In the BTCfi sector, Yala's recent growth has been impressive, and its operations are commendable.

Let me briefly share my understanding of Yala's operational rhythm👇

1️⃣ User positioning: Balancing between large holders/institutions and retail investors, launching different products tailored to the preferences and needs of different groups.

> BTC large holders/institutions: Provide most of the liquidity, requiring secure custody and stable returns.

> Retail investors: Large volume and base, pursuing high returns.

Yala has launched custody solutions suitable for both groups, opening up the ceiling for TVL growth.

2️⃣ Staged minting to enhance market expectations.

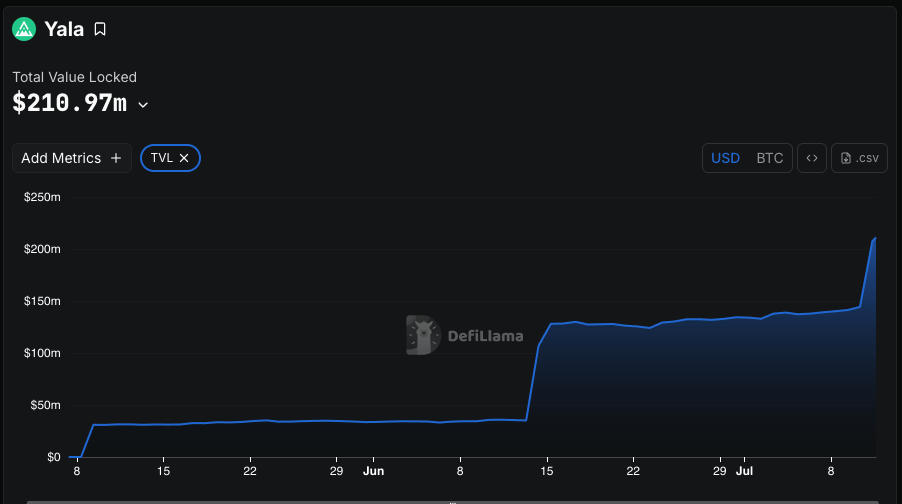

For TVL, the Yala team has been relatively "restrained," opening minting in phases, with each phase having a cap. After three phases, the TVL of $YU reached over 210M+, making it the second-largest among all BTC over-collateralized CDPs;

At the same time, various DeFi protocol mining yields are used to increase the application scenarios and efficiency of YU, revitalizing TVL.

3️⃣ $YU fund supermarket, diversified yield strategies.

The primary application scenario for YU is wealth management.

The Earn section on the Yala website resembles a fund supermarket for YU, with clear positioning for different yield products:

> Various stablecoin mining around $YU ➕ leverage (I went for Kamimo+ Rate X, after all, the stablecoin yield subsidy is really attractive)

> Yala Lite's limited fixed income 12% wealth management activity (it seems to be aimed at retail investors but was snapped up by large holders in a minute 😂; another question is where the 12% APR yield comes from, which seems unclear)

> RWA yields: The Yala Real Yield interface offers yield products from three top U.S. private equity funds, APY 5%+, currently not open yet, but this type of product seems more aligned with the preferences of Asian large holders and institutions.

4️⃣ Ultimate payment route: U Card + Circle alliance.

Yala recently announced a partnership with Alchemy Pay➕Circle, launching the U Card to connect YU's payment scenarios.

The most challenging aspect of stablecoins is payments, and Yala can easily achieve two points: a) YU is pegged to USDC; b) using YU for consumption far surpasses many on-chain stablecoins.

Behind Yala's rapid growth is the core team's profound thinking on stablecoins and strong BD resources.

Looking forward to more new moves from Yala @yalaorg @VickyXAI @Bin_YalaLabs @cktlore

YU Cap 3 + Yala Protocol TVL

In less than 48 hours, $YU Cap 3 has been filled with a total of $110m $YU now minted!

At the same time, Yala protocol has hit an all-time high in TVL, now exceeding $210m.

Here's how value flows through the protocol ↓

6.49K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.