Many see the charts rip and freeze.

''I missed it again''

I’ll show and explain my favorite setup.

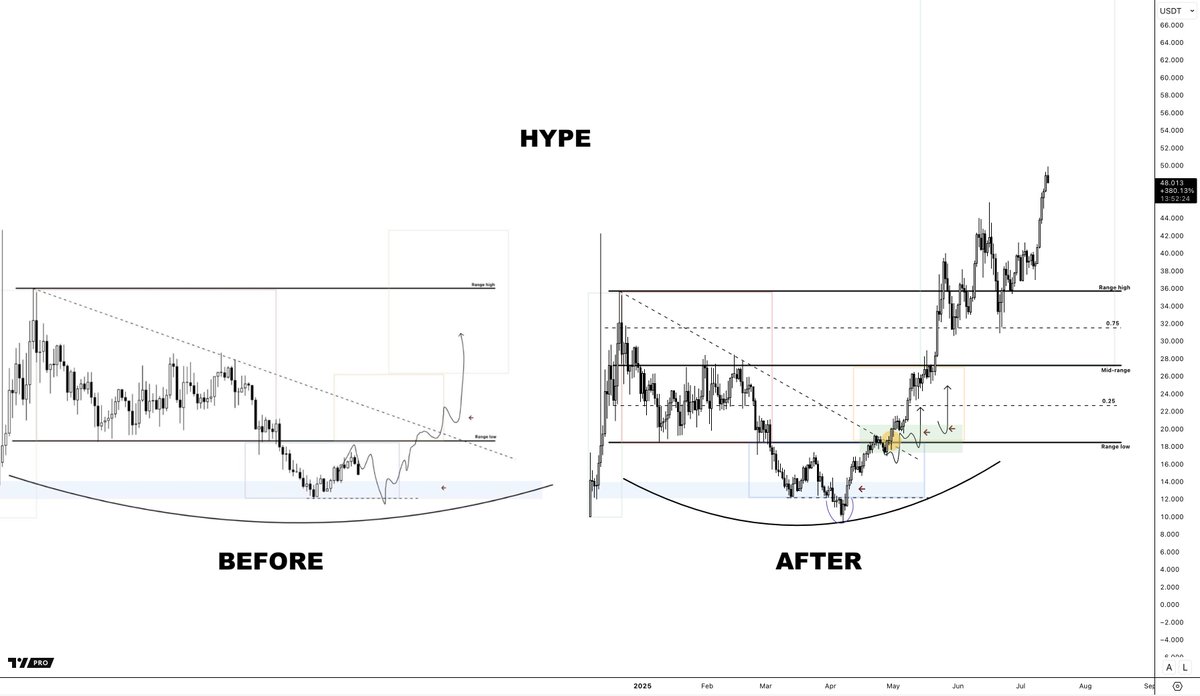

Used it on SOL at $30 and HYPE at $14

1. How to use it

2. Some Altcoin examples

(1/9) 👇

We have now covered all the basics of the setup, so we can continue to the fun part, the actual setup, which you can use.

