HyperEVM ecosystem, meet your orchestration layer 🚀

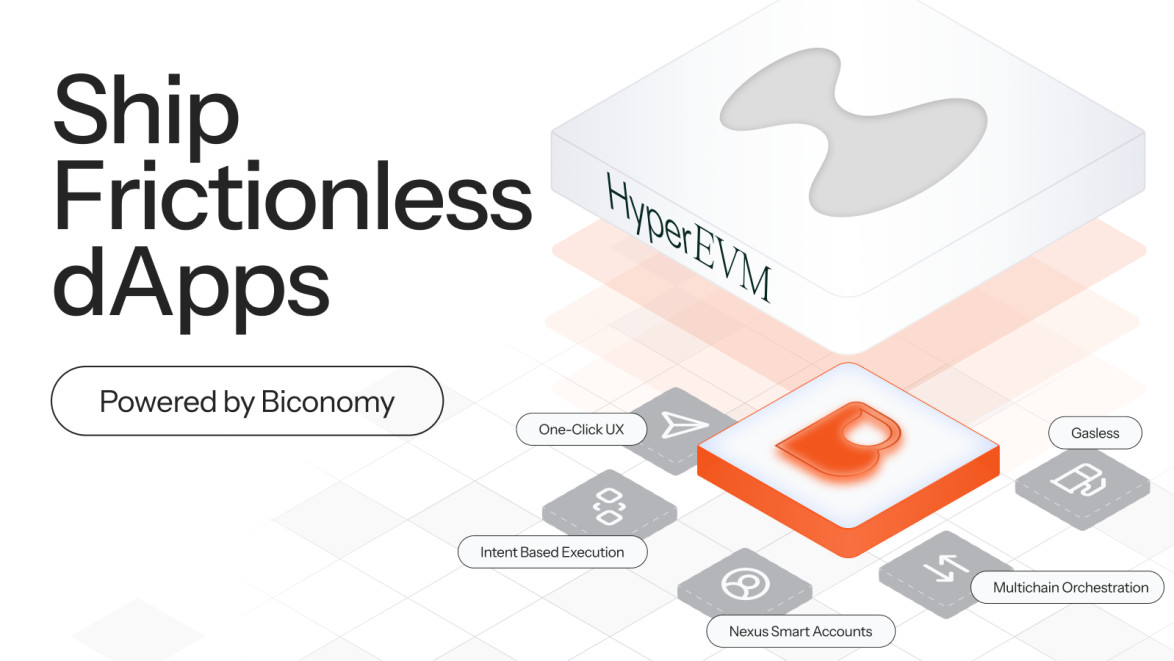

Biconomy orchestration is now live on @HyperliquidX, enabling cross-chain operations with just one click. No more chain-switching, no more gas token juggling, no more user drop-off.

See how this changes everything 👇

1/11 Orchestration turns complicated multichain workflows into seamless user experiences. Bridge, swap, stake across chains, all with one signature.

MEE (Modular Execution Environment) is the infrastructure that makes this orchestration possible at scale.

📢 Big news - @HyperliquidX 🫡

Biconomy’s Modular Execution Environment (MEE) is officially integrated into the HyperEVM stack.

What this means for builders:

✅ Single-signature flows let users approve once while your app handles everything

✅ MEE enables cross-chain and session execution, so one click pulls assets from any network, like swapping ETH on Arbitrum into USDC on Hyperliquid

✅ Nexus smart accounts bring gasless, no-friction UX

Hyperliquid is fast. Now it’s modular.

Let’s get to work. No second best.

