ETH is finally showing strength against BTC and others. I think it’s time to pay more attention to the ETH ecosystem, especially ETH Layer 2s.

@arbitrum is the first chain launched on Ethereum Layer 2 and has attracted significant attention for a long time after its launch.

Recently, #Robinhood chose Arbitrum One for their tokenized US on-chain stock.

Combined with stablecoin supply and the rapidly growing #RWA sector on the chain, I believe Arbitrum is ready for the next leg!

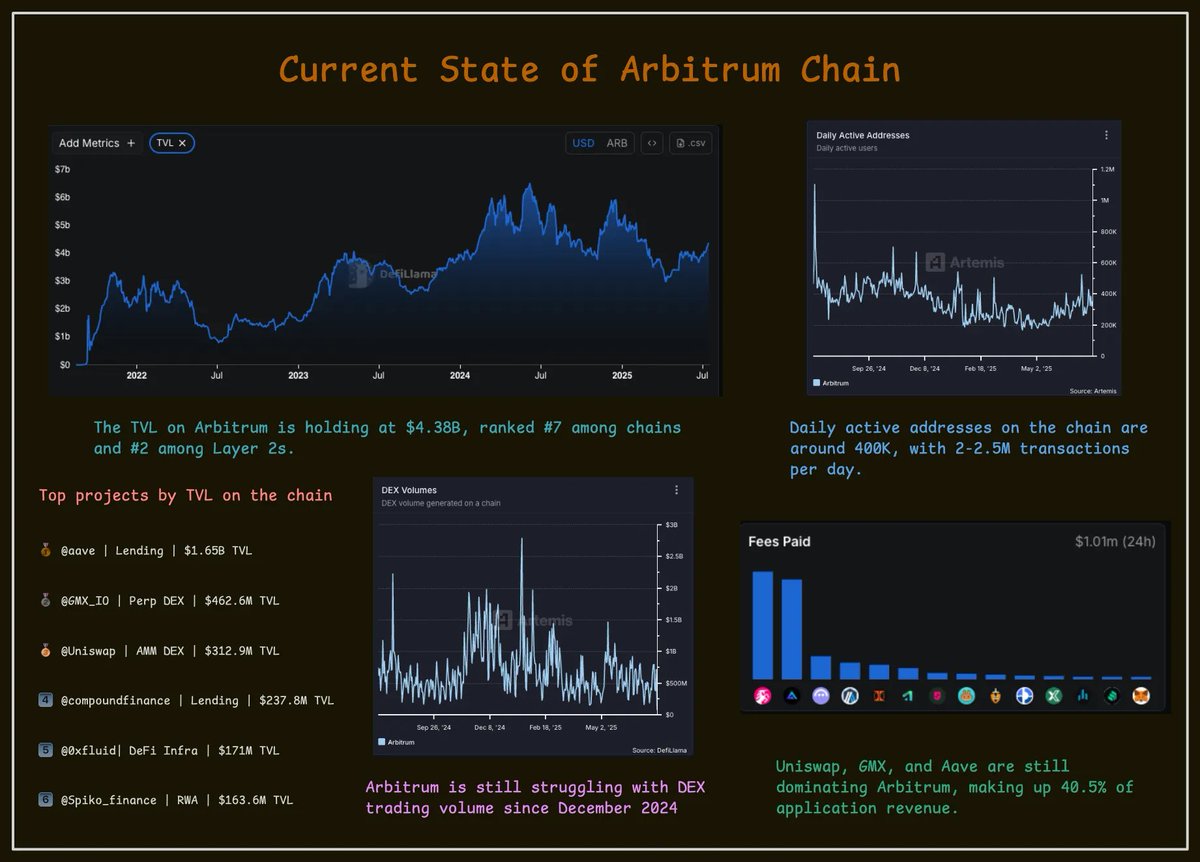

– The TVL on Arbitrum is holding at $4.38B, ranked #7 among chains and #2 among Layer 2s.

– Daily active addresses on the chain are around 400K, with 2-2.5M transactions per day.

– Arbitrum is still struggling with DEX trading volume since December 2024. At the moment, Arbitrum is only executing $500-800M in daily volume.

– #Uniswap, #GMX, and #Aave are still dominating Arbitrum with fees around ~$300K/day, making up 40.5% of application revenue.

📌 Lastly, here are some top projects by TVL on the chain:

🥇 @aave | Lending | $1.65B TVL

The king of EVM lending, owns 37.6% of Arbitrum’s TVL.

🥈 @GMX_IO | Perp DEX | $462.6M TVL

OG perps protocol on Arbitrum. Still one of the best-native trading venues.

🥉 @Uniswap | AMM DEX | $312.9M TVL

Uniswap dominates AMM volume across EVM. #1 DEX on Arbitrum by volume.

4️⃣ @compoundfinance | Lending | $237.8M TVL

Cross-chain lending veteran with $50M+ in annualized fees.

5️⃣ @0xfluid| DeFi Infra | $171M TVL

A liquidity layer that combines lending, trading, and borrowing into one seamless UX.

6️⃣ @Spiko_finance | RWA | $163.6M TVL

The biggest RWA play on Arbitrum. Regulated in France and investing in US/EU T-Bills.

→ As ETH regains momentum, I expect Arbitrum to quietly lead a new wave of activity, not through memecoins, but through real use cases like RWAs, stables, and modular #DeFi infra.

Show original

25.06K

119

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.