> The setup

1. The range low deviation

2. Combining the cycle & the range

3. How to enter?

4. Past examples that played out

5. Examples of live trades

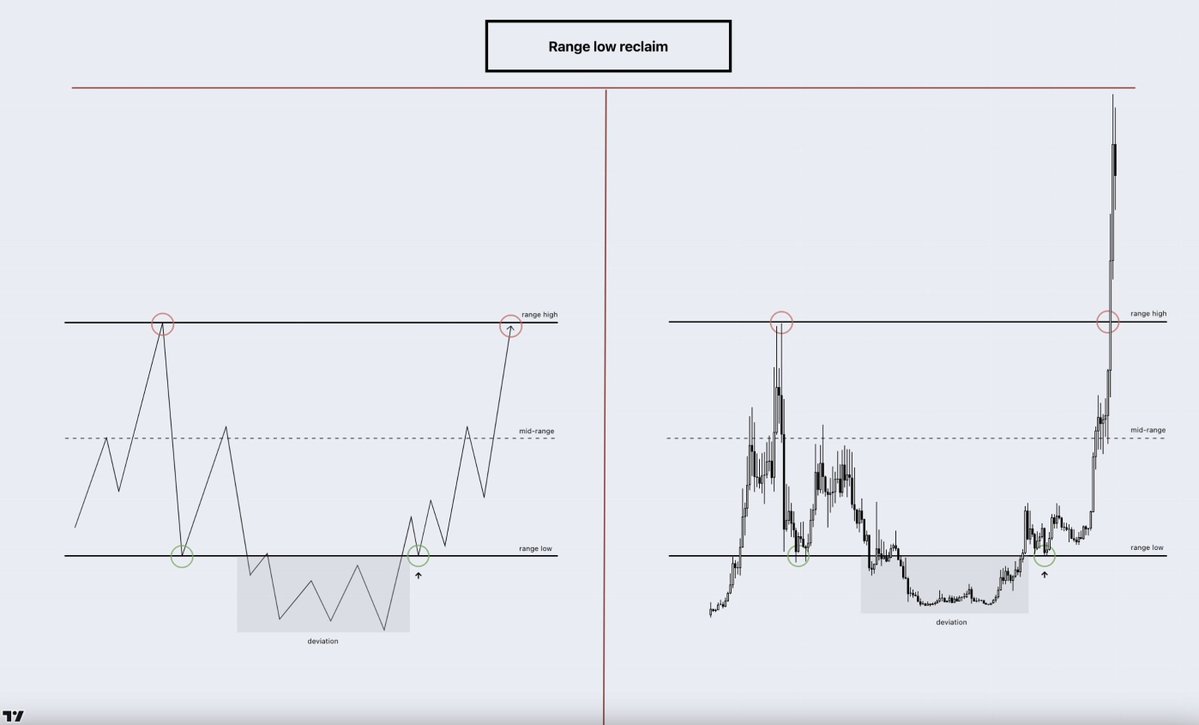

1. The range low deviation

Remember, we spoke about deviations earlier in this thread? Let's go a little deeper.

Eventually, a range breaks up or down.

In this example, we focus on a breakdown. What happens after a breakdown is that people:

- Open a short

- They sell their position as they're assuming lower prices.

- Their stop losses are getting tagged on leverage longs or spot.

But what if this breakdown fails, and prices reclaim the range?

- People with shorts close these (they BUY themselves out)

- People with shorts get their stop loss hit (automatically BUYs them out)

- People who sold spot BUY themselves back in.

- People see a range reclaim/support flip setup and BUY-in.

Now, after a confirmed deviation and reclaim, either at the top or bottom of the range, prices often quickly reverse and visit the opposite side.

We can form a setup around this pattern; the range low reclaim.