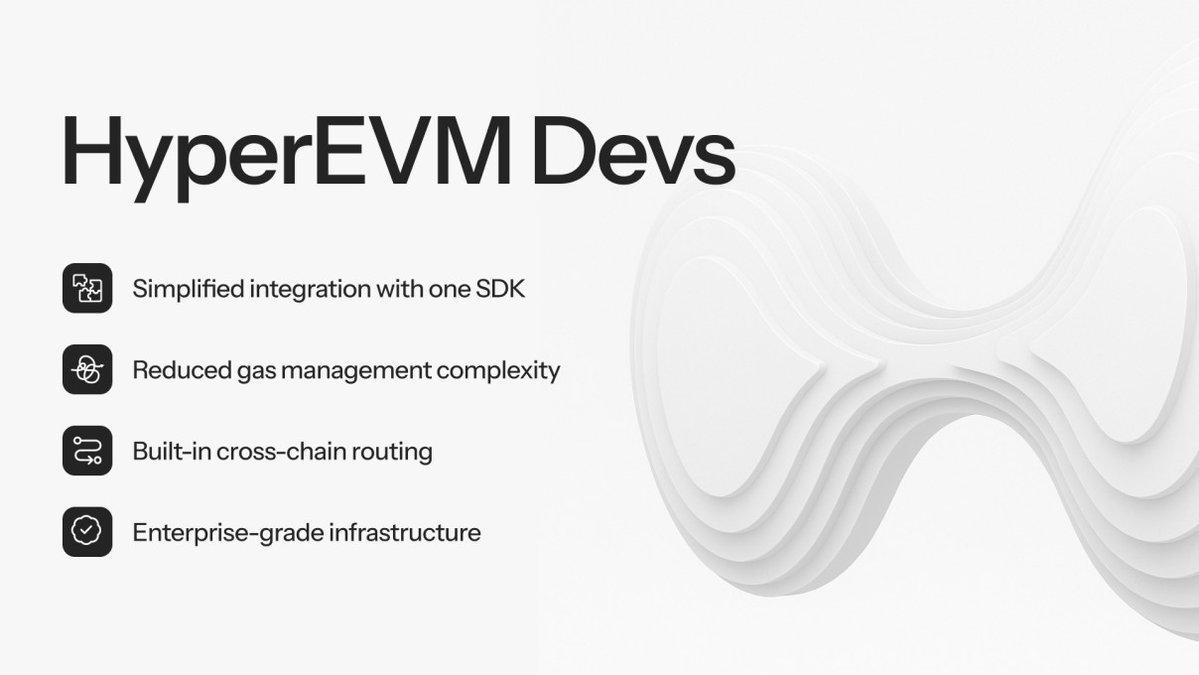

2/11 Technical benefits for HyperEVM developers:

3/11 Here's what MEE brings to HyperEVM builders:

4/11 🔄 DEXs & AMMs

For protocols like @HyperSwapX, @KittenswapHype, and @ValantisLabs: MEE bundles token approvals, deposits, and LP staking into single transactions.

Users can provide liquidity across chains without multiple wallet confirmations.

5/11 🏦 Lending & Borrowing

For protocols like @hyperlendx, @sentimentxyz, @HyperYieldx, and @hyperdrivedefi: MEE can enable cross-chain collateral management.

Deposit ETH on Ethereum, borrow USDC on HyperEVM, manage LTV ratios, all orchestrated seamlessly.

6/11 📊 Yield Optimization

For protocols like @0xHyperBeat, @Looped_HYPE, @upshift_fi, and @NapierFinance, MEE automates complex yield strategies.

Stake HYPE, deploy across protocols, auto-compound rewards, and rebalance positions without manual intervention.

7/11 🪙 Stablecoins & CDP

For protocols like @felixprotocol, @KeikoFinance, and @CurveFinance: MEE orchestrates multi-chain stability mechanisms.

Cross-chain collateral deposits, feUSD minting, and automated collateral management in one flow.

8/11⚡ Advanced Protocols

For protocols like @TimeswapLabs, @symbiosis_fi, @gauntlet_xyz, and @ArkisXYZ, MEE streamlines complex operations.

Enhanced lending/borrowing flows, seamless cross-chain bridging, and leveraged farming across networks.

9/11 🚀 Launchpads & Infrastructure

For launchpads like @Hypurrfun and infrastructure protocols: MEE can enable cross-chain token launches and trading.

Users can participate in launches using assets from any EVM chain, while projects access broader liquidity pools from day one.

10/11 MEE leverages infrastructure with 400K+ compliant Nexus accounts already deployed across the ecosystem, representing $25M+ in secured volume. Our tech is not experimental, it's battle-tested infrastructure ready for production.

11/11 DApps on HyperEVM integrating MEE can attract capital and liquidity from the entire multichain environment with drastically lower complexity at the UX level for their users.

9.34K

67

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.