Chainlink CCIP + USDC on Sei is a powerful catalyst for SEI’s growth across multiple dimensions and you guys are sleeping on this announcement.

First of all, Chainlink CCIP (Cross-Chain Interoperability Protocol) brings secure, audited interoperability trusted by institutions like SWIFT.

Putting this into perspective, USDC is the most regulated and widely used stablecoin in DeFi and TradFi.

Together, they provide the rails for settlement-grade cross-chain value transfer, making Sei attractive for real-world finance and fintech use cases.

• CCTP would allow USDC to move seamlessly across chains. With Sei now on the route, the entire ecosystem would get access to billions in stablecoin liquidity.

• This would eventually lead to deeper liquidity pools, better market efficiency, and more volume for Sei-native apps.

_____________________________

Chainlink's CCIP is already the backend for several TradFi experiments (e.g., tokenised treasuries, cross-border settlements).

With USDC and CCIP on Sei, TradFi players can now plug into a performant L1, enabling experiments like:

-Tokenised RWAs on Sei

-FX swaps with stablecoins

-Real-time payments between institutions with the rise of payment options.

-Increased exponential growth in the GameFI sector.

___________________________

Sei’s architecture enables sub-second finality and low fees — ideal for stablecoin transactions and real-time finance.

With native USDC and CCIP, Sei becomes the fastest highway for global stablecoin settlements across chains and platforms.

Currently, the Sei ecosystem has been in a state of frenzy if you're looking closely

-Increase in new daily users with a record of 449,379 recorded yesterday July 14, 2025.

-Clear spikes in daily dex volume and transaction count.

- Growth in TVL (currently $646m+ enroute to $700m) across protocols.

-Maintained uptime of 99.90% even with all this growth compared to some L1s.

Without doubt, this integration is a foundational unlock for real-world adoption, cross-chain composability, and DeFi scale on Sei.

The next phase of institutional-grade finance starts with Chainlink CCIP & USDC coming to Sei.

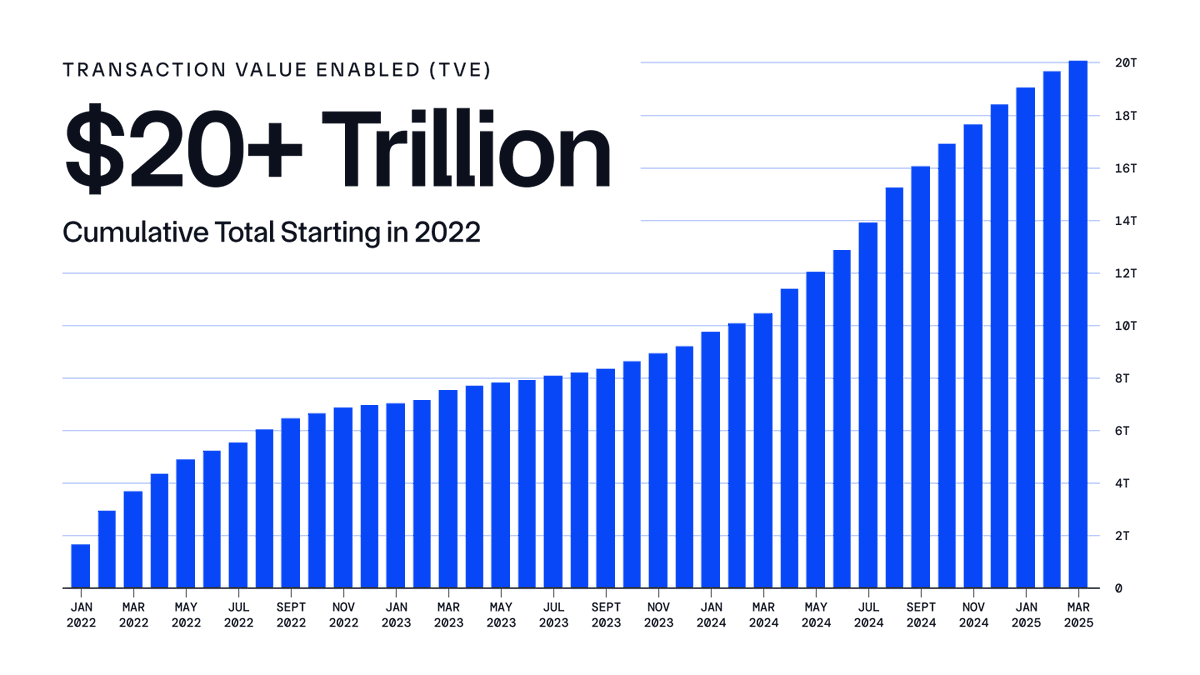

Chainlink has enabled $20T+ in transaction value, as the institutional standard for onchain oracles, and serves as the USDC oracle on CCTP-enabled chains.

Markets Move Faster on Sei.

10.29K

70

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.