- Range forms

- Range breaks down

- Range reclaims - this is our entry trigger

- We get in as close as possible to the range low

- We target the opposite side of the range

- Invalidation if we fall below the range low and find acceptance

3. How to enter?

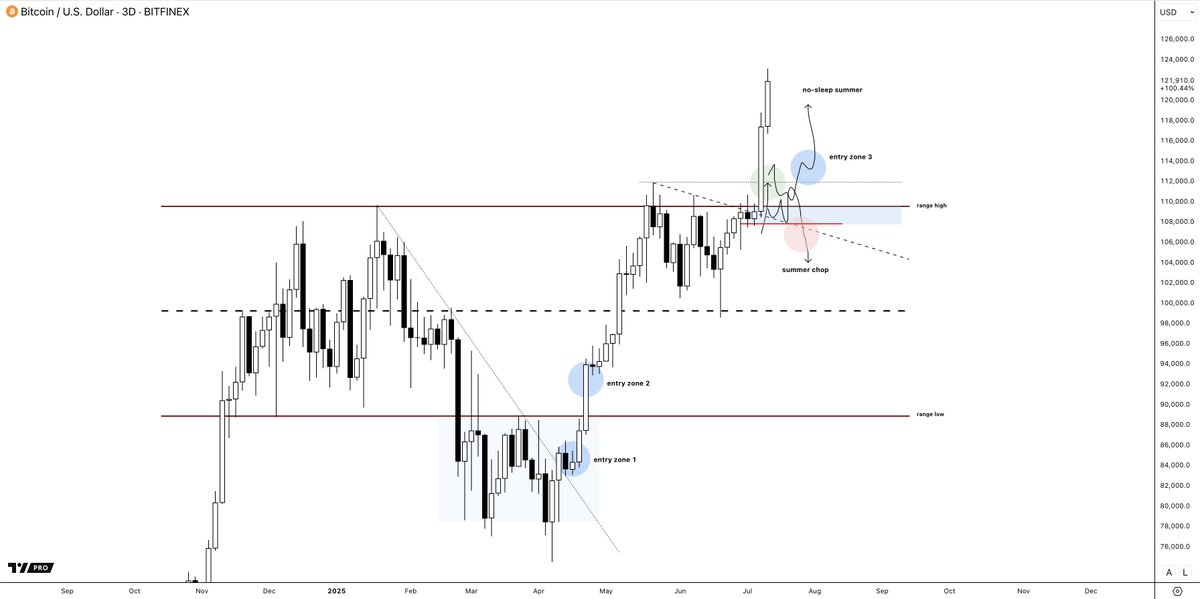

This part hits home for many right now. A lot of people didn’t accumulate properly during the 7-month range and missed the chance when—yes, there he is—Bitcoin reclaimed the range low in early April. Yet they’re bullish and believe altcoins will go higher.

Now we’re here, 10% up after a strong rally. Frozen by green candles. Scared it’ll retrace if they enter. Scared they’re FOMOing the top. But also scared it keeps going if they don’t buy.

Feels terrible, right?

Here's how I do it:

/ If you think the market for Altcoins is bullish, don't be scared of Bitcoin. For me, as long as Bitcoin is above this range high, it's go-time.

/ If an Altcoin has a bullish setup, play and focus on that bullish setup. Not on the Bitcoin day-to-day price action.

/ Understand that Bitcoin can be volatile, and you don't want to get stopped out on a Bitcoin move within bullish territory; focus on higher time frame altcoin charts and setups.

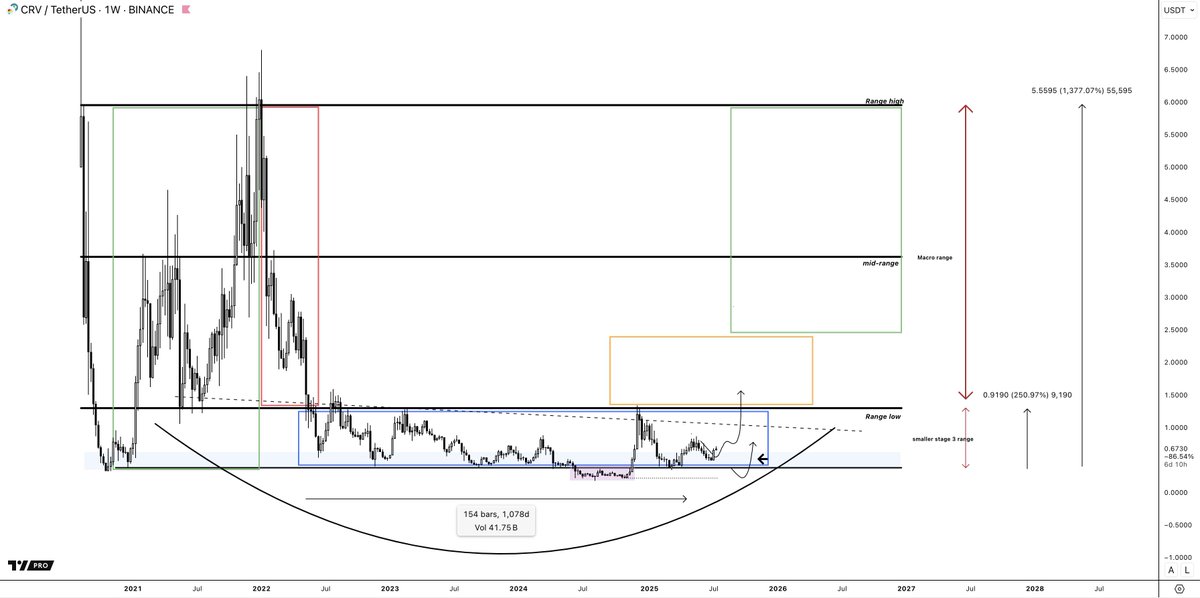

2. CRV

Beautiful flattened range, still in what is imo stage 3 on the macro cycle.

