MSTR’s mNAV: The Wild Ride – How High (and Low) Can We Go?

MSTR’s multiple of net asset value (mNAV) is a rollercoaster—exciting, unpredictable, and sometimes downright terrifying.

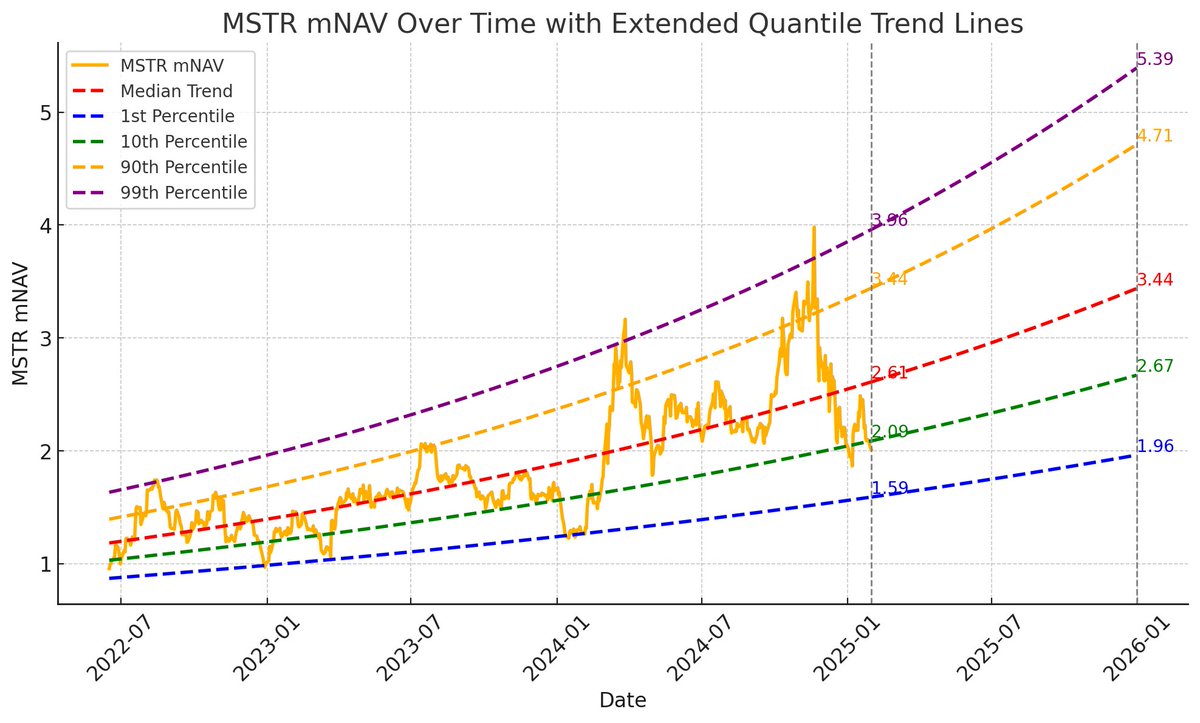

While MSTR’s mNAV might appear erratic, the data provides clues to its long-term trajectory.

· The good news? MSTR’s mNAV is trending exponentially upward and to the right.

· The even better news? If history repeats, it could go MUCH higher.

· The bad news? There’s no guarantee we’ve hit the floor just yet.

As the bulls and bears battle it with massive bets in either direction—particularly in the options market—MSTR’s price and mNAV swing wildly.

For long-term holders, this volatility acts like a vortex, sucking more capital into the MSTR ecosystem.

However, for short-term traders, mistiming the cycle can lead to financial pain.

So, how low can we go? And more importantly, how high can we climb?

In this 🧵, we’ll decode MSTR’s mNAV, explore quantile regression models highlighting its historical patterns, and map out where it could be headed next—including price projections through December 2025.

Ready? 🚀

Buckle up! 🎢

Show original

67.89K

484

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.