great observation. this is an intentional strategy.

most chains and apps incentivize, for example, a USDT-WBTC pool and a USDC-WBTC pool. it’s a big mistake.

instead concentrate incentives in a USDT-USDC pool and then in a USDC-WBTC.

the analysis is whether the slippage improvements will be less than any additional lp fees. my bet is that slippage will often outweigh additional lp fees so you are better off not having overlapping pools.

once again, @katana and core apps like @SushiSwap are ahead of the curve.

Some thoughts on Sushi rewards in Katana:

I noticed today that the ETH/USDC pool is incentivized, but ETH/AUSD is not. Meanwhile, AUSD/BTCk gets rewards, but USDC/BTCk doesn’t.

Seems like Sushi’s strategy is to avoid rewarding overlapping pools — like both ETH and BTC versus stables — to prevent splitting liquidity.

For stables, only USDC/AUSD and USDC/USDT are incentivized. There’s no meaningful AUSD/USDT pool — so no rewards there either.

It makes sense: AUSD is the stablecoin partner for both Katana and AggLayer, and USDC has historically seen more demand on Polygon. So Sushi supports both.

In short: Sushi is selectively incentivizing specific pairs, not everything across the board.

And for users, trades will just route through multiple pools if needed. For example, buying ETH with USDT would go via USDT → USDC → ETH. On a fast and cheap chain, the total cost is almost the same.

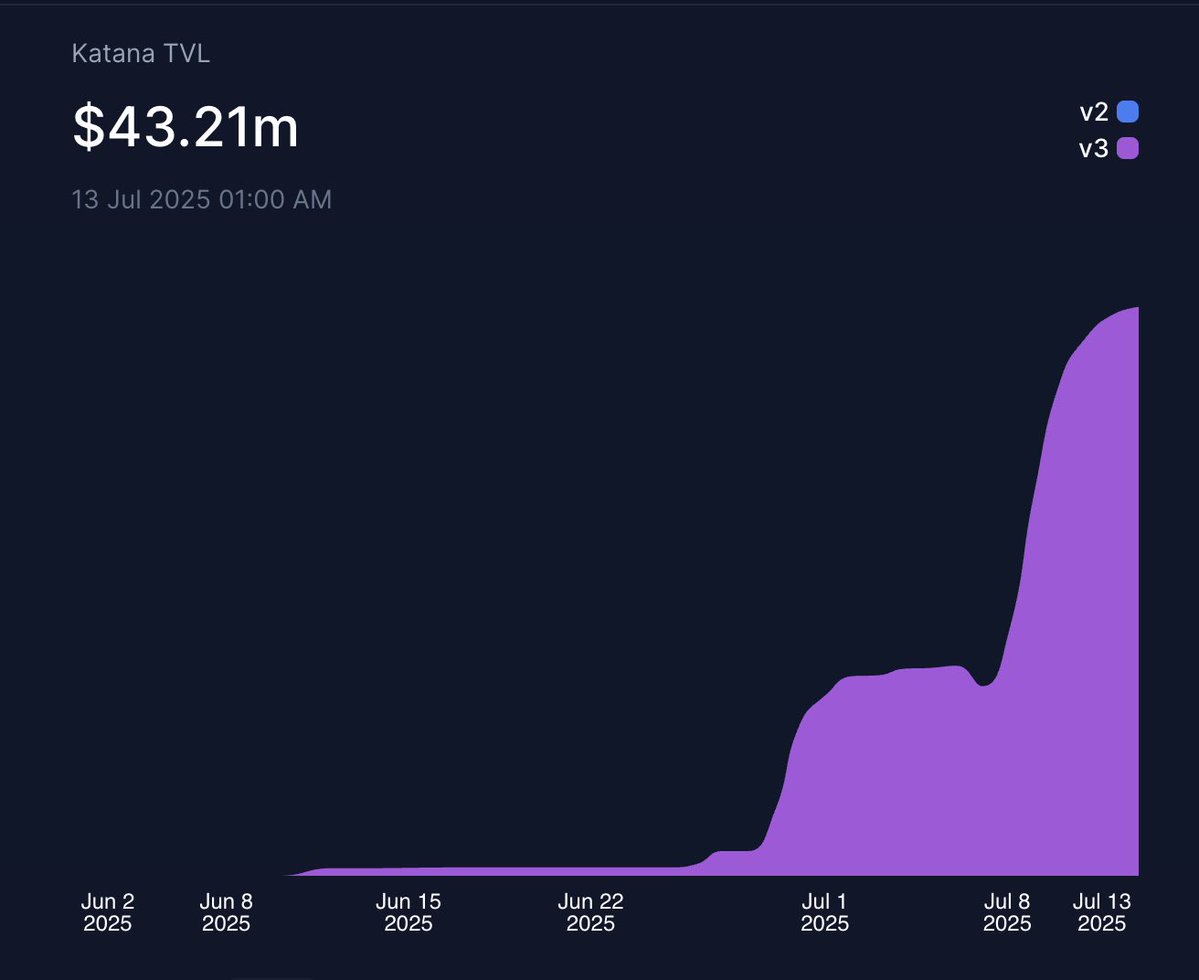

By the way, Sushi's TVL on Katana has already reached $43M 🍣

28.48K

79

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.