I've been accumulating the stage 3 range lows (blue) and will be ready if the market turns into trash this summer and we sweep the lows (don't expect it, but not ruling it out)

Why did I pick this one while it's in stage 3, and most die there?

> Stablecoin narrative play

> DeFi pumps when Ethereum pumps

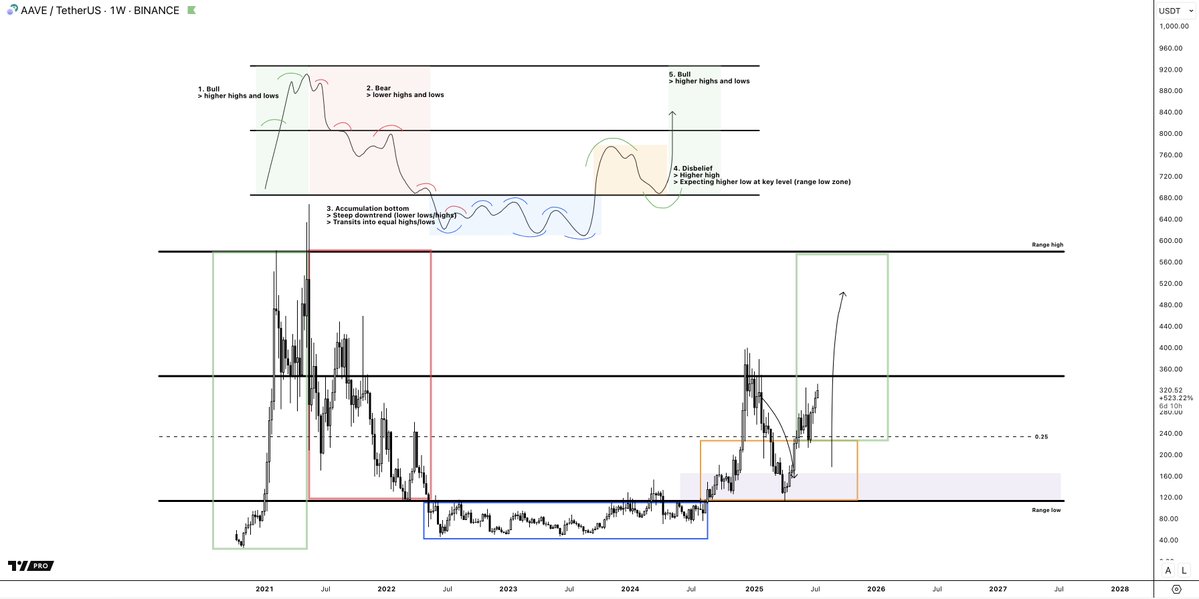

3. AAVE

Accumulated AAVE at the range lows in April (purple), but will be ready, not expecting it, if we visit the lower part of the range again.

TLDR:

> If you are bullish on the macro market, ignore lower time frame Bitcoin.

> Look for tokens at the lows (potential stage 3 or stage 4 reclaim), there are a lot of them.

> Ensure, if in stage 3 and no strength yet, that there is a reason in your opinion for this token to do well; most tokens will die in stage 3.

> Have a plan for either an entry at the stage 3 range, or if the market continues, after a macro range low reclaim into stage 4.

Setups don't work out 100% of the time, use an invalidation (that's where ranges and market structure come in handy).

Have patience, don't fomo, but have a plan and invalidation.

I'll come up with some more examples of this structure this week.

I hope you enjoyed this post, and if so, I would appreciate a share.

Amsterdam! 🫡

42.05K

304

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.