra:

• Native USDC with Circle’s CCTP

• Agora’s USD1 as a compliant stable backing pUSD

• Now USDY, backed by short-term US Treasuries, with daily attestations and two formats (accumulating and rebasing)

All of this is happening on a chain optimized for speed, cost, and composability.

Tokenized Treasuries are still early…$7B onchain vs $28T in the real-world market.

But from what I see, this is the moment where infrastructure starts getting built for that scale.

And Sei and a few others are making the right moves to become part of that foundation.

What wins in the stablecoin wars won’t just be market cap.

It’ll be:

✅ collateral quality

✅ redemption mechanics

✅ cross-chain liquidity

✅ regulatory alignment

NFA. DYOR. Opinions are my own.

Show original

23.48K

41